views

X

Research source

Making Installment Payments

Evaluate your budget to determine if you can afford the payments. Your CCJ letter likely includes a breakdown of weekly or monthly installment payments you can make to pay off the debt. However, you need to make sure you can afford those payments without getting yourself deeper into financial trouble. Look at the bills you have to pay each month (non-discretionary items, such as food and housing expenses) compared to your income. Determine how much you have left after all your bills are paid. You might have to eliminate some "fun" expenses for a few months so you can afford to pay the installment payments each month. However, if paying the installment payments would mean you couldn't cover necessary expenses, such as rent, you might want to apply to the court to change the terms instead.

Ask the creditor about the best method of payment. Even if you have a CCJ, you'll make payments directly to the creditor, not to the court. Contact the creditor and find out if they have a preferred method of payment they want you to use. At a minimum, never make payments with cash. You'll have no way to prove that the payment was made if the creditor claims you didn't, especially if you send cash through the mail. If you mail in a personal check or money order for payment, send it several days before the payment is due so you don't have to worry about your payment being received late.

Set up a standing order to avoid late payments. If you're certain you'll have enough money in your bank account to cover the installment payment each month, create a standing order with your bank. Then, your bank will automatically make an electronic payment to the creditor for you each month on the date you've selected. If you pay through a standing order, keep your bank statements as proof of payment. You might also ask the creditor to send you a receipt for each payment so you'll have those for your records.Tip: Retain proof of every payment made until the CCJ is paid in full. When you make your last payment, ask the creditor for a statement that you've paid off the CCJ and keep that for your records.

Applying to Change the Payment Terms

Find out if the creditor is using bailiffs to collect the money. If you received a CCJ and ignored it or didn't make any payments, the creditor may have applied to the court for a warrant. The warrant gives a bailiff the right to come to your home or property and demand payment. You have 7 days from the date the warrant is issued to take care of the situation before the bailiff comes to visit you. Applying to change the payment terms can stop the bailiff.Tip: Contact the creditor and let them know that you're applying to change the payment terms. They may withdraw the warrant on their own.

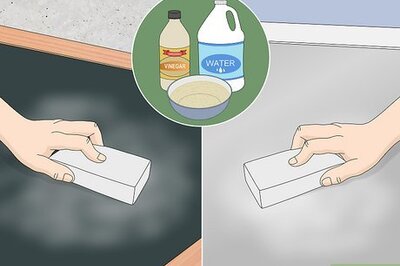

Gather financial documents that show your income and bills. Get proof of all of your income, including wages as well as any benefits or credits you receive. Then, get documents that show all of your priority bills, including your rent or mortgage, council tax, gas, electric, water, and other bills. These are all bills that you're required to pay every month. Any money left over after those bills are paid is your discretionary income. Looking at your discretionary income, budget how much you normally spend for basic needs, such as food, along with other bills, such as your phone bill. This will help you determine how much you can afford to pay each month towards the CCJ.

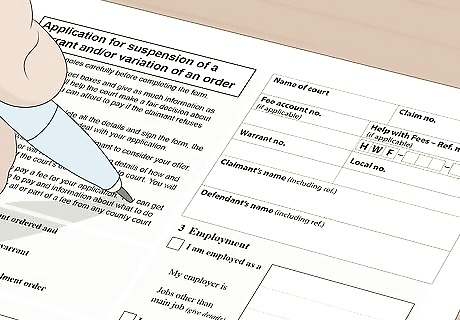

Fill out court form N245 to ask for a variation of the order. On the form, provide information about your income and expenses, then make an offer of an installment payment you can afford to pay each month. Make sure this offer is realistic. You can download a copy of the form with instructions at https://www.gov.uk/government/publications/form-n245-application-for-suspension-of-a-warrant-and-or-variation-of-an-order. You can also pick up a paper form at the courthouse. If you literally have little to no discretionary income, the court may order a token installment payment of, say, £1 a month. However, this doesn't mean the debt goes away. It simply means that you can't afford to make a realistic installment at this time. You'll be expected to keep the court up to date on your financial situation and make larger installments if your income improves.

Submit your completed form to the court with payment of the fee. Send the form to the address listed on the CCJ along with a personal check or money order for the court fee, which is £50 (as of 2020). If you have a low income or are currently receiving government benefits, you can apply to the court for help paying the fee. If you need help paying the fee, go to https://www.gov.uk/get-help-with-court-fees and start the application before you send your form to the court. You can also download and print a paper form from the same page if you prefer to apply that way.

Wait for the judge to decide on new installment payments. The judge will send your form to the creditor and find out if your installment offer is acceptable to them. If the creditor refuses your offer, the judge will order installment payments they find fair considering your income and expenses. The judge typically decides on new installment payments without holding a hearing. However, if the judge wants to hold a hearing to speak with you, you'll get a notice in the mail.Tip: If you were making payments under the original CCJ, keep making them until you hear back from the judge. Otherwise, the creditor might take further action to enforce the CCJ. Typically, it will take a few weeks for the judge to make a decision on a variation request.

Getting the CCJ Canceled

Determine if you're eligible to have the CCJ set aside. If the court never should have entered the CCJ, you can apply to have it canceled or set aside. However, generally, you need to be able to prove that each of these things is true: You weren't previously aware of the claim and didn't have the opportunity to respond to it (for example, you've recently moved and the claim form was sent to your old address). You have a genuine argument against the claim (for example, you've already paid the debt or the debt is so old it is barred from enforcement). You responded as soon as possible after you found out about the CCJ.

Gather information about the debt. Records you have about the debt can help you prove that you have a genuine argument against the claim that the creditor made. Look for statements or letters from the creditor about the debt, as well as receipts for any payments. If you're arguing that you've already paid off the debt, or that you owe less than the creditor claims you do, payment receipts or bank account statements can help you. You'll also need to explain why you didn't respond to the claim. For example, if you've recently moved, get documents that prove when you moved.

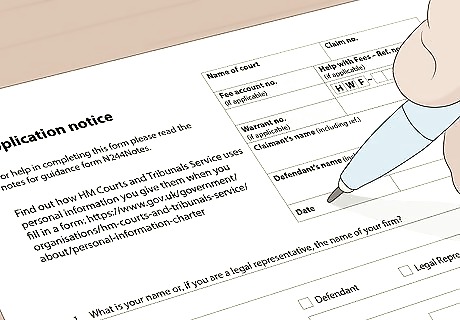

Fill out court form N244 to explain why the CCJ should be set aside. On your form, explain why you didn't know about the original claim, why you don't owe the money the creditor claims you do, and when and how you found out about the CCJ. You can either download a copy of the form at https://www.gov.uk/government/publications/form-n244-application-notice or pick up a paper form at the court that issued the CCJ.Tip: When you finish filling out your form, make a copy of it for your records.

Send your completed form to the court along with the fee. Mail the form along with copies of any documents that prove the explanation you provided on the form. Include a check or money order for the application fee. As of 2020, the application fee to cancel a CCJ is £255. If you have a low income or are receiving government benefits, you may be able to get help with the fees. Go to https://www.gov.uk/get-help-with-court-fees to get started on that application before you send in your form.

Attend the court hearing if necessary. Typically, the court will schedule a hearing before canceling a CCJ. You'll get a notice in the mail from the court letting you know when and where the hearing will take place. This usually isn't a full court hearing. Instead, you'll meet in a private room with the judge and the creditor's representative. Even though this is a relatively informal hearing, you still want to dress appropriately and treat the judge and other court staff with respect. Dress as though you were going to a job interview and make sure your clothes are clean and neat. Bring your copy of the application form as well as copies of any documents that support your explanation as to why the CCJ should be canceled.

Explain to the judge why the CCJ should be set aside. The judge will ask you questions about the information you provided on your application form. Stick to the facts, telling the judge exactly how you found out about the CCJ and the steps that you've taken since then. If the creditor's representative is there, they may talk to the judge as well. However, often the hearing consists of just you and the judge.

Find out the judge's decision. Once the judge has reviewed your situation and the documents you brought with you, they'll decide whether to cancel the CCJ or issue a new order. If the judge doesn't agree with you, they may decide that the original CCJ should stand. Even if the judge decides not to cancel the original CCJ, they may make changes to the payment terms if you've made it clear that you can't afford the installment payments originally ordered. If the judge agrees with you that you owe less money than the creditor originally claimed, they may issue a new CCJ to reflect the revised amount. You won't have to attend another hearing and can make payments under the new CCJ. If you argue that you didn't owe the money at all and the judge agrees with you, they may cancel the order. The creditor is free to refile their claim, at which point you'll have to prove your defense to the claim.Tip: If the judge cancels the CCJ, that doesn't mean the debt disappears. You still have to argue in court that you don't owe the money. A canceled CCJ simply gives you a second chance to do that.

Comments

0 comment