views

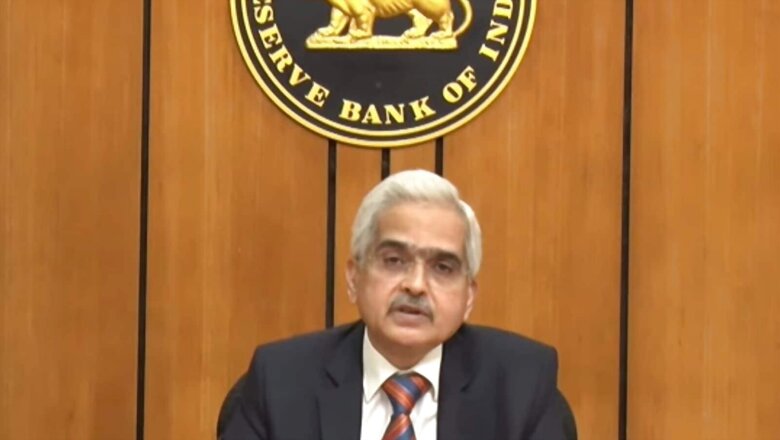

RBI governor Shaktikanta Das is scheduled to make a statement at 2pm on Wednesday, May 4, the central bank said in a tweet on the day. The Reserve Bank of India governor is making the statement at a time when the inflation rates in India have soared to a months high and have remained past the central bank’s upper band of tolerance at 6 per cent. India’s inflation rates are at a high at the moment, resulting out of global inflation as a whole, and has posed a challenge in the economic recovery of the country after three waves of the Covid-19 pandemic.

“Watch out for the statement by the RBI Governor @DasShaktikanta at 02:00 pm on May 04, 2022,” the RBI said in its tweet.

Watch out for the statement by the RBI Governor @DasShaktikanta at 02:00 pm on May 04, 2022YouTube: https://t.co/DTAhQZ52jH

Live streaming also available on @RBI on Twitter and @reservebankofindia on Instagram#rbitoday #rbigovernor

— RBI Says (@RBIsays) May 4, 2022

However, it is not yet clear what the RBI governor speech today will be about, while it is being anticipated that the RBI press conference will be on rising inflation rates.

In its monetary policy committee meet in April, the RBI had revised the inflation outlook upwards to 5.7 per cent and had voted to focus on “withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.” The central bank had kept its lending rates at record low, with the repo rate remaining the same at 4 per cent since it was brought down during the pandemic.

Retail inflation in March touched a 17-month high of 6.95 per cent led by a jump in the prices of fuel and food items such as vegetables, milk, meat, and cereals. It has been anticipated that with rising inflation, the RBI will also opt for a rate hike by June this year.

“With inflation likely to exceed 6 per cent for three consecutive quarters, especially if energy prices remain elevated, the RBI is likely to get quite perturbed. With higher food price pressure in the near term (summer effect, international prices, higher transport costs, supply chains) and persistent input cost pressure in the non-food segment, we see inflation crossing 6 per cent in FY23,” said an Emkay report shortly after the MPC meet of the RBI.

The inflation in March shot up mainly due to costlier food items. The inflation in the food basket during the month stood at 7.68 per cent, up from 5.85 per cent in the previous month. Core inflation, which excludes food and fuel components, also rose to a 10-month high of 6.29 per cent in March. Supply shortages of coal and power is also a reason to worry, along with the strengthening of the dollar index which may weaken the rupee and result in imported inflation.

The RBI governor’s speech today comes days before the US Federal Reserve meeting, and is likely to touch up on these issues in India.

Read all the Latest Business News here

Comments

0 comment