views

X

Research source

Examining the Check

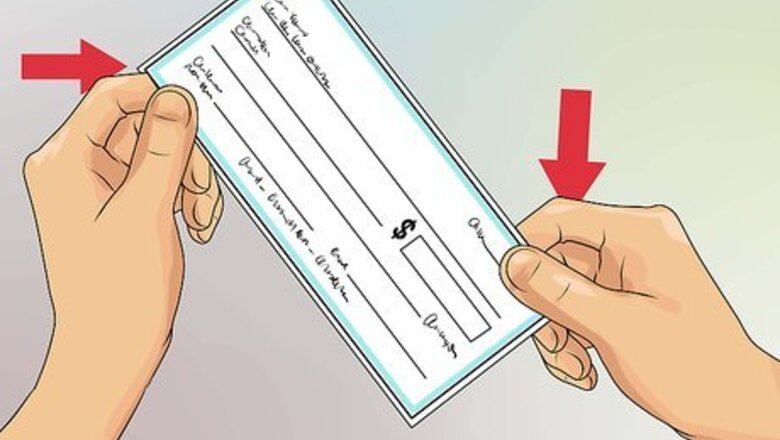

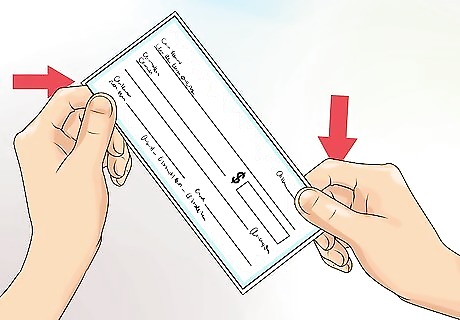

Look at the edges. Most checks that were written by a legitimate business have one edge that is rough or perforated. Examine the sides of the check to see if all sides are smooth. If they are, it might have been printed on a computer.

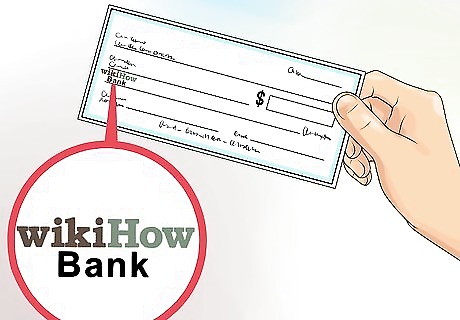

Check the bank logo. Look on the front of the check for the logo of the bank where the checking account is held. If you don't see a logo, the check is likely fake. If the logo is faded or faint, this is probably evidence of the logo being copied from another source. This signals a fake check as well. If the logo seems legitimate, look for an address. You need to check the validity of the bank address, which you can do by going online to the bank's website or calling the bank. Make sure each part of the address is correct. If the check has no address or just a PO Box, the check is likely a fake.

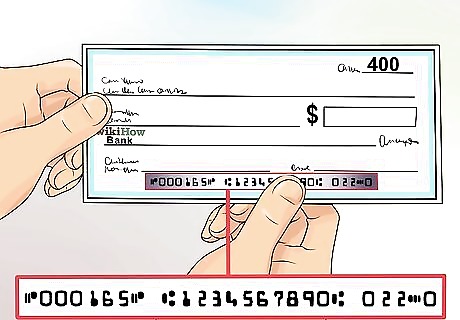

Find the check number. Any legitimate check issued by a bank has a check number. The check number appears at the top right hand corner of the check. If the check does not have a check number, the check is fake. If it does have a check number, check the number against the number in the magnetic ink character recognition (MICR) line. The MICR line is the line of numbers at the bottom of a check printed by the issuing bank that gives all the relevant numbers for a check. From left to right, the long string of numbers contains the routing number, the account number, and the check number. The check number should match the numbers on the far right of the line. If it doesn't match, the check is likely a fake. If the check number is low, from 101-400 on a personal check or 1000-1500 in a business check, the check may be fake. This signals a new account, and 90 percent of fake checks are written from new accounts.

Examine the MICR line. The MICR line appears at the bottom of every check issued by a real bank. Rub your finger over the line to check the feel of the ink. Also look at the ink's quality. The special ink used for the MICR line is dull and should print smoothly. If it is raised or shiny, the check is fake. You also need to examine the routing number in the MICR line. This will be the first series of numbers in the MICR line. Go to the Federal Reserve Bank Services website and search the routing number of the institution issuing the check. If it exists, check the information of the bank against the name and address given to you by the Federal Reserve. If it doesn't match, you likely have a fake check.

Feel the paper. Real checks are typically printed on thick, sturdy stock paper. Rub your fingers along the check. Notice the thickness of the check. Bend the check back and forth, noticing the resistance the check gives. If the check is thin and flimsy, it is likely a fake check. Fake checks are also typically printed on shiny paper. If the check is not printed on matte paper, it might be fake. You can also try an ink test. Dampen your finger and run it across an inked area of the check. If the color smears, it was printed on a color printer and is fake.

Notice the signature. Most signed checks have a consistent signature. Look for gaps in the signature, a digital appearance or shaky and erratic pen strokes. These are signs that may indicate the signature was forged or scanned from another source and printed. This doesn't always mean it is a fake check, but you should look for other clues if the signature seems forced. There are some instances where a stamp is made up to sign checks, which can make it look printed or irregular. Be aware of this issue.

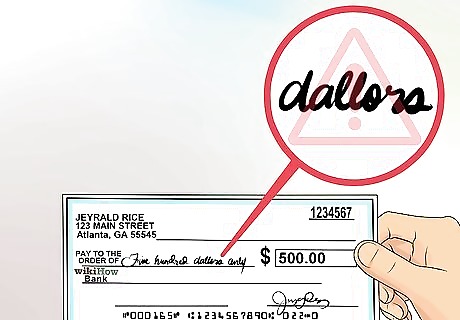

Check for irregularities. A few irregular aspects of a check can show it as being fake: Look for an address of a payee. Notice if it is typed instead of printed on the check. Check for spelling or typing errors within any of the printed areas. Match the amount of the check with the spelled out amount. Pay attention to areas where things have been added or erased from the check. If you see anything out of the ordinary in these areas, you might have a fake check.

Avoiding Common Scams

Develop a policy for accepting checks. If you run a business, it's essential that you make stringent rules for accepting checks. Do not rely on just a physical examination of the check to protect yourself from fraud. The following are common guidelines for check policies: Checks must be from a local or in-state bank Checks should not be written and accepted for more than the purchase amount Checks should not be accepted that are starter checks, unnumbered checks, or non-personalized checks The customer's complete name and address must appear on the check The date must be accurate The check should be signed in your presence and verified with the signature on a photo identification (driver's license, military ID, or state ID) You may want to write down the person's driver's license number

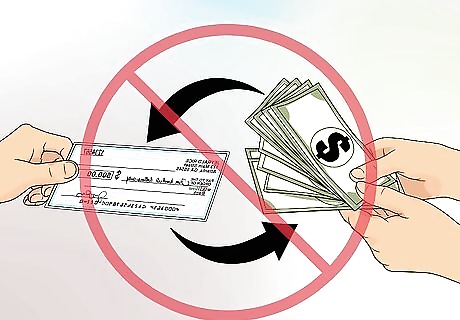

Do not send money to people you don't know. If you get a check in the mail that claims that you won a sweepstakes you never entered or that you won the lottery, you should be wary of the check. Often these scams say that this check only represents part of your winnings and is the first of many. They also ask you to send money for taxes on your winnings. This is an obvious sign of a scam. You should never send money to anyone you do not know. A legitimate company or sweepstakes will never ask you to send money to them. Taxes on such winnings should always be paid directly to the government. Also never send money through wire transfer under these circumstances. This is the same as sending someone cash. Once the scammer picks it up from the wire service, there is no way to get your money back once you realize it is a scam.

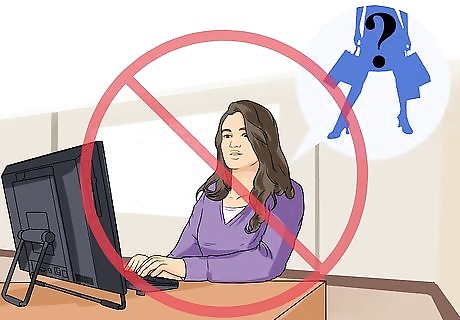

Double-check companies. Many check scams use legitimate businesses as a cover for their corrupt ventures. If you recognize a real company attached to a check you receive and the check looks real, contact the company. Don't use any of the information that was sent with the check. These details could have been created by the person scamming you. Look for information about the company from an independent source to verify if the check you received is real. Research the company on the web or look up its number in a phone directory. Most businesses will let you know if they sent you a check or if they are participating in a sweepstakes.

Do not spend the funds before the check is verified. A fake check isn't always spotted by a bank. You may be able to cash a check, even if it is fake. A bank may not know a check is fake until the bank tries to clear the check. This process can take weeks. If you cash the check or deposit the check and then spend the funds, you will be responsible for paying the money back to the bank. It does not matter that the check is a scam or that you were unaware of it being fake. Do your due diligence to ensure the check is legitimate. Then wait until the check is cleared by the bank before spending the money. The bank holds you responsible for determining the legitimacy of a check before you try to cash it. If you fail to comply with the bank's request to return the money, your accounts can be frozen. The bank can also take legal action and sue you for the money. You can also be charged with fraud, even if you were unaware of the circumstances.

Avoid working-at-home scams. Some check scams seem like job offers. If you are contacted to be a mystery shopper or an account manager at home, this is likely a scam. Most legitimate companies that hire mystery shoppers will never send you checks or money orders ahead of time.The scammers will likely tell you that all you need to do is deposit the checks or money orders they send you. You take your pay as cash from the checks when you deposit them. Never deposit checks for someone you don't know or try to make money fast by working at home for an unknown business. Mystery shopping is a legitimate business, but it is not a get-rich-quick opportunity. You are only paid after you complete the necessary tasks and send in a survey form. If you are ever asked to buy something, the company will always reimburse you. If you think it might be a legitimate mystery shopping opportunity, check with the Mystery Shopping Providers Association. This kind of scam can also apply to many other scenarios where you do a small amount of work from home. A legitimate company would never ask you to deposit checks on their behalf or pay you in such a way.

Shy away from foreign investments. Many scams will write you and ask you to invest in a foreign company or property. They will then send you an check that is an advance on your profits. This is a scam. Never cash a check that is supposed to be an advance on a foreign investment. You should also avoid investing in anything that you do not perform extensive research on beforehand.

Refrain from taking unsolicited grants. If you receive a notification that you received a grant that you did not apply for, this is a scam. Grants are always awarded for a specific purpose. They are not a form of free money. A scam organization may send you a check advance of the amount and ask you to send in some form of payment to get the rest of the grant. The check sent to you is fake and you will lose any money you send to the organization. Real grants are never given unsolicited. You must always apply for grants to receive them. Grants are also typically given in conjunction with an organization or institution where you will be performing some kind of research, paper, or study.

Comments

0 comment