views

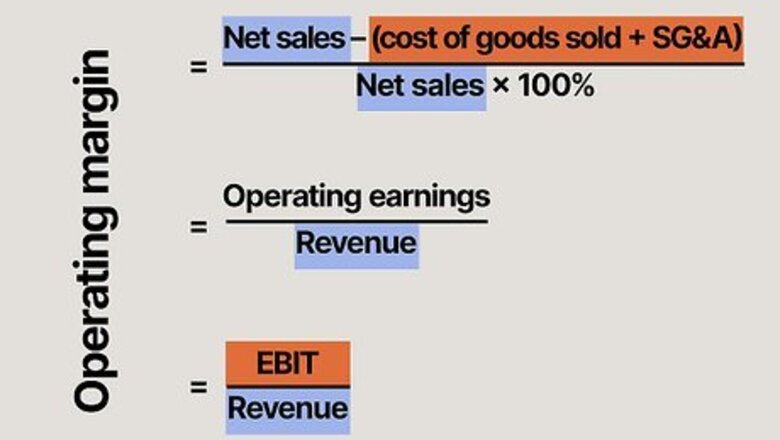

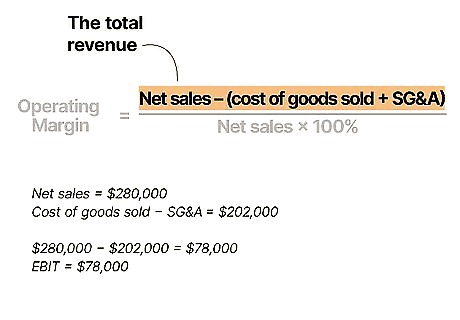

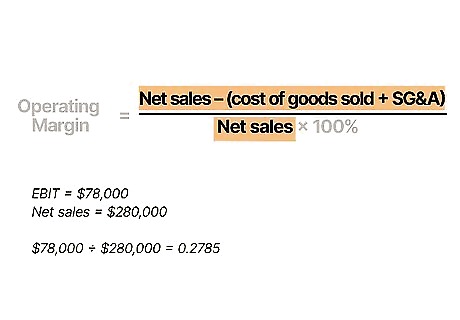

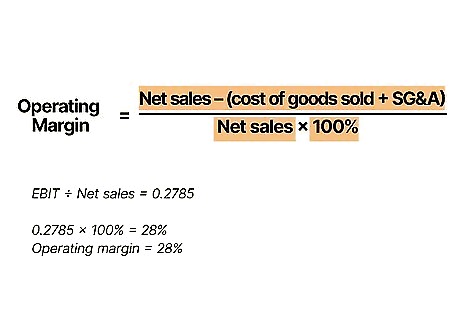

- The formula for operating margin is: Net sales – (cost of goods sold + SG&A) / Net sales x 100% = Operating profit margin.

- Operating margin, also known as operating profit margin or return on sales, represent how much money a company earns at the end of the day.

- Investors and business owners use operating margin to assess how efficient and profitable a company is.

Operating Margin Formula

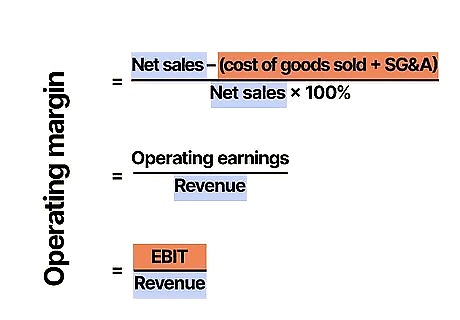

Net sales – (cost of goods sold + SG&A) / Net sales x 100% = Operating margin. The SG&A calculation represents your cost of sales (S), general expenses (G), and administrative costs (A) added together. Remember to use the order of operations here! Also, as a note, the x 100% at the end simply converts the core calculation into a percentage. It’s not technically a part of the essential math. At its absolute simplest, you could say the operating margin formula is Operating margin = Operating earnings / Revenue or Operating margin = EBIT / Revenue. Revenue and net sales are the same thing. Operating margin is often referred to as return on sales. These terms are interchangeable. The cost of goods sold + (sales + general + administration expenses) is the same thing as EBIT.

Operating Margin Example

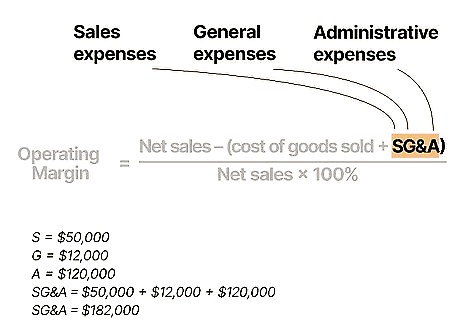

Start by adding your sale, general, and administrative expenses. A company’s sales expenses include things like the costs of marketing, distribution, logistics, and insurance. General expenses are the rent for the company building, utilities, computer equipment etc. Administrative expenses include benefits, salaries, and wages. Multiply these together to get the SG&A in the formula. Let’s say a company spends $50,000 on sales expenses, $12,000 on general expenses, and $120,000 on administrative expenses. This comes out to a total SG&A of $182,000. Remember, your general expenses are only for the most recent quarter (or year depending on how far back you’re looking). The computer you bought this month is an expense. A computer from last year is an asset.

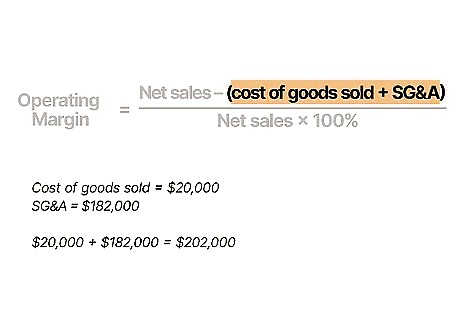

Add the SG&A to your cost of goods sold. The cost of goods sold includes all of the costs and expenses that pertain to your production of goods—what most people call “overhead.” If you sell stuffed animals, for example, this might include the cost of yarn, stuffing, needles, and stitches. If you sell a home cleaning service, the cost of goods sold might include cleaning supplies, marketing, and phone bills. You might ask yourself, “Wait, you just said marketing is a sales expense?” Some income statement line items are flexible depending on where you put them. So long as you don’t “double dip” by including something twice, you’re good. For our example, let’s say a company has a cost of goods sold totaling $20,000. We add this to our SG&A to get a total of $202,000.

Subtract that number from your net sales. The net sales, also known as the total revenue, is all of the money that comes into the business as a consequence of your work with clients (minus things like returns, discounts, etc.). Subtract the cost of goods and SG&A from your net sales. If you have a positive number, the company is said to be “negative revenue” or “pre-revenue.” This means they’re operating at a loss. For our example, let’s say the company’s net sales come out to $280,000. $280,000 – $202,000 leaves the company with $78,000. This $78,000 can also be called the company’s EBIT. This stands for earnings before income and taxes.

Divide that number by your net sales. Take the same net sales you just used to calculate the top line item of the main equation. This gives you the operating income as a fractional number. In our example, we’ve got a top line item of $78,000. We divide this by the company’s net sales, which we’ve established are $280,000. This gives us a fractional operating income of 0.2785.

Multiply the final number by 100 to get your operating profit margin. This simply turns the number into a percentage. Traditionally, you drop everything after the whole number and you round up or down depending on whatever is closer. Note, if you’re keeping books, you must include a footnote or explanation that you’re rounding up or down. So, take 0.2785 and multiply it by 100 to get a final operating margin of 28%.

Why are operating margins important?

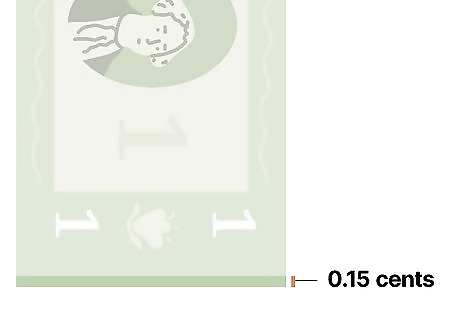

Operating margins tell you what happens to each dollar a company makes. If a company has an operating margin of 15%, that means they have 0.15 cents left over for every dollar that comes into the company as a result of their sales. In other words, the operating margin basically tells you how efficiently a company is operating.

What does your operating margin tell you?

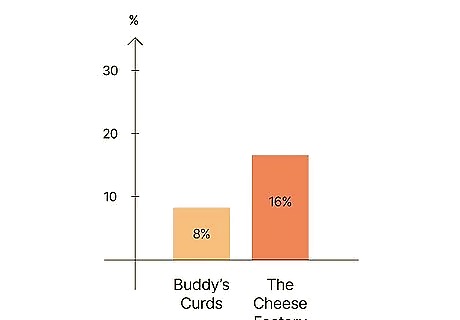

Operating margins allow you to assess competitive advantages. Let’s say there are two companies that sell cheese—Buddy’s Curds and The Cheese Factory. If Buddy’s Curds has an operating margin of 16%, and The Cheese Factory has an operating margin of 8%, Buddy has more room to breathe when it comes to things like cutting prices, expanding, or hiring better employees. So, you could say that a better operating margin indicates a competitive advantage. Keep in mind, you should only compare the operating margins of companies that offer nearly-identical services or products in the same markets. Comparing a burger company in Vermont to a vegan restaurant in Sweden doesn’t tell you anything. While you can compare public companies, you’ll need to take a look at the books of a private company to determine their operating margins.

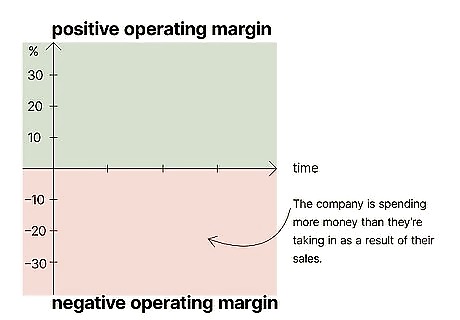

A negative operating margin helps determine a company’s runway. If a company has a negative operating margin, it means they’re spending more money than they’re taking in as a result of their sales. This is common when new companies overspend to acquire customers and grow. However, it also gives you the company’s burn rate, which is the amount of money the company loses every quarter (or year). This can tell you how long a company can exist before they go bankrupt. If you’re assessing a pre-revenue company and you’re worried they’re going bankrupt, look at their “cash on hand.” These two numbers represent how much the company can continue to spend before they have to sell off assets. This is actually one of the most common uses of an operating margin. It helps you identify how long a company can keep losing money before they end up in trouble.

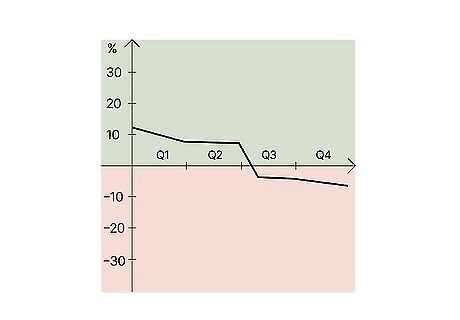

Wild swings in operating margin are a prime indicator of risk. Look at the company’s operating margin across multiple quarters or years. If it swings around wildly (or even goes from positive to negative), it’s a sign the company is relatively unstable. This indicates a high level of risk if you’re considering investing or expanding. As an investor or business owner, you want to see a company’s profit margins either stay the same, or move up at a slowly increasing rate. If the operating margin moves in a pattern (i.e. it’s low in Q1 and Q2 but shoots up in Q3 and Q4), it’s a sign the company is cyclical. In other words, they excel in parts of the year and struggle in other parts of the year. A ski resort, for example, might do really well in the winter but lose money in the summer.

How is operating margin different from gross profit?

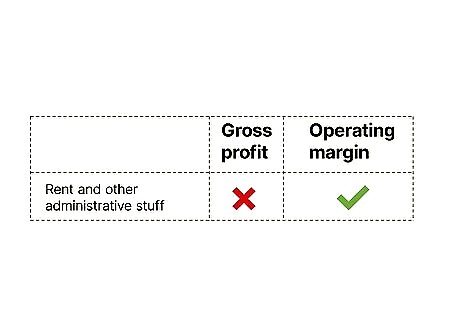

Gross profit leaves out expenses that operating margins include. The operating margin paints a clearer picture of how much money is left over at the end of the day. However, it doesn’t necessarily demonstrate how much a company makes off of their sales alone. The gross profit margin gives a much better sense of that because it doesn’t include things like rent and other administrative stuff. The gross profit margin should always be higher than the operating margin.

What is a good operating margin?

It really depends on the type of business. Some businesses, like grocery stores or airlines, will consider 4-5% a “good” operating margin (Walmart only has a margin of 3.5%!). Other businesses, like software companies, will consider it a disaster if their operating margins fall below 30-40%. Visa has an operating expense of 63%, for example. It all depends on the sector. So long as a company’s operating profit margins are consistently positive, you can claim it’s a “good” company.

Improving Your Operating Profit Margins

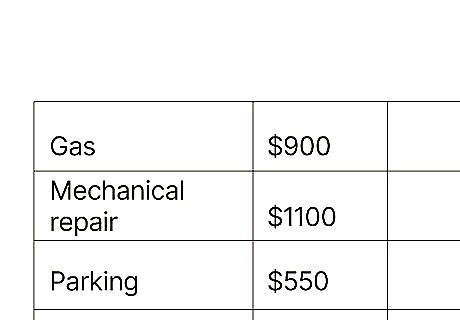

Track all of your expenses as accurately as possible. A lot of business owners have a distorted (and inflated) sense of their operating margins because they don’t adequately measure all of their expenses. If you don’t know exactly how much money your business is spending, you may not have the clearest picture of where you can trim the fat to add to your bottom line. Incorporate gas prices and mechanical repairs into your travel expenses and upkeep costs. Add a buffer to your wage costs for employee turnover and bonuses. Consider the true costs of marketing. How much time do you spend designing ads or scouting opportunities?

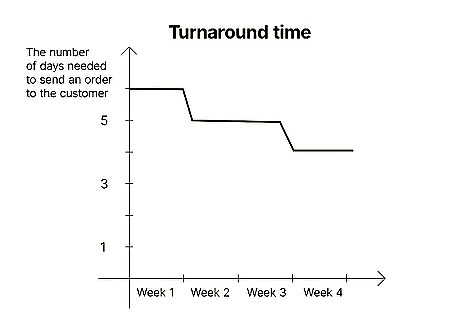

Decrease your turnaround time to speed up deliveries. The faster you can get your product or service out there, the more time there is for more sales. Look for inefficiencies in your supply chains, logistics, or production and resolve them. It’s hard to oversell how important it is to operate efficiently, so take a hard look at your time management. Consider hiring a business consultant. It’s hard for an owner to take a realistic and honest look at their own workflows, and an experienced professional can help you spot things you’d otherwise miss.

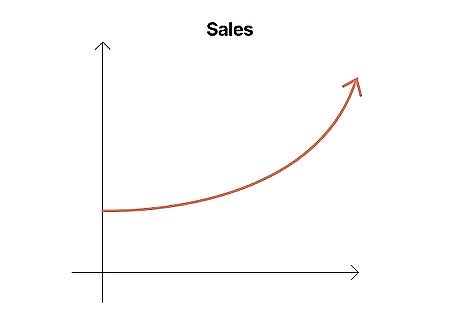

Increase your overall sales to boost your bottom line. If you can sell more products or services, you can increase the overall volume of returns. This may not necessarily increase your operating margin (remember, it’s a percentage), but it will help you ramp your growth and scale. The bigger and more efficient you get, the easier it will be to sharpen your margins in the future. Look at your product-to-market fit. Where do your specific company’s offerings fit into the broader narrative of the market you operate in? Is it possible to adjust your marketing or product to better suit your target audience? Make sure that you completely understand why your customers come to you, then focus on that. It may take a few focus groups or research consultants to help you identify your value proposition.

Comments

0 comment