views

Calculating the Amount of Equity

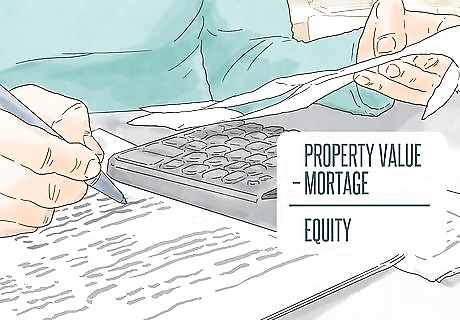

Find out the amount owed on your mortgage. Take out your most recent mortgage statement and look at how much you owe. If you can’t find the most recent statement, call your mortgage servicer and check. Remember to look at the current amount owed, not the amount you took out originally. For example, you might have borrowed $200,000 but have paid back $60,000. The amount you currently owe is $140,000. You also need to count any liens on the home as part of the mortgage. For example, a contractor might have put a mechanic’s lien on your house because you didn’t pay your bill.

Estimate the value of your home. The only surefire way to find out the market value of your house is to sell it. However, you can estimate the value using several different methods: Hire an appraiser to value the property. You can find an appraiser online or in your phone book. Ask a real estate agent to perform a market analysis. This analysis will compare your home to comparable properties in your neighborhood (called “comps”). Find comps yourself and estimate the value. Comps should be similar in size and style to your home. You can find them online at websites such as Zillow.com.

Subtract the mortgage from the value. Your equity is the amount of value that exceeds your mortgage. For example, the estimated value might be $220,000. If you owe $140,000 on the mortgage, then your equity is $80,000.

Dividing the Equity Fairly

Decide if you want a 50/50 split. The easiest way to divide the equity is in half—you get 50% and your spouse gets 50%. In community property states, an equal division might be required. However, you might not want to divide it evenly in certain situations. For example, you both might not have made equal contributions to the home. If only one spouse worked full-time and the other didn’t, then the spouse who paid for most of the mortgage might want a larger share. One spouse might have sold their own property to pay the down payment. In this situation, they might want more than half.

Don’t forget other marital property. You probably own more than just the equity in your home. For example, you might own cars, other real estate, or investments like stocks and bonds. Your goal should be to divide all of your marital property fairly, so don’t focus only on the equity in your house. For example, you might have investments worth $30,000, and the equity in your home is also worth $30,000. In this situation, you might want to take the investments and let your spouse keep all of the equity in the home.

Avoid an unfair division. You aren’t required to divide the house property 50/50. However, a judge will need to approve any division you agree to. Generally, judges will give you leeway to divide the property as you see fit, but make sure one spouse isn’t completely wiped out. A judge won’t approve any property division that is too unfair. Sometimes, an equitable split might not be exactly 50-50. For instance, sometimes it makes more sense for one spouse to retain the house versus selling the house and splitting the proceeds 50-50. In that case, there are often other considerations you have to make to ensure the other person is equitable.

Consult with an attorney. If you have a question about how to divide your marital property, each spouse should consult with their own lawyer. Your lawyer can help you understand your options and how a judge will likely divide the property if you can’t reach an agreement with your spouse. Obtain a referral to a divorce lawyer by contacting your nearest bar association. Call up the attorney and schedule a consultation. Each spouse should have their own lawyer. Avoid meeting with the same one.

Deciding What to Do with the Home

Sell immediately. In some situations, you might be able to sell your house before your divorce is even finalized. You and your spouse must agree to the listing price and how to split expenses. Once you sell, you distribute the proceeds from the sale based on your agreement to divide equity. However, selling quickly isn’t always realistic. For example, the housing market might be cold. Homes could sit on the market for years before fetching a price that you are willing to accept. Also, you might have minor children who attend a local school. In that situation, it might be easier for one parent to continue living in the house with the children.

Consider buying out your spouse. You can get the house entirely in your name by buying your spouse’s share. Essentially, you will refinance the mortgage in your name only. For example, if your home is worth $220,000 and your mortgage is worth $140,000, you’ll need to refinance for at least $180,000. This amount will cover the current mortgage and your ex’s half of the equity that has built up. Before going down this route, research home refinance mortgages (called “refis”). Check the interest rates and whether you can afford to pay the mortgage on your own. If you are the spouse who is selling, make sure to get your name off the mortgage. It is generally not enough to give your lender a copy of your marital separation agreement. Instead, your ex needs to refinance in their name only. The spouse who was bought out should also have their name removed from the deed.

Agree to sell at a later date. You can also agree to sell the home at some point in the future. For example, one spouse might want to stay in the home until your children graduate from high school. At that point, you will sell the house and divide the equity. This might be a good option if your home doesn’t have any equity built up in it. By waiting, the home can increase in value. You need to decide who will pay the mortgage and other expenses during the period that you continue to own the home. Get this in writing. By not selling, both spouses typically remain on the mortgage. This can make it hard for you to go get another mortgage for a new home.

Rent the home until you can sell it. If your home has negative equity—meaning you owe more than it’s worth—then you might want to rent the home. You can collect rent to pay back your mortgage and wait for the market to improve before selling. One spouse will need to act as the primary landlord. Choose which one of you is more organized and better at dealing with difficult people. This person might eventually get more of the equity when you do sell your home. Another option is to hire a property management company to manage the property. Each of you will split the costs of hiring them. You can find property management companies in your phone book or by looking online.

Put your agreement in writing. You can draft a property settlement agreement, which both spouses should sign. In this agreement, you state what you intend to do with the home and how you will divide the equity should you sell it. You can draft a property settlement agreement yourself, but you should have a lawyer look it over to make sure you haven’t left anything out.

Comments

0 comment