views

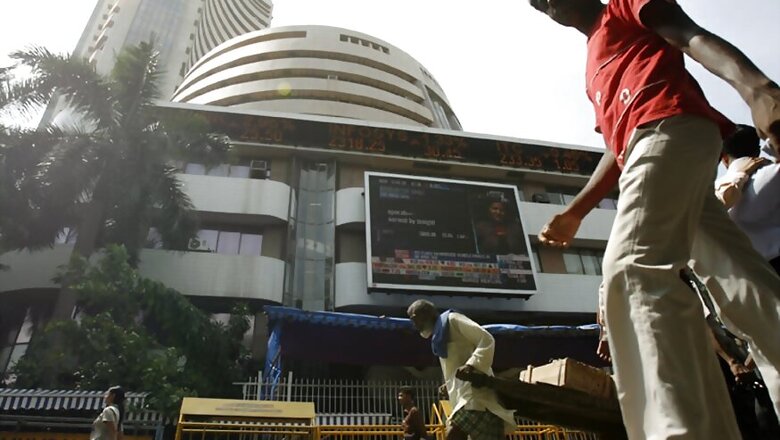

Mumbai: Stocks were in exhale mode on Monday as the Sensex lost over 130 points to reverse two days of climb and the Nifty got off the record after an eventful last week amid mixed global cues.

The Nifty, which had hit a life high of 9,160.05 on Friday after scaling an intra-day record of 9,218.40, succumbed to profit-booking and closed down 33.20 points, or 0.36 per cent, at 9,126.85.

The Sensex moved in a narrow band and closed at 29,518.74, down 130.25 points or 0.44 per cent. It shuttled between 29,482.40 and 29,699.48.

The Sensex had rallied 702.76 points, or 2.42 per cent, to 29,648.99 last week after the BJP's big win in Uttar Pradesh. The Nifty gained 225.50 points, or 2.52 per cent, to finish at a new closing peak of 9,160.05.

Meanwhile, the Cabinet today approved four legislations to implement the goods and services tax (GST) ahead of their introduction in Parliament this week for rollout of the tax reform from July 1.

Approval of the Bills by Parliament and a separate one by all state assemblies will complete the legislative process for rollout of one-nation-one-tax regime by merging central taxes like excise duty and service tax and state levies like VAT.

The GST Council has already approved four-tier tax slabs of 5, 12, 18 and 28 per cent plus an additional cess on demerit goods like luxury cars, aerated drinks and tobacco products. The work for fitting various goods and services in different slabs is slated to begin next month.

Foreign portfolio investors (FPIs) bought shares worth a net Rs 1,532.90 crore last Friday while domestic institutional investors (DIIs) sold shares worth a net Rs 711.50 crore, as per provisional data.

Most Asian stocks ended higher while European shares were trading in the negative zone.

Stocks of IT companies saw selling as the rupee continued to strengthen, which dragged down the Sensex. The rupee was trading higher at 65.31 (intra-day) against the dollar.

The market is in an "over-bought" position and cautious participants preferred to lock in some gains.

Idea Cellular tumbled 9.55 per cent to Rs 97.60 after the company announced its merger with Vodafone India to create the country's largest mobile telephone services player.

Among the 30-share Sensex components, Axis Bank emerged as the top loser by logging a fall of 2.41 per cent to Rs 504.55, followed by ICICI Bank 1.99 per cent to Rs 275.15.

Other laggards were Infosys, TCS, Wipro, RIL, Tata Steel, L&T, Hind Unilever, PowerGrid, Maruti Suzuki and M&M.

In contrast, NTPC, Coal India, Bharti Airtel, HDFC Bank, Lupin, HDFC Ltd, ONGC, GAIL and Asian Paints ended with gains up to 0.87 per cent, which cushioned the losses.

The BSE IT index suffered the most by losing 1.36 per cent, followed by technology, oil and gas and bank.

Outperforming the Sensex, the broader markets remained firm as investors were seen widening their bets, lifting the small cap index by 0.30 per cent and mid-cap by 0.17 per cent.

Elsewhere, most Asian markets ended higher. Japanese markets were shut today for a public holiday. Europe was trading negative.

Comments

0 comment