views

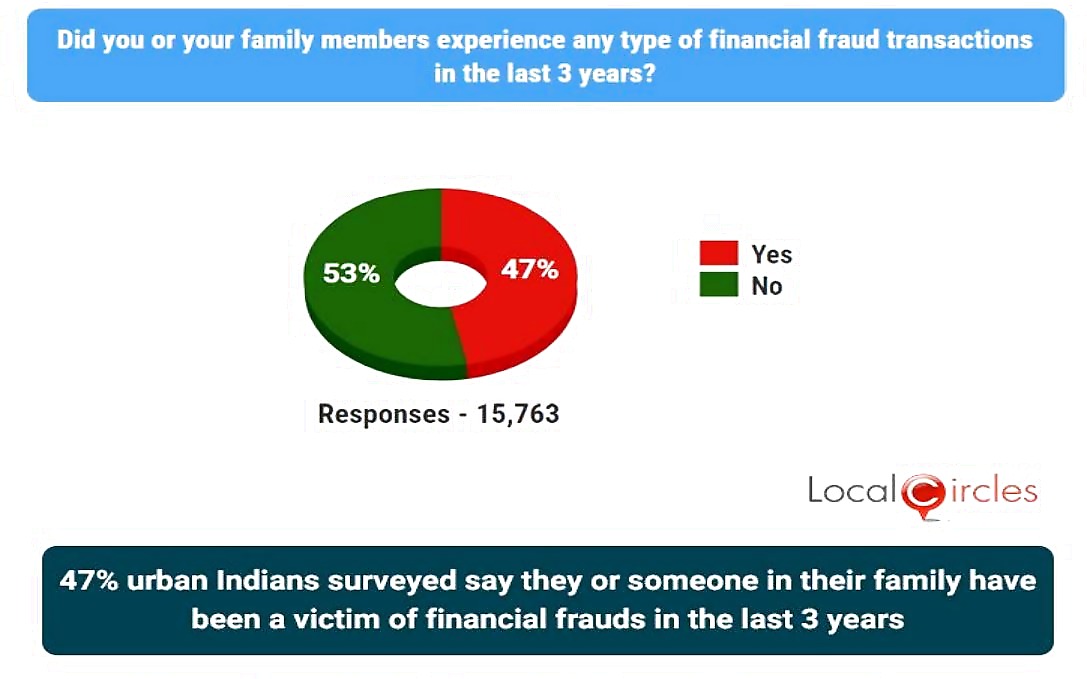

Around 47% of Indians have experienced one or more financial frauds in the last three years, with UPI and credit card marked out as the most common ones, a LocalCircles survey has revealed.

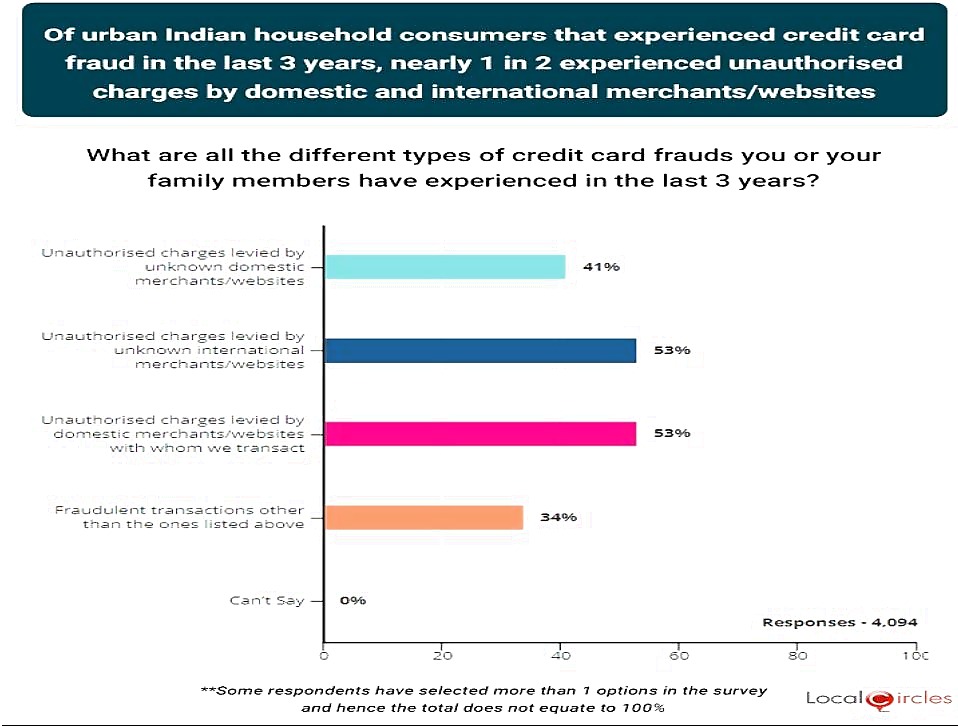

The survey of 23,000 respondents from 302 districts showed over half of the people also experienced unauthorised charges levied on their credit cards by domestic and/or international merchants/websites.

The findings highlight an urgent need to put safeguards and create consumer awareness to prevent fraud, the survey report said.

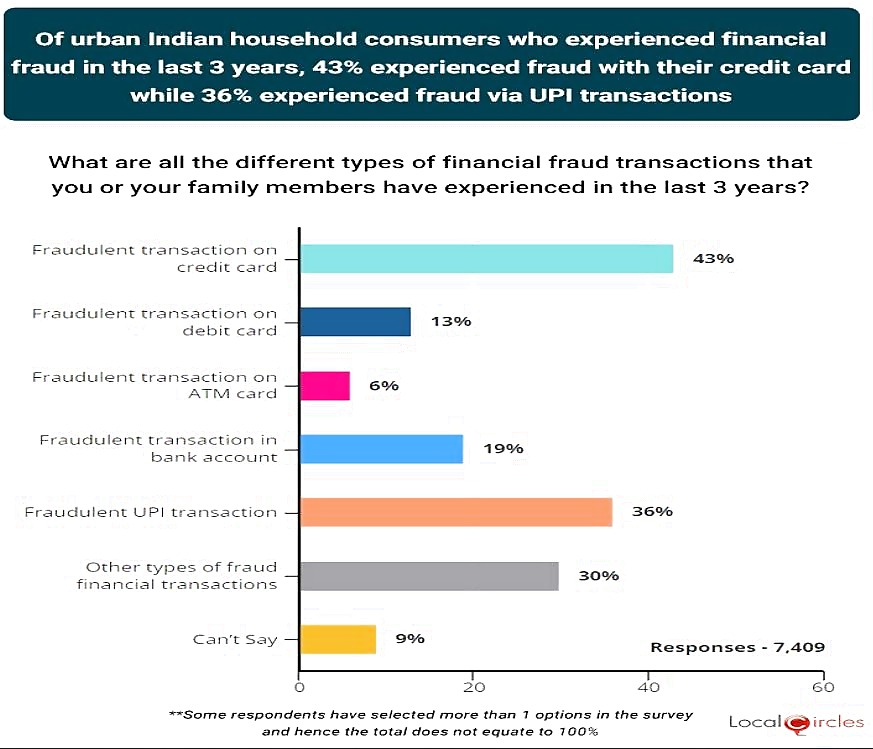

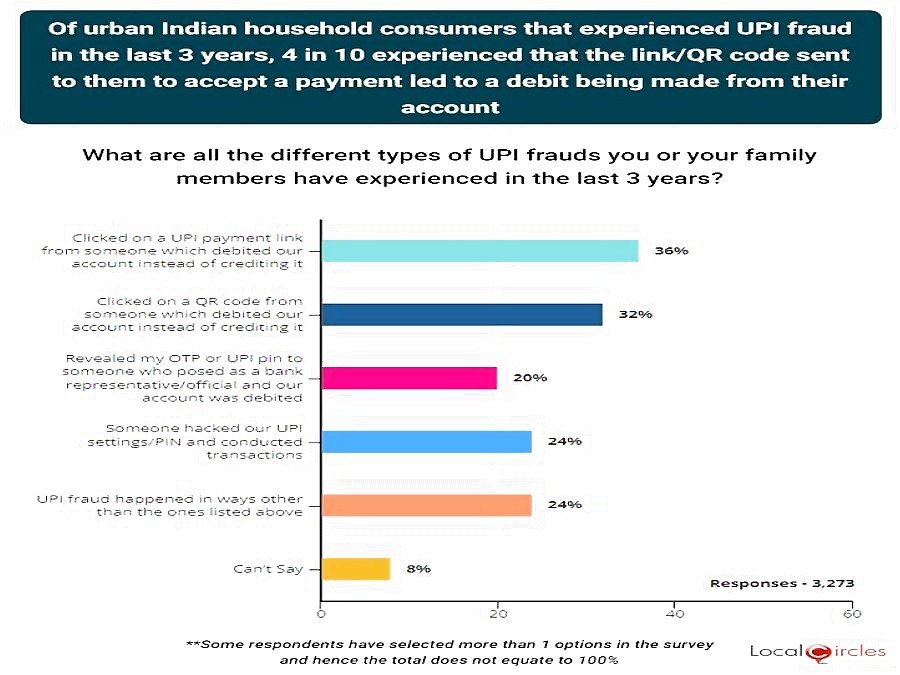

Replying to a question on whether the respondent or their family members witnessed a fraud, 43% reported a fraudulent transaction on a credit card, while 36% said they had a fraudulent unified payment interface transaction.

Among the credit card frauds, 53% of the respondents spoke about unauthorised charges levied by domestic and domestic merchants and websites.

As per RBI data, LocalCircles said, that in FY24, there was a 166% increase in the number of frauds at over 36,000 even though the value is nearly half of the previous fiscal at Rs 13,930 crore.

Citing feedback received by it over the last three years, LocalCircles said it estimates that 6 in 10 Indians do not report financial fraud to regulators or law enforcement agencies.

Comments

0 comment