views

Understanding the Basics of Bonds

Learn about the terms of a bond. There are three important characteristics of any bond. The first is the face value (also known as "par value"), which is the total amount of money the bond represents. The second is the interest rate, and the third is the length of the bond in years - the time between the bond's issuance and maturity.

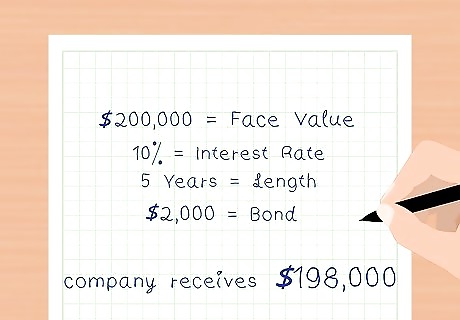

Understand how companies raise capital with bonds. Corporations sell bonds to investors to raise capital. Investors purchase bonds at a certain price, and then receive interest payments every six months from the issuer. At the bond's maturity date, the investor also receives the face value of the bond in cash. For example, suppose a company needs to raise money for capital improvements. To raise the money, the company issues, or sells, $200,000, 10%, 5 year bonds. Investors purchase the bonds. The company gets the money from the investors for its capital improvements, but it has to pay the investors back plus interest. At the end of the five years, the bond matures. The company now owes the investor the amount paid for the bond plus the 10 percent interest.

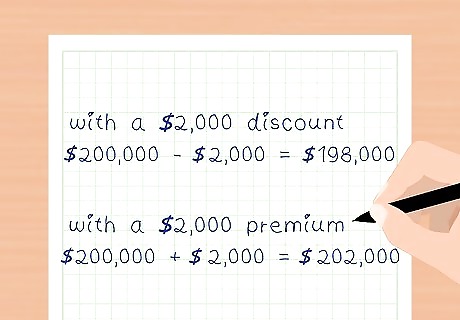

Understand the factors that influence bond prices. If a bond's interest rate differs significantly from the overall market rate for similar bonds, the bond will be sold at either a premium or a discount. Interest rates fluctuate daily. When interest rates rise, bond prices fall. When interest rates fall, bond prices rise. Similarly, when inflation is on the rise, bond prices fall. When inflation rates decrease, bond prices rise. Finally, bond issuers and specific bonds are rated by credit rating agencies. An issuer with a high credit rating is likely to get higher prices for a bond. Consider the company that is selling the $200,000, 10%, 5 year bonds. Suppose investors can get a better return on their investment than 10 percent because market interest rates are high. They won’t want to purchase the bond for the face value because they could make more money with a different investment. So the company sells the bond at a $2,000 discount. Now investors can purchase that $200,000 bond for $198,000. When the bond matures after 5 years, the investor gets back the face value of the bond, $200,000, plus 10 percent interest. Using the same example, if market interest rates are lower than 10 percent, then the company’s bonds give investors a better return than they would get on other investments. So the company sells the bonds at a $2,000 premium. Now investors must pay $202,000 for the bond. When the bond matures, the investor gets back $200,000 plus 10 percent interest.

Know the meaning of the carrying value. The carrying value is a calculation performed by the bond issuer, or the company that sold the bond, in order to accurately record the value of the bond discount or premium on financial statements. The discount or premium is amortized, or spread out, over the term of the bond. Accountants use this calculation to spread out the impact of the premium or discount over time on a company's financial statements. The carrying value (or "book value") of the bond at a given point in time is its face value minus any remaining discount or plus any remaining premium. Knowing how to calculate the carrying value of a bond requires gathering a few pieces of information and performing a simple calculation.

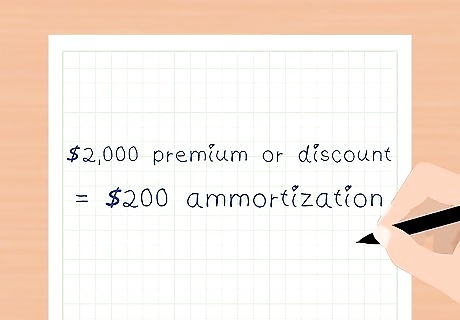

Understand amortization. Amortization is an accounting method that systematically reduces the cost of an asset over time. It spreads the effect of a bond discount or premium over the term of the bond. The amortized discount or premium is recorded as an interest expense on financial statements. By the time the bond matures, the carrying value and the face value of the bond are equal. For example, suppose a company sells a $200,000, 10%, 5 year bond at a $2,000 discount. The company receives $198,000 from investors. This is recorded on financial statements as a liability. The $2,000 is an asset. It is amortized, or recorded on financial statements in increments over the term of the bond. The difference between the face value of the bond and the unamortized portion of the discount at any point in time is the carrying value.

Understand the difference between carrying value and market value. The market value of a bond is the price investors are willing to pay for a bond. It is determined by market influences such as interest rates, inflation and credit ratings. Bonds can be sold at a discount or a premium, depending on the market. The carrying value, on the other hand, is a calculation accountants use to record the impact of the premium or discount on the bond issuer's financial statements. The carrying value is the net value of an issued bond for the bond issuer. It is calculated based on the amount of the bond premium or discount, the elapsed time in the term of the bond and the amount of amortization that has already been recorded.

Accounting for Bond Premiums and Discounts

Make the initial entry at the date of bond sale. For both bond premiums and discounts, the company will have to make an initial journal entry when the bonds are sold that records the cash received and the discount or premium given. In both cases, bonds payable will be credited for the total face value of the bonds. Using the previous example, with the company issuing $200,000 bond would record a $200,000 credit to Bonds Payable. If the company sells the bonds with a $2,000 discount, the company would debit the cash account for the cash received, $198,000 ($200,000 - $2,000) and debit Discount on Bonds payable for the amount of the discount, $2,000. Similarly, if the company sells the bonds with a $2,000 premium, the company would debit the cash account for cash received, which would total $202,000 ($200,000 + $2,000). They would also credit Premium on Bonds Payable for the amount of the premium, $2,000.

Calculate how much of the premium/discount will be amortized. When the next entries are made, the company will have to determine how much of the premium or discount to amortized. This amount will reduce the balance of either the discount or premium on bonds payable. If they are using straight-line depreciation, this amount will be equal for every reported period. For simplicity, we still stick to using this method in the example. Imagine that for our example $200,000 bond issue, the bond makes a coupon payment twice per year, or every six months. This means that we will make two entries per year that record interest expense. Additional entries must be made at the same time for the proper amount of amortization of premiums or discounts. Because it is a 5-year bond payable semi-annual payment, we will amortize one-tenth of the premium or discount in each period (5 years x twice per year). For our $2,000 premium or discount, this means recording $200 amortization each time.

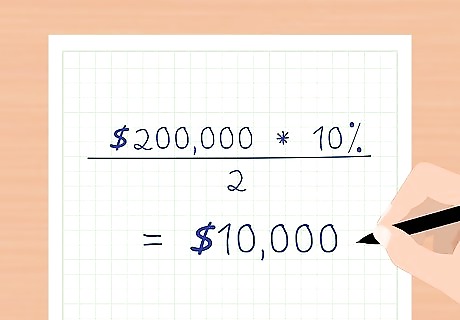

Calculate interest expense. In order to properly report amortization, we will also need the know the amount of interest expense paid to bondholders over the same period. This is the amount of the coupon payment, based on a percentage of the par value. It is made in annual or semiannual payments to bondholders. Calculate annual interest expense by multiplying the coupon rate, or interest rate, by the par value of the bond. Divide this number by two to get the semiannual interest expense. For the example $200,000 bond, the interest expense would be found by multiplying the coupon rate, 10%, by the par value, $200,000. This gives $20,000. Therefore, the semi-annual interest expense recorded would be half of that, or $10,000.

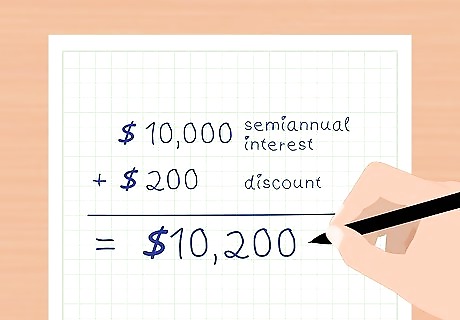

Record discount/premium amortizations on annual statements. For each year, the company must record any interest expense paid incurred from the sale and maintenance of bonds. This includes both the coupon payments made to bondholders plus or minus the premium or discount amortization. For semiannual payments, the company would record both interest payments made within the year separately, along with their respective amortizations. This is recorded with a debit to interest expense for the total interest expense, which is either the semiannual interest payment plus the amortization on the discount or minus the amortization on the premium. For a discount, there are also a credit to cash account for the amount of interest expense and a credit to discount on bonds payable for the amount of the amortization. These are entered equally for both semiannual payments. For a premium, there are also a debit to premium on bonds payable for the amount of the premium amortization and a credit to the cash account for the amount of the interest payment, For example, using the aforementioned $200,000 bond sale and a discount, we would recognize the $10,000 semiannual interest payment plus the $200 discount amortization as a debit to interest expense for a total of $10,200. We would also credit discount on bonds payable for $200 and credit the cash account for $10,000.

Calculating the Carrying Value

Determine the terms of the bond in question. Know whether the bond sold at par, at a premium, or at a discount. Determine the time elapsed since the bond's issuance. To calculate the carrying value of a bond, you will need to know how much of the premium or discount has been amortized, which will depend on the time elapsed since the issue date.

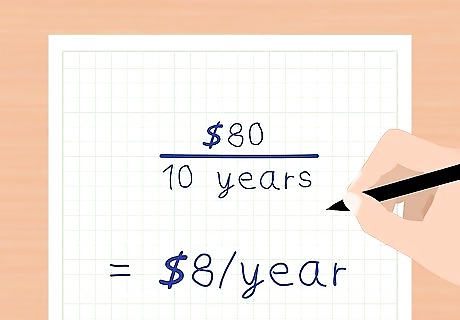

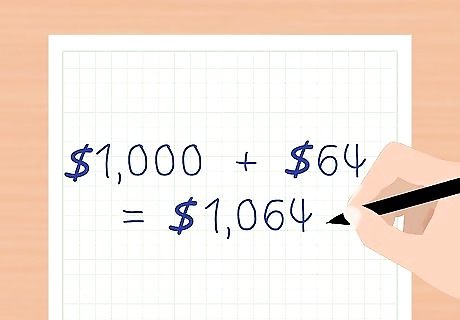

Calculate the amortized portion of the discount or premium. Most premiums or discounts will be amortized on a straight-line basis, meaning the same amount is amortized each reporting period. For example, suppose a 10-year bond was issued two years ago. Two years of amortization have been recorded, and eight years of amortization remain. You need to know the remaining amount of unamortized discount or premium to calculate the carrying value. For example, suppose a company issued a 10 year bond with an $80 premium two years ago. Each year, $8 of amortization is recorded ($80 / 10 years = $8 per year). If two years have passed, then $16 of amortization has been recorded ($8 x 2 years = $16) and $64 is unamortized ($8 x 8 years = $64).

Calculate the carrying value of a bond sold at premium. Suppose a company sold $1,000 10%, 10 year bonds for $1,080 and 2 years have passed since the issue date. Calculate the premium by subtracting the face value from the sale price with the equation $1,000 - $1,080 = $80. The $80 premium will be amortized over the term of the bond at $8 per period. Since two years have passed, two amortization entries have been recorded. Eight amortization entries remain. Calculate the remaining amortization with the equation $8 x 8 = $64. The carrying value equals the face value of the bond plus the remaining premium to be amortized. Use the equation $1,000 + $64 = $1,064.

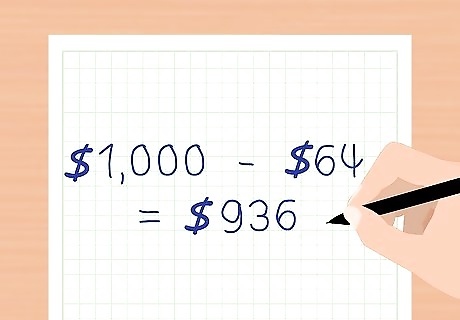

Calculate the carrying value of a bond sold at a discount using the same method. Subtract the unamortized discount from the face value. For example, suppose a company sold a $1,000, 10%, 10 year bond for $920, or an $80 discount and two years have passed since the bond issuance. The annual amortization of the discount is $8. Two amortization entries have been recorded. Eight remain, for a value of $8 x 8 = $64. The carrying value of the bond is $1,000 - $64 = $936.

Understanding Amortization of Bonds

Know the difference between straight-line amortization and the effective-interest method. Straight-line amortization records the same amount of interest expense in each period until the bond matures. The effective-interest method records interest expense based on the carrying value of the bond and the amount of interest paid. Both methods record the same amount of interest over the term of the bond. However, the difference is in how much is recorded each period and how it is calculated. In the United States, the straight-line amortization method is permitted under SEC-approved rules known as Generally Accepted Accounting Principles (GAAP). Elsewhere the effective interest method may be required in accordance with International Financial Reporting Standards (IFRS).

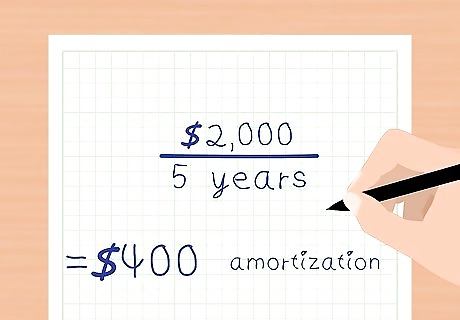

Understand straight-line amortization of bond discounts. The straight-line method of amortization records the same amount of interest expense in each interest period. For each period until the bond matures, the balance in discount and bonds payable will decrease by the same amount until it has a zero balance. Using this method, by the time the bond matures, the carrying value will be equal to the face value. For example, suppose a company sold $200,000, 5-year, 10% bonds for $198,000. The $2,000 bond discount ($200,000 - $198,000) amortization is $400 ($2,000/5) for each of the five amortization periods.

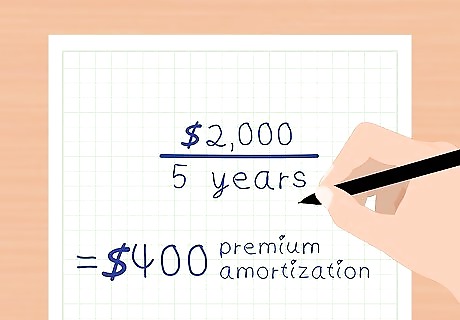

Understand straight-line amortization of bond premiums. This is similar to straight-line amortization of bond discounts. Over the term of the bond, the balance in premium on bonds payable decreases by the same amount each period. By the time the bond matures, the balance in premium in bonds payable is zero, and the carrying value equals the face value of the bond. For example, suppose a company sold $200,000 bond for $202,000. This results in a bond premium of $2,000 ($200,000 - $202,000). The premium amortization for each interest period is $400 ($2,000/5).

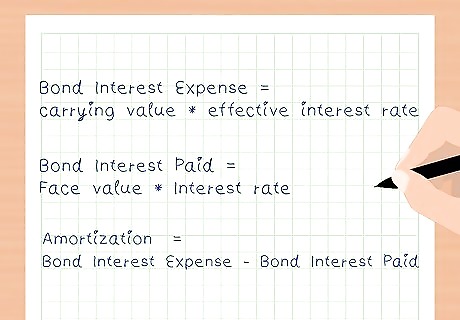

Understand the effective-interest method of amortization for discount and premium bonds. The effective interest rate is the percentage of carrying value over the life of the bond. It is established when the bond is issued and remains constant in each period. For this method, the interest expenses recorded equals the constant percentage of the carrying value of the bond. Multiply the carrying value of the bond at the beginning of the period by the effective-interest rate to calculate the bond interest expense. Multiply the face value of the bond by the contractual interest rate to determine the bond interest paid. Derive the amortization amount by calculating the difference between the bond interest expense and the bond interest paid.

Comments

0 comment