views

- You should already understand future value, present value, rate, number of periods, and payment parameters.

- Create your financial calculator by using built-in Excel financial functions for each parameter.

- Once you've made a calculator for each parameter, you've completed your Excel financial calculator.

Remember the 5 common finance parameters. It is assumed that you already have some knowledge of the 5 parameters often used in finance: FV (future value), PV (present value), Rate, Nper (number of periods) and PMT (payment). The function of this calculator is, given any 4 of these parameters, to calculate the 5th parameter. You also may need to include type. In Excel, type is either 0 or 1. The type is 0 if payments are due at the beginning of the period. The type is 1 if payments are due at the end of the period.

Open Microsoft Excel. Once you open Excel, you will have a blank spreadsheet on hand ready to create your financial calculator.

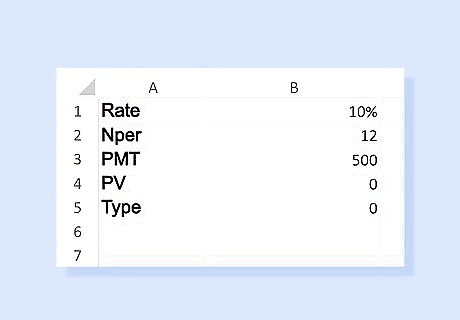

Label fields for Rate, Nper, PMT, PV, and Type. Insert some sample values to help create your formulas.

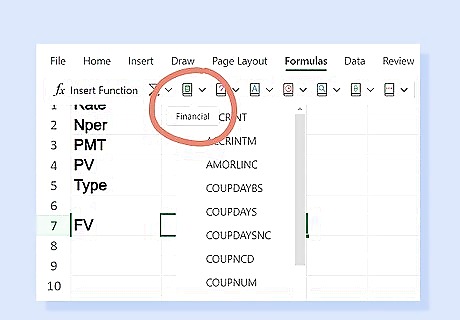

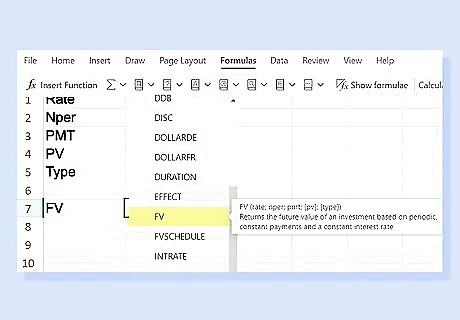

Choose the cell where you want the result for FV to go. Click Insert, then Function (or fx on the task bar) to open Insert Function window. In the left column, select "Financial". This will give you all the functions in financial calculation.

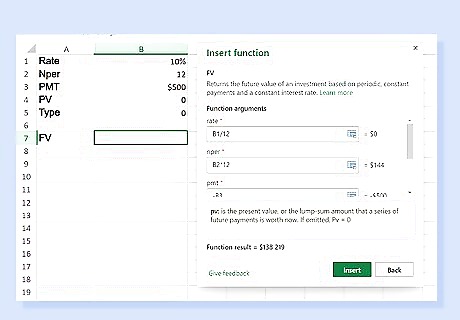

Double-click FV. A Function Arguments window will open. Fill in the field numbers according to how you labeled them. While you're in this window, you can click the ? button for help and read the details of how this Excel function works.

Click OK. If you fill in the value of Rate, Nper, PMT, and PV, Field B17 will show the FV.

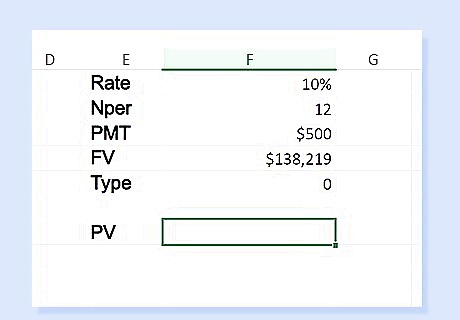

Repeat these steps to make a calculator for other parameters. Instead of solving for FV, you will want to solve for PV, Rate, Nper, and PMT.

Comments

0 comment