views

Home Loan Interest Rate Comparison 2024: Navigating the home loan market can be challenging, especially with interest rates that can fluctuate and significantly affect your long-term financial plans. For anyone considering buying a home or refinancing, staying informed about the current interest rates from India’s top banks—State Bank of India (SBI), Punjab National Bank (PNB), ICICI Bank, and HDFC Bank—is crucial.

This guide offers an in-depth comparison of the latest home loan interest rates from these major financial institutions. Whether you’re a first-time homebuyer or looking to refinance your existing loan, this resource will help you make a well-informed decision in today’s dynamic home loan landscape.

Home Loan Interest Rate Comparison

Below is the list of floating interest rates of various banks;

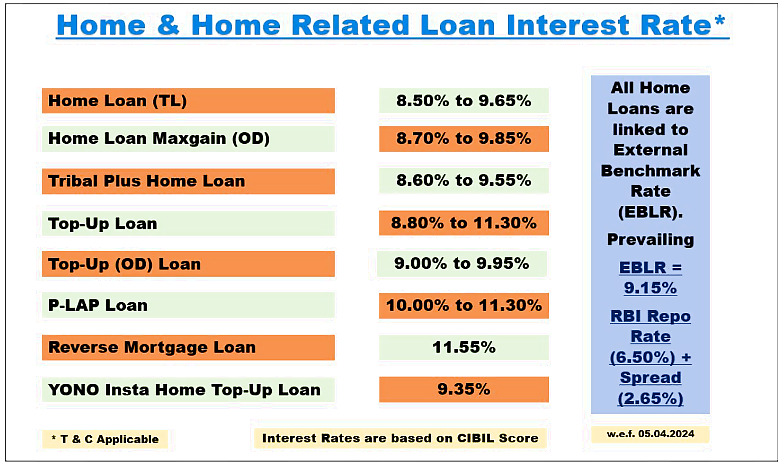

SBI Home Loan Interest Rates

The State Bank of India offers multiple options for home loans. The rate of interest ranges from 8.50% to 11.55%. Check the chart given below;

PNB Home Loan Interest Rates

PNB Housing offers seamless and swift loans for a variety of needs, including home purchases, renovations, construction, and extensions.

PNB Housing offers customers 30-year housing loans (up to the age of 70).

PNB Housing can sanction and finance up to 90% of the house value (percentage funding depends upon the loan amount).

PNB’s rate of interest ranges from 8.50% to 11.45%. Check the chart given below;

Up to 35 lakh

Above up to 35 lakh

ICICI Bank Home Loan Interest Rates

At ICICI Bank, special home loan interest rates are customised based on your credit score. These rates play a crucial role in determining the interest applicable to your home loan, ensuring fair and personalised lending.

Credit Score Salaried Self – Employed

800 9.00% 9.00%

750 – 800 9.00% 9.10%

Standard Home Loan Interest Rates

Loan Slab Salaried Self-Employed

Up to Rs 35 lakhs 9.25% – 9.65% 9.40% – 9.80%

Rs 35 lakhs to Rs 75 lakhs 9.50% – 9.80% 9.65% – 9.95%

Above Rs 75 lakhs 9.60% – 9.90% 9.75% -10.05%

HDFC Bank Home Loan Interest Rates

HDFC Bank provides attractive home finance interest rates starting from 8.60% per annum. These rates apply to home loans, balance transfer loans, house renovation loans, and home extension loans.

HDFC Bank offers both adjustable-rate (floating rate) loans and fixed loans. With fixed loans, the interest rate remains fixed for a specified period (such as the first two years of the loan tenure) before switching to an adjustable rate.

HDFC Bank Adjustable Home Loan Rates

All rates are benchmarked to the Policy Repo Rate, which is currently 6.50%.

Special Home Loan Rates for Salaried & Self-Employed (Professionals & Non-Professionals)

Loan Slab Interest Rates (% p.a.)

For All Loans Policy Repo Rate + 2.25% to 3.15% = 8.75% to 9.65%

Standard Home Loan Rates for Salaried & Self-Employed (Professionals & Non-Professionals)

Loan Slab Interest Rates (% p.a.)

For All Loans Policy Repo Rate + 2.90% to 3.45% = 9.40% to 9.95%

These rates are linked to HDFC Bank’s repo rate and may vary throughout the loan tenure.

The information provided on home loan interest rates for SBI, PNB, ICICI Bank, and HDFC Bank is for informational purposes only and represents typical ranges at the time of writing. Interest rates are subject to change frequently based on various factors, including the bank’s internal policies, market conditions, and the Reserve Bank of India (RBI) guidelines.

Before finalising any home loan, thoroughly read and understand all the terms and conditions of the loan agreement. Pay close attention to prepayment clauses, lock-in periods, and any exit charges.

Comments

0 comment