views

London: Illinois car parts baron Shahid Khan will find plenty of familiar faces and accents when he visits English soccer stadiums this year after spending an estimated $300 million to buy London team Fulham.

With Khan's arrival U.S. sports franchise owners now control six of the 20 clubs in the world's richest soccer league, reflecting an explosion in interest in the game in the United States and a growing trend among owners to seek global networks.

Investors like the Glazer family at Manchester United, Arsenal's Stan Kroenke and Boston Red Sox owner John W. Henry at Liverpool have been drawn by the Premier League's ability to generate vast sums of TV cash and support from fans all over the world.

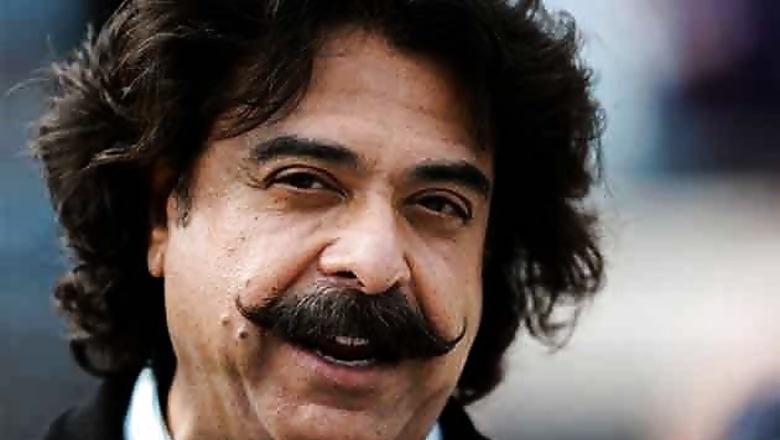

"The Premier League obviously has a huge global audience," says the moustachioed Khan, who was born in Pakistan and already owns Florida's Jacksonville Jaguars in American football. "It's got a great media deal, it's got great leadership at the top and most importantly a very, very passionate fan base and it's an excellent business platform," he told Reuters.

As a new season kicks off this weekend, television deals at home and abroad have allowed the English top flight to put the dark hooligan days of the 1980s behind it. The league's 20 clubs will share annual TV revenues of around 1.7 billion pounds thanks to new broadcast deals starting this month.

Underlining the growing interest in the United States, NBC has bought the rights there for the next three years, paying an estimated $250 million to unseat Fox. There are now an estimated 24 million Americans playing soccer compared to 100,000 in 1967.

"Soccer is on the rise big time," Khan said, commenting on the game's growing U.S. profile. "I think Fulham can get its fair share of fans and we want to help them do that, playing friendlies in Jacksonville next year," he added.

To try to build his NFL team's international profile, Khan is bringing the Jaguars to London's Wembley Stadium to play a game in each of the next four seasons. The U.S. influx comes at a turning point for English soccer as a business.

After a decade in which rich Russian and Arab owners have poured hundreds of millions of pounds into winning the Premier League title at Chelsea and Manchester City, the European game's governing body UEFA is striving to force clubs to run tighter and more sustainable budgets.

Stan Kroenke's Arsenal, starved of success but reliably in the upper reaches of the league, have created one model admired by the game's financial planners, generating operating profits of 20 million or more annually.

Champions Manchester United have seen around 100 million pounds in annual EBITDA profit in each of the past three years, allowing them to service the debts - controversial with many of the club's fans - that the Glazers took out when they bought the club for 790 million pounds in 2005.

At Fulham, whose stadium on the banks of the Thames sees crowds of a third to at most half of those at the bigger clubs, the sums are much tighter and dominated by the threat of relegation out of the top flight.

Fulham's revenues for 2011-12 were 79 million pounds - a quarter of what Manchester United generated in the same season. "The key challenge for me is that it's got to be sustainable for the long haul," said Khan. "The investments we have to make - obviously in the squad but more importantly in the stadium - are something that will generate the revenue so we will get into a virtuous circle."

The Financial Fair Play regime being implemented by UEFA is second nature to Americans where mechanisms like salary caps and a luxury tax levy are in place to regulate spending by sports franchises. At Fulham, former owner Mohamed Al Fayed pumped some 200 million pounds into the club after taking it over in 1997, loans he converted into shares earlier this year before selling up.

Fulham and fellow U.S.-owned clubs Sunderland and Aston Villa are among a group of teams whose initial ambition is to garner enough points to avoid finishing in the bottom three of the Premier League and losing their place in the elite.

American sports franchises do not have to deal with that system of promotion and relegation with the big swings in income that it can bring. Khan, who paid an estimated $770 million to buy the Jaguars less than two years ago, says that the annual threat of demotion makes it cheaper to buy a Premier League club than to acquire an equivalent NFL franchise.

"The risk of relegation prices teams less than they would be in a closed league," he said. "I think it's a simple matter of economics."

Comments

0 comment