views

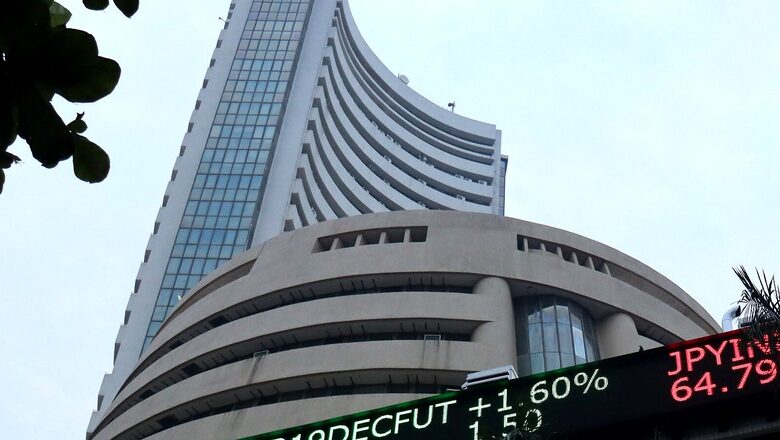

The Indian indices opened on a positive note on Tuesday, the benchmark BSE Sensex was up 111.94 points or 0.19 per cent at 58408.85, and the Nifty was up 28.90 points or 0.17 per cent at 17406.70. About 1224 shares have advanced, 510 shares declined, and 103 shares are unchanged. The Indian market opened on a flat note- thanks to the mixed global cues.

On NSE, Tata Consumer, JSW Steel, Tata Steel, Asian Paints were the top gainers. However, Axis Bank, Sun Pharma, Kotak Bank were among the laggards. Sectorally, barring Nifty FMCG, Nifty Media, Nifty Metals, Nifty Consumer Durables all indices opened in the red. However, on BSE, DishTv, Lincoln Pharmaceuticals, Cain Fin Homes were the gainers while Ujjivan Financial Services was the top loser.

“Domestic equities look to be flat as of now. We believe that high frequency key economic indicators for Aug ’21 in the form of GST collection, railway freight, auto sales volume despite semiconductor issues, power consumption, import-export data and fuel volumes indicate a sustained economic recovery on YoY comparison. While 1QFY22 GDP growth 20.1 per cent indicating a sharp recovery, there has been sharp contraction in sequential comparison due to the second wave of COVID-19 and growth is still lagging from pre-pandemic level. Hence, the economy still needs policy support from the government and RBI, which is likely to persist. Additionally, the low fiscal deficit at Rs3.21 trillion (21.3 per cent of budgeted) as on July’21 reflects that the government can spend more in coming months to sustain economic activities. These indicate a sustainable earnings growth in subsequent quarters. In our view, India is at the beginning of the capex revival phase and therefore corporate earnings recovery looks sustainable and premium valuation might sustain,” Binod Modi, head strategy at Reliance Securities said.

Indian markets riding on the back of mixed global cues opened on a flat note. Asian bourses such as Japan Tokyo stocks open higher Tuesday, the benchmark Nikkei 225 index was up 0.62 per cent, or 183.20 points, at 29,843.09 in early trade, while the broader Topix index was up 0.67 percent, or 13.64 points, at 2,054.86. US stock and bond markets were shut on Monday on account Labor Day. Hong Kong’s The Hang Seng Index added 0.17 percent, or 43.59 points, to 26,207.22. The Shanghai Composite was flat, inching 0.15ints lower to 3,621.71, while the Shenzhen Composite Index on China’s second exchange was also hardly moved, ticking down 0.55 points to 2,462.81.

“Benchmark Indices are expected to open on a flat note as suggested by trends on SGX Nifty. US stock and bond markets were shut yesterday on account of Labour Day. In the last trading session Nasdaq ended at a new peak but the other main US indices fell, reflecting the mixed sentiment arising from a disappointing US jobs report. Asian market off to a positive start with Tokyo stock trading higher on hope of new economic stimulus under a future Japanese prime minister. Overall, Indian indices are seen in positive territory with regular foreign capital inflows, strong domestic data and cumulative COVID-19 vaccination coverage inching closer towards 70 crores. On the technical front, 17450 may act as immediate resistance for Nifty 50 followed by 17,500 while 17,100 remains a crucial support for Nifty 50,”Mohit Nigam, head – PMS, Hem Securities said.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment