views

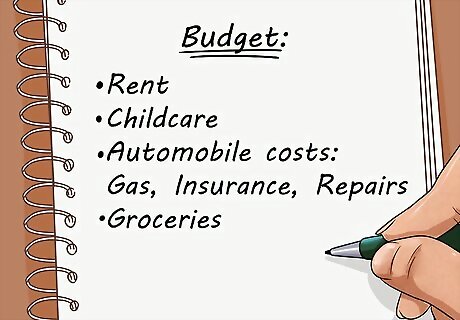

Create your budget. This means dividing your money into categories. Avoid "Miscellaneous" categories, as you should ideally know where your money is going.Some suggestions include: Rent or mortgage payment Childcare Automobile costs: Gas, Insurance, Repairs, etc. Groceries Club Fees (or some type of organization): Gym, Girl Scouts, Yoga Studio, etc. Utilities Taxes (if these are not taken out automatically or for some reason you need to pay back). Saving (which should be transferred into your bank account) Entertainment: Eating out, Concerts, Movies, Outings, etc.

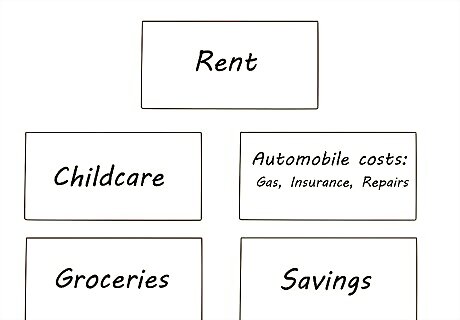

Assign each category to a single envelope. You will be putting the cash assigned to various spending items in these envelopes. Use whatever size works best for you. The money that will be spent outside your home should be kept in envelopes that fit easily in your wallet or purse. Use a marker and make it easy to read. Plastic envelopes may be better in a purse or briefcase, as paper ones tend to disintegrate. Coupon holders or mini accordion folders work well too.

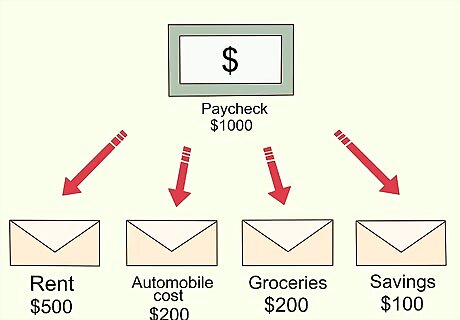

Break down your income into the various envelopes. All of the categories that get spent incrementally (that is, not all at once) should be spent in cash. Rent, mortgage payments, or anything you're only going to pay once and in full can have their envelopes left empty, or you can write a check and put it in there, or you can get rid of those envelopes altogether. The remaining envelopes, however, need to have the allocated cash inside. If you budgeted $500 to spend on groceries until your next paycheck, for example, put $500 cash in that envelope. Optional: In pencil, write on the back of the envelope how much you are putting in. This can help you get practice in keeping a balance.

Pull money from the envelopes as needed for that category. Recalculate how much is left, and write it on the back, so you know how much remains at a glance. If you run out of money for a category but need more, you only have two choices: When an envelope is empty, you can not spend any more money in that category; you have spent it. This becomes a concrete reminder that if you spent all your entertainment funds, you are really out. Pull money from another envelope. Of course, that leaves you less money to spend in that category.

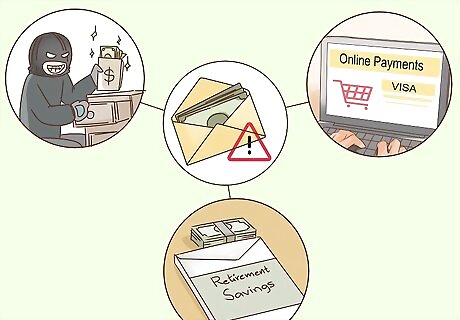

Understand the Limits of the Envelope Budgeting System. This is a great training tool, and for some people it is exactly what is needed to keep on budget. But this is still supposed to be a temporary use situation, not a permanent lifestyle. Living out of envelopes does have some drawbacks: Security: If your purse is stolen, car broken into, or roommate turns criminal, stolen money has very little security. A debt card at least has a number, a PIN and if it is stolen and used, it can be "frozen" to protect from further misuse. Cash has none of those protections. Lack of Convenience: Using cash for everything may mean you cannot make an online payment. You cannot transfer money to a spouse in an emergency. Or an automatic payment online. Or if your car breaks down, and you need emergency repairs you may not have a way to pay for it. This can be problematic. Complicated Money Situations: This system works best for people with relatively straightforward financial situations. This may work wonderfully for a 23 year old single female learning to budget for the first time. However, it does not work so well for more complicated financial situations. A 62 year old father who owns a dog grooming business and saving for retirement should likely not be dealing exclusively in cash. This may not be a long-term organizational solution. For some individuals, this really is the best way to organize funds. However, the envelope budgeting system is usually best used as a transitional system. Eventually, you should be able to get a sense of how to keep within budget and not need all of those envelopes. It is best to use a banking institution. Some people do get by without a bank account, but going without one has drawbacks. There is security putting funds in a bank unavailable to cash as mentioned above. Maintaining a bank balance is vital in establishing credit. If you do not have a bank account, sending money orders incur fees that are much more than checks.

Comments

0 comment