views

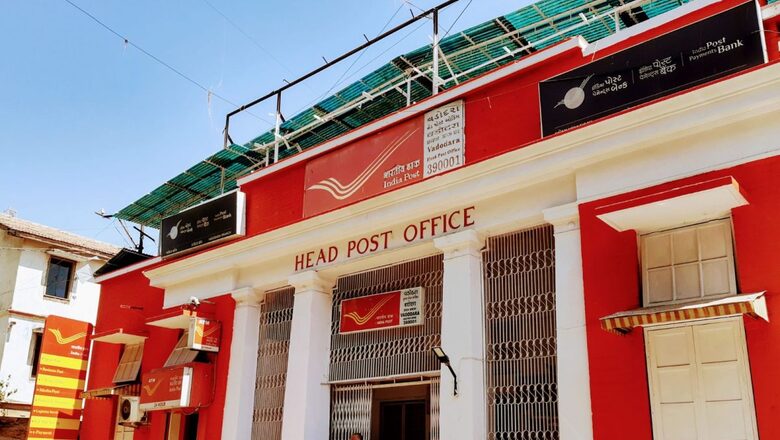

Investment of money in right schemes is a task which many find difficult to perform considering the fact that the market is full of such proposals which sometimes confuse an investor. While schemes related to personal savings have a long list in the market, whether by private or public sector undertakings. In the government-backed schemes people find a sense of security and in this aspect, post office schemes are popular because of the accessibility of the postal network as well as the rate of interest they offer with a guarantee.

The interest rates of these schemes are revised from time to time.

India Post offers several saving schemes which are targeted in different time period. Here are five schemes that can be subscribed from the Post Office.

15 year Public Provident Fund Account

Anyone willing to invest in this scheme needs to deposit a minimum of Rs 500 and a maximum of Rs 1,50,000 in a financial year. Currently, it offers an interest rate of 7.1 % per annum which is compounded yearly. Moreover, deposits to the scheme can be made in a lump-sum or in 12 installments and the maturity period is 15 years. However, it can be extended within one year of maturity for a further 5 years and so on. Also, the deposits under the scheme qualify for deduction from income under Sec. 80C of Income Tax Act and it provides a loan facility available from 3rd financial year, where a policy customer can avail loans for personal purposes.

National Savings Certificates

NSC comes with a maturity period of 5 years and currently offers an interest rate of 7 percent per annum compounded half-yearly but payable at the time of maturity. It does not bound on the maximum investment part as there is no maximum limit to invest and only a minimum amount of investment of Rs.1000 is required. You can invest in denominations of Rs.100, Rs. 500, Rs. 1,000, Rs. 5,000 and Rs.10,000. One can also pledge NSC certificates as security for availing bank loans.

Sukanya Samriddhi

To promote gender equality and to encourage parents of girl-child, Sukanya Samriddhi scheme is designed where the current interest rate is 7.6 percent per annum. The scheme account can only be opened in the name of a girl child. The account can be opened after birth and upto the age of 10 years.

Senior Citizen Savings Scheme

Targeted to the senior citizens, the schemes come with a maturity period of five years. There can only be one deposit in the account in multiple of Rs 1000 maximum not exceeding Rs 15 lakh.

Currently, it offers an interest rate of 8 percent and can be availed by an individual of the age of 60 years. However, an individual between 55 and 60 years, who has retired on superannuation or under voluntary retirement scheme can also open an account when the account is opened within one month of the receipt of your retirement benefits and amount should not exceed the amount of the benefits.

Post Office Monthly Income Scheme Account

The monthly investment scheme offers 7.1 percent interest rate per annum. It requires investment in multiples of Rs 1,500. Maximum investment limit is Rs 4.5 lakh in a single account and Rs 9 lakh into a joint account. Any number of scheme accounts can be opened in any post office subject to maximum investment limit by adding balance in all accounts.

Apart from the above listed schemes there are other options like small deposit schemes, according to different tenures and Kisan Vikas Patra.

Also Read: Six Major Changes that Impacted our Personal Finances in 2022

Read all the Latest Business News here

Comments

0 comment