views

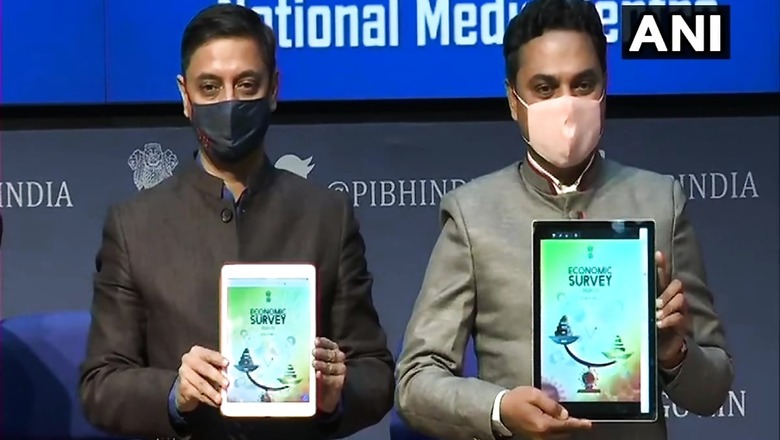

The Economic Survey 2021, released on January 29 ahead of the Union Budget 2021, has called for adequate capitalisation of public sector banks flagging fears of lenders resorting to risk-shifting, which will, in turn, impact the economy which has just begun its upward rise months after the crippling impact of the Covid-19 pandemic.

“Under-capitalised banks may again resort to risk-shifting and zombie lending, thereby severely exacerbating the problem,” the survey said.

“The adverse impact could then spill over to the real economy through good borrowers and projects being denied credit. The resultant drop in the investment rate of the economy could then lead to the slowdown of economic growth,” the survey stated.

This warning is significant since credit growth has plunged to record low levels in recent months on account of a range of factors, including general economic slowdown and muted demand. Also, banks have been highly risk-averse to lend to smaller firms due to a high-risk perception.

Public sector banks (PSBs) account for 60 per cent of the assets in the Indian banking system and are under government ownership. These banks also account for over 90 per cent of the stressed assets in the banking system.

Banks require capital to meet the mandatory reserve requirements laid out by the Reserve Bank of India (RBI), make provisions for bad loans and kick-start the lending cycle when demand revives in the economy. In the last union budget, Finance Minister Nirmala Sithraman didn’t allocate any fresh capital for PSBs. She said over years, the government has infused Rs 3.5 lakh crore capital in PSBs and asked banks to move to the capital market for fundraising purposes.

In August 2020, rating agency Moody’s had said that India’s public sector banks would require up to Rs 2 lakh crore over the next two years to bounce back. About half of it will be used to build provisions on bad loans, the agency had said.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment