views

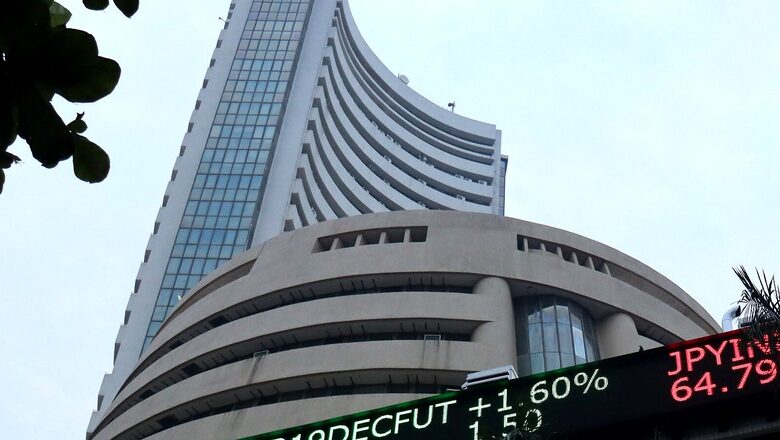

The 30-share BSE Sensex closed at 60,077.88, up 29.41 points, or 0.05 per cent, while Nifty was at 17,855.10, up 1.90 points, or 0.01 per cent. The Sensex remained above the 60,000 mark, while Nifty closed below 17,900. On BSE, Nirlon, EIHotel, IndiaGlyco, PSPProject are the top gainers. While the Mindtree, KPI Tech, Mayur Uniq. HCL Tech, Sequent were among the laggards. Sectorally, BSE MidCap, at closing, did not change and BSE SmallCap closed down at 0.13 per cent.

“Due to profit booking in IT, Pharma and FMCG, domestic markets failed to uphold its winning streak to close flat in a volatile session. Realty stocks continued its rally on positive developments in the sector while the sentiments in the auto sector were lifted on expectation of better sales numbers for September. The market is also awaiting the release of August’s core sector output data and September’s manufacturing PMI data this week,” Vinod Nair, head of research at Geojit Financial Services said.

ON NSE, Maruti, Mahindra and Mahindra, Tata Motors, ONGC, Hero Motor Corp were the top gainers. On the flip side, HCL Tech, Tech Mahindra, Wipro, DivisLab, Bajaj Finserv were the top losers. Sectorally, Nifty Bank, Nifty Auto, Nifty Financial Services closed in the green. However, Nifty FMCG, Nifty IT, Nifty Pharma ended in the red.

“Indian markets started on a positive note despite mixed Asian market cues as fears of further waves of coronavirus outbreaks clouded the economic outlook for the region, tempering gains. During the afternoon session Indian markets are maintained their up move as across-the-board buying by funds as well as retail investors was seen. Traders took support as India, US looking forward to reconvening trade policy forum this year,” Narendra Solanki, head- equity research (Fundamental), Anand Rathi Shares & Stock Brokers said.

“Sentiments also got boost as Finance Minister stated that the Indian economy is on a sustained path of revival and cited rise in GST collections and direct taxes to support her assertion. Also, the sentiment further got boosted as further easing in lockdown was announced in Maharashtra with opening of multiplexes and cinema halls,” he added.

The core sector data that is scheduled to be released on Thursday will also weigh on the market. The capex growth data for the September quarter on Friday as well as the India manufacturing PMI which is also due on Friday US, UK will also release their official GDP figures later this week. All these data sets will influence the market and will decide the way ahead for the market.

“Domestic equites traded in rangebound amid positive cues from global equities. However, heavy profit booking in IT and pharma nullified the impact of sharp recovery in Auto stocks. Further, financials and realty indices extended gains today. Nifty IT fell over 2.5 per cent today as investors preferred to book some amount of profit ahead of September quarter earnings. Auto stocks witnessed strong rebound today as continued underperformance for last couple of months, expectations of improvement in demand scenario from October and positive commentary from select companies about semiconductor issue made investors to buy quality names in OEMs,” Binod Modi, head strategy, Reliance Securities said.

In early trade, the 30-share BSE Sensex on Monday opened in green and was trading at 60,271.64, up 223.17 points, up 0.37 per cent. The broader Nifty was trading at 17,913, up 63.80 points, or 0.36 per cent. The market opened with gains, taking mixed cues from global markets, the MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, after three consecutive weeks of loss. Japan’s Nikkei gained 0.4 per cent on hopes for further fiscal stimulus once a new prime minister is chosen.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment