views

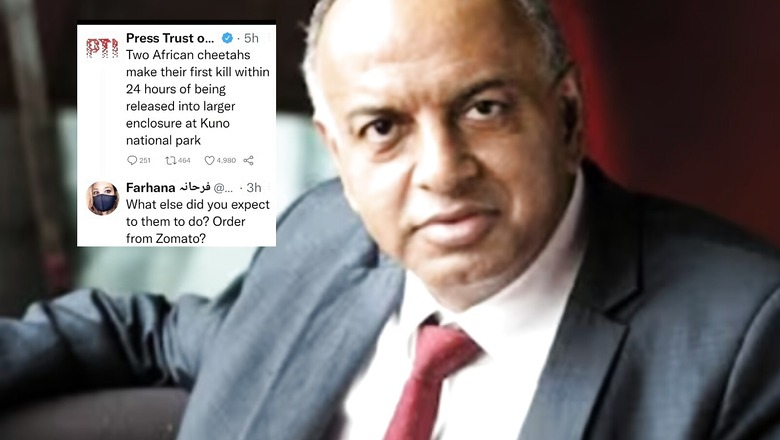

Which is the first name that comes to mind when you think of food delivery? Probably Zomato. That’s not a coincidence and the co-founder of Info Edge is here to prove it. Sanjeev Bikhchandani shared on his Twitter handle the power Zomato holds over our minds. He shared a snapshot of two tweets. The first, from news agency Press Trust of India, mentioned that two African tigers at Kuno National Park made their first kill within 24 hours of being released into a larger enclosure. In its response, a Twitter user sarcastically made a remark and wrote, “What else did you expect them to do? Order from Zomato?” Sanjeev Bikhchandani, in his tweet, wrote, “Clear evidence of TOMA. Top Of Mind Awareness,” and tagged Zomato.

Clear evidence of TOMA. Top Of Mind Awareness @zomato pic.twitter.com/S6OFQ5B2J7— Sanjeev Bikhchandani (@sbikh) November 13, 2022

Social media users are in total agreement about Zomato’s brand power. Top of mind awareness is a measure of how well a brand ranks in the mind of its consumers. If a brand is the first thing a person thinks when they are thinking of a certain niche, product or industry, the brand has reached TOMA. Zomato certainly has done it. A Twitter user wrote, “Agreed, when a brand becomes synonym to a noun, verb or action, we have grown up hearing the Godrej story and these are new India Godrej’s.”

Agree, when a brand becomes synonym to a noun, verb or action, we have grown up hearing the godrej story and these are new India Godrej's— Swapnil Tripathi (@tripathiswapnil) November 13, 2022

“Now is the time to give the coupon code: 2cheetahs,” read another hilarious comment.

Now is the time to give the coupon code : 2cheetahs.— saurabh parmar (@saurabhparmar) November 13, 2022

According to TimesNow News, The co-founder of Info Edge was one of the earliest and biggest investors of Zomato. In 2010, Info Edge invested ₹4.7 crore in the food delivery company for around 18.5% stake. Last year, Sanjeev Bikhchandani made 1050x return on his investment in 11 years. The shares were issued at ₹76 in the initial public offer and closed at ₹126 apiece, that is, 66% higher. This led to a market capitalization of ₹98,849 crore. Info Edge now holds 15.23% stake in Zomato, valued at around ₹12,000 crore. This is after selling 3.3% stake through the IPO.

Read all the Latest Buzz News here

Comments

0 comment