views

Since March 10, two banks in the United States have failed: Silicon Valley Bank (SVB) and Signature Bank, the largest bank failures since 2008. Both catered to businesses and had ties to the technology industry, which has been ailing as a result of severe drops in crypto currencies and deteriorating investor sentiment.

And, banking giant UBS is set to take over its troubled Swiss rival Credit Suisse for $3.25 billion following weekend crunch talks aimed at preventing a wider international banking crisis. However, Asian equities sank Monday on lingering worries about the sector. Read more on this story here

The developments have prompted experts a throwback to the 2008 financial crisis. Let’s understand what had happened then:

What was the 2008 Financial Crisis?

The 2007-08 financial crisis, often known as the subprime mortgage crisis, was a major contraction of liquidity in global financial markets caused by the collapse of the US housing market. It threatened the international financial system, led to the failure (or near-failure) of several major investment and commercial banks, mortgage lenders, insurance companies, and savings and loan associations, and precipitated the Great Recession (2007-09), the worst economic downturn since the Great Depression (1929–c. 1939), explains a report by Britannica.

The 2007-2008 financial crisis had been building for years, said Investopedia in its report. During the summer of 2007, financial markets throughout the world were displaying symptoms that a years-long feast on cheap borrowing was coming to an end. Two Bear Stearns hedge funds had failed, 1 BNP Paribas was advising investors that they might not be able to withdraw monies from three of its funds, 2 and Northern Rock, a British bank, was set to seek emergency assistance from the Bank of England.

Despite the warning indications, few investors believed that the global financial system was about to be engulfed by the biggest crisis in over eight decades, bringing Wall Street’s titans to their knees and sparking the Great Recession. It was ‘an epic financial and economic collapse that cost many regular people their jobs, life savings, or all three,’ explains the report.

What Caused It?

Cheap borrowing and low lending regulations fostered a housing bubble, which triggered the 2008 financial crisis. When the bubble burst, banks were left with trillions of dollars in worthless subprime mortgage investments.

According to a report by the Reserve Bank of Australia, economic conditions in the United States and other countries were favourable in the years preceding the crisis. Economic growth was strong and consistent, while inflation, unemployment, and interest rates were all low. House prices rose dramatically in this atmosphere.

Expectations that house prices would continue to grow drove households, particularly in the United States, to borrow excessively to buy and develop houses. A similar anticipation for house values encouraged European property developers and households (including Iceland, Ireland, Spain, and other Eastern European countries) to borrow excessively. Many mortgage loans, particularly in the United States, were for amounts near to (or even greater than) the purchase price of a home.

A major portion of such hazardous borrowing was done by investors seeking short-term profits by ‘flipping’ properties and by ‘subprime’ borrowers (who have higher default risks, primarily because their income and wealth are relatively low and/or they have previously skipped loan repayments).

The crisis was triggered by decreasing American housing values and an increasing number of borrowers unable to repay their debts. Home prices in the United States peaked in the middle of 2006, coinciding with a sharp increase in the availability of newly built houses in some areas. As home prices began to decrease, the proportion of borrowers who failed to make loan payments increased. Debt repayments in the United States were particularly sensitive to property prices because the number of American families (including owner-occupiers and investors) with substantial loans had risen significantly during the boom and was higher than in other nations.

Financial system stresses first became apparent in mid-2007, the report explains. Several lenders and investors began to suffer huge losses as a result of the fact that many of the homes they repossessed after borrowers failed to make payments could only be sold at prices lower than the loan total. As a result, investors became less eager to buy mortgage-backed securities (MBS) and actively sought to liquidate their holdings. As a result, MBS prices fell, lowering the value of MBS and, as a result, the net worth of MBS investors. As a result, investors who purchased MBS with short-term loans found it much more difficult to roll over these loans, exacerbating MBS selling and price falls.

Foreign banks too were active participants in the US housing market throughout the boom, including the purchase of mortgage-backed securities (MBS) (with short-term US dollar funding). Banks from the United States also had significant operations in other nations. These interconnections allowed the difficulties in the US housing market to spread to other countries’ banking systems and economies.

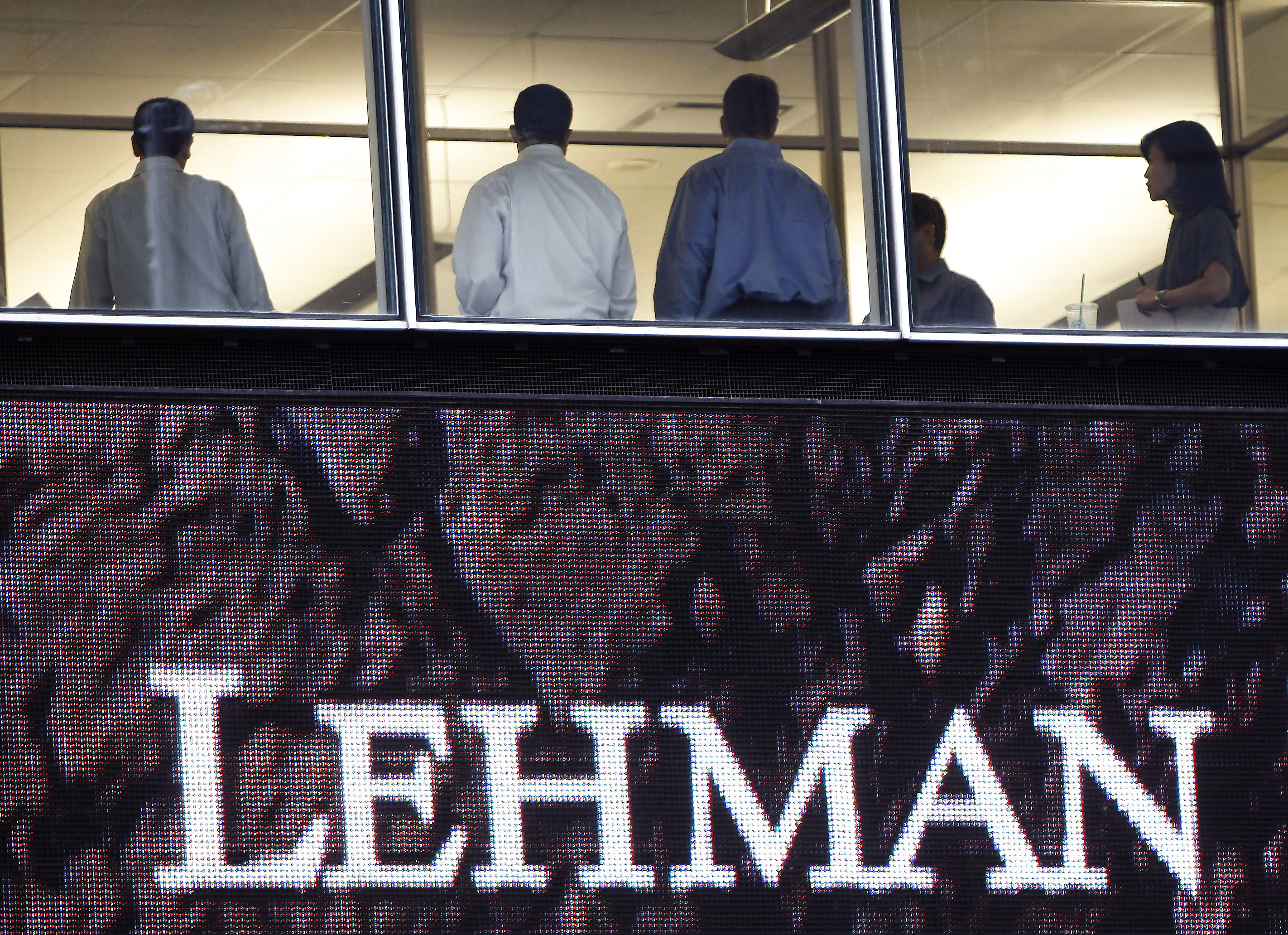

Financial tensions rose in September 2008, following the fall of the US financial giant Lehman Brothers. This, along with the failure or near-failure of a number of other financial organisations around the same time, created a panic in financial markets worldwide.

Investors began withdrawing cash from banks and investment funds around the world because they didn’t know who would fail next or how exposed each institution was to subprime and other distressed loans. As a result of everyone trying to sell at the same time, financial markets became dysfunctional, and many institutions seeking new capital were unable to receive it. When confidence fell, businesses became less inclined to invest and households grew less willing to spend. As a result, the US and various other economies experienced their biggest recessions since the Great Depression, the report says.

Read all the Latest Explainers here

Comments

0 comment