views

- Visit the IRS website and download the appropriate form for the violation, such as Form 3949-A for businesses or individual fraud.

- Complete the form, filling out every field you can, then follow the instructions on the form to submit it, either via mail or online.

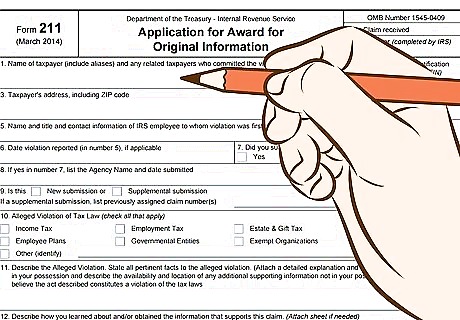

- To receive a reward for a report, first verify your suspicion as best you can, then complete Form 211 and submit it according to the instructions on the form.

Reporting Suspected Tax Fraud

Gather evidence of the fraud. The more evidence you can share with the IRS, the better. Look for anything that supports your claims. For example, consider the following: If you have documents that show fraud, keep a copy of them. For example, someone might not report income from a bank account. If you have a copy of the bank statement, hold onto it. Write down your own memories or observations. You are a witness to any fraud. Try to be as detailed as possible. Collect the names of witnesses. Other people might have first-hand knowledge of the fraud, and you can give the IRS their names and contact information. Avoid breaking the law. For example, you shouldn’t open someone’s mail, log onto their computer, or steal files. If you don’t have documents in your possession, you can tell the IRS where they can find them.

Identify the correct form to use. You will report suspected fraud to the IRS by filling out a form. You can download these forms from the IRS website or order by calling 1-800-829-0433. You need to use the right form, which will depend on the violation you are reporting: Form 3949-A. Use this form to report a business or individual of violating the tax laws. Common examples include failure to pay, kickbacks, false deductions or exemptions, not reporting income, and altering or falsifying tax documents. Form 14157. Use this form to report an abusive tax scheme or fraud perpetrated by a tax return preparer or tax preparation company. Also use this form (and Form 14157-A) if you think the preparer altered your form without your consent. Form 14039. Complete this form if someone stole your identity and used your Social Security Number for a job. Also use this form if you suspect someone could file a tax return using your number. Form 14242. Use this form to report an abusive tax promoter or promotion. Form 13909. Submit this form if you suspect wrongdoing by an exempt organization or employee plan.

Read the instructions. You should also download or request the instructions for any form you fill out. Read the instructions thoroughly and refer back to them as you fill out your referral form.

Complete the form. Each form will request different information. You should complete each form as completely as possible. For example, Form 3949-A will ask for the following: identifying information about the taxpayer you are reporting contact information for the taxpayer you are reporting alleged violation of the law short description of the facts (who, what, where, when, etc.) information about the banks used by the taxpayer whether you consider the taxpayer dangerous information about yourself (optional)

Choose whether to report anonymously. You have the option of not telling the IRS your name when you report fraudulent activity. However, if you do disclose your name, then the IRS will keep your name confidential. If you don’t give your name, then you can’t testify against the person should they be prosecuted. For that reason, you might want to give your name.

Submit the form. The form should tell you where to submit it. Generally, you can mail the form to the IRS. Alternately, you might fax the form. Remember to make a copy of your completed form for your records. Include copies of all supporting evidence as well. The IRS does not provide updates on the status of any investigation. However, you may be contacted if the IRS needs additional information. Provide it promptly.

Reporting Fraud for a Monetary Reward

Check if you qualify for an award. Sometimes, the IRS rewards whistleblowers where their information results in the collection of substantial taxes, penalties, and interest. For example, you might qualify for an award in one of the following situations: If the amount in dispute exceeds $2 million, and a few other conditions are satisfied, then you may get 15-30% of the amount the IRS collects. Furthermore, if the case involves an individual, their income must exceed $200,000. The IRS also has discretion to give awards in other cases. The maximum amount of the award is 15% of the amount collected, up to $10 million.

Confirm your information is solid. The IRS won’t rely on your speculation that someone has broken the law. Instead, it wants solid leads. Analyze what documented information you have that someone is a tax cheat. Supporting evidence can include contracts, emails, bank records, ledger sheets, receipts, and books or records. You don’t need to have supporting evidence in your possession. However, you should describe them and identify their location with as much detail as possible.

Complete Form 211. You must submit this form if you want to claim an award. You can download it from the IRS website here: https://www.irs.gov/pub/irs-pdf/f211.pdf. Provide the following information: name of the taxpayer you are reporting, including any aliases last four digits of their Social Security Number or Employer Identification Number taxpayer’s address taxpayer’s date of birth or estimated age information about whether you have already reported the taxpayer to the IRS alleged violation short description of when and how you uncovered the violation your relationship to the taxpayer amount owed by the taxpayer your identifying information your signature under penalty of perjury

Submit the form. Make a copy for your records and submit the form along with all supporting evidence to the IRS. Don’t withhold information or evidence, since doing so could be held against you. If you have a question about what to submit, call the Whistleblower’s office. Mail to: Internal Revenue Service, Whistleblower Office—ICE, 1973 N. Rulon White Blvd., M/S 4110, Ogden, UT 84404.

Await the IRS decision. Your information will be sent to a subject matter expert, who might contact you to ask questions. If the IRS doesn’t use the information, you’ll be sent a denial letter. A claim with merit gets forwarded to an investigator. Generally, it can take five to seven years to complete an investigation. Because it can take so long to decide, you should make sure the IRS has your current contact information. If you move, send your new contact information as soon as possible to Internal Revenue Service, Initial Claims Evaluation Team, 1973 N. Rulon White Blvd., M/S 4110, Ogden, UT 84404.

Appeal to the Tax Court. In some situations, you can appeal to the tax court if the IRS turns down your claim for a reward. In order to appeal, the amount in dispute must have exceeded $2 million. It usually takes three to ten years to go through the court process. Because so much money is at stake, you should hire a tax lawyer to help you make the strongest case that you can. You can find a qualified tax lawyer by contacting your local or state bar association.

Comments

0 comment