views

X

Research source

Calculating Your Benefits

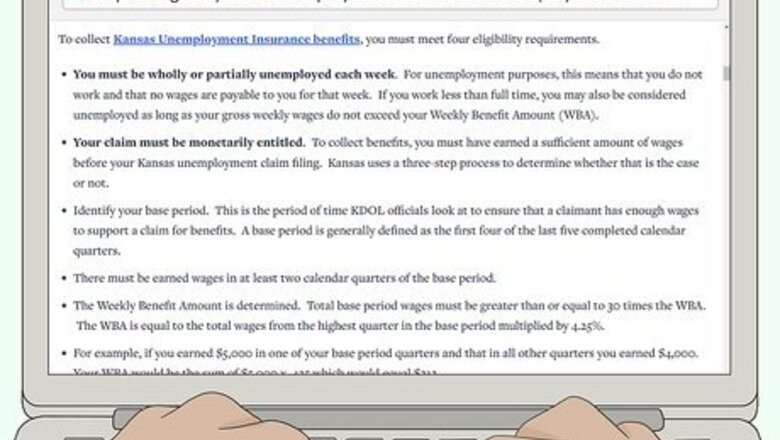

Confirm that you're eligible for unemployment benefits. Generally, you must have lost your job through no fault of your own to be eligible for unemployment benefits. This means you aren't eligible if you were fired for violating your employer's rules or policies. You also must have lost your job permanently, meaning you aren't typically eligible for unemployment benefits if you were temporarily laid off or suspended, even if the temporary separation was due to no fault of your own. To determine monetary eligibility, the KDOL will look at the amount of wages you earned from employment during the first 4 of the 5 completed calendar quarters preceding the date in which you filed for benefits. If you recently moved to Kansas from another state, you can include wages earned in another state as part of that base period. However, your benefits may be delayed while the KDOL receives wage information from the other state to verify the information you provided.Tip: You may be eligible for unemployment benefits if you quit your job, provided you quit for a legally justified reason, such as harassment or your employer's failure to accommodate your disability. If you're in this situation, consult an attorney who specializes in unemployment, as these cases can get complicated.

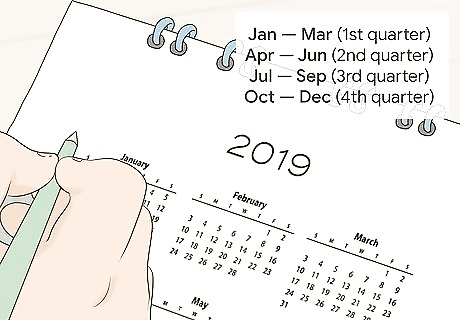

Determine your base period. Your base period is defined as the first 4 of the 5 completed calendar quarters immediately before you filed your claim for unemployment benefits. You must have earned wages during at least 2 of these 4 quarters to qualify for unemployment benefits. Calendar quarters run as follows: January — March (1st quarter), April — June (2nd quarter), July — September (3rd quarter), October — December (4th quarter). For example, if you filed your claim in April, your base period would be from January to December of the previous year. April falls in the second quarter, and the first quarter of the year (January — March) wouldn't be counted.

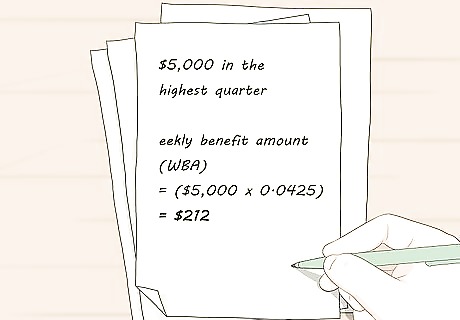

Calculate your weekly benefit amount (WBA). Add up the wages you earned in each quarter. Identify the quarter in which you earned the most wages. Take that amount and multiply it by 4.25%. This gives you your WBA. When determining your WBA, round any decimals down to the nearest whole number. For example, if you earned $5,000 in the highest quarter, you would multiply $5,000 by 0.0425. The result, rounded down to the nearest whole number, is $212.Tip: Wages include any money you earned from an employer. The amount does not include any income from self-employment.

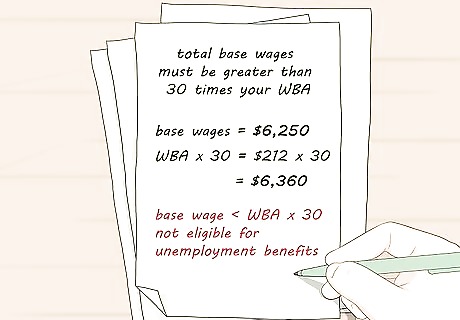

Compare your WBA to your total base wages. Add up your wages for the four quarters that make up your base period. Then, take your WBA and multiply it by 30. To be eligible for unemployment benefits, your total base wages must be greater than 30 times your WBA. For example, suppose your WBA is $212 and your total base wages are $6,250. Since 30 x $212 is $6,360, you would not be entitled to unemployment benefits because $6,360 is greater than $6,250.

Submitting Your Initial Claim

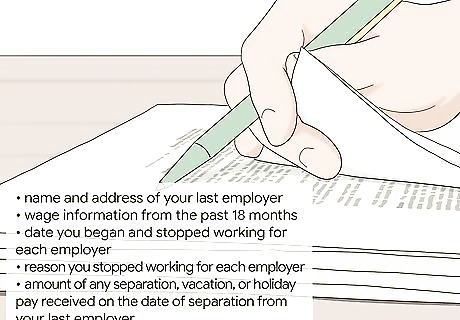

Gather the documents you'll need to file your claim. Before you file your initial claim, get together documents you'll need to provide accurate information about your wages and employment over the past 18 months. Pay stubs, W-2 forms, or tax returns may have the information you need. Specifically, you will need to provide the following information: The name and mailing address of your last employer Wage information for all employers from the past 18 months The date you began and stopped working for each employer The reason you stopped working for each employer The amount of any separation, vacation, or holiday pay you received on the date of separation from your last employer or will receive in the future

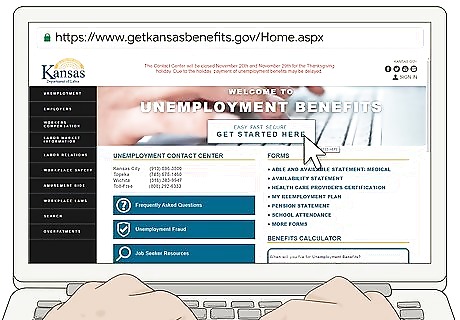

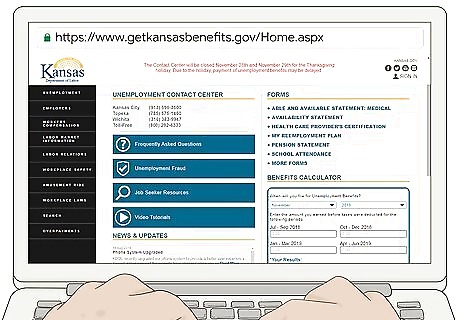

Go to the unemployment benefits website to file your claim online. To get started, go to https://www.getkansasbenefits.gov/ and click on the "Create" button to create a user name, password, and PIN. Then, you can use that information to log in and file your claim. Online claims services are available Sunday from noon through Monday at 9:00 p.m., Tuesday through Friday from 7:00 a.m. to 9:00 p.m., and Saturday from 7:00 a.m. to 10:00 p.m. You may be asked to attach documents to your claim. You can scan these documents and upload them through the online system or mail paper documents to the address provided for the Kansas Unemployment Contact Center.Tip: You cannot file your claim online if you worked in any state other than Kansas in the past 18 months, filed an unemployment claim in another state in the past 12 months, or were in the military or employed by the federal government in the past 18 months.

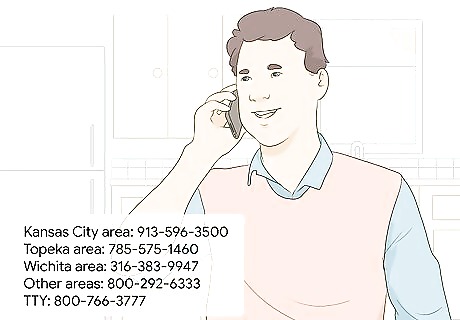

File your claim over the phone if you can't file online. If you aren't eligible to file online or don't have reliable internet access, call the Kansas Unemployment Contact Center. The automated phone system is available from 7:00 a.m. to 7:00 p.m. Monday through Friday and 9:00 a.m. to 7:00 p.m. on Saturday. Typically, you'll have to speak to a claims specialist. Claims specialists are available Monday through Friday from 8 a.m. to 4:15 p.m. except on state holidays. However, you can file your claim at any time and then call back to speak to a claims specialist. Your information will be saved for 7 days. The numbers for the Kansas Unemployment Contact Center are: Kansas City area: 913-596-3500 Topeka area: 785-575-1460 Wichita area: 316-383-9947 Other areas: 800-292-6333 TTY: 800-766-3777

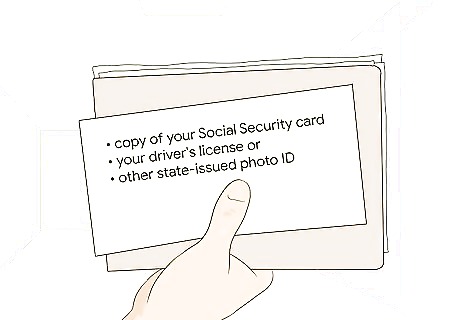

Complete the identity verification process. You must provide a copy of your Social Security card and your driver's license or other state-issued photo ID when you file your initial claim. This information will be transmitted to the Social Security Administration (SSA) to verify your identity. If you've recently changed your name, you must report the name change to the SSA first. You'll need a copy of an official document recognizing your name change, such as a marriage certificate, divorce decree, or court order. You may receive an identity verification form from the KDOL if your application was randomly selected or if additional information is needed to verify your identity. Complete and submit this form as soon as possible to avoid further delay in receiving your benefits.

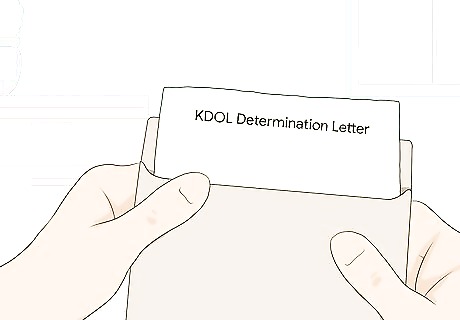

Wait to receive your determination letter. Within a few weeks after you submit your claim, you'll get a determination letter in the mail from the KDOL. This letter shows whether you've earned enough money to qualify for unemployment benefits. It doesn't necessarily mean that you will receive benefits. The letter includes the start date of your claim, the amount of wages reported by each employer, your base period, your weekly benefit amount (WBA), and your total benefit amount. If any of the information in the letter is incorrect, contact the Kansas Unemployment Contact Center as soon as possible using the contact information on the letter. You will be asked to provide documentation that proves the information on the letter is incorrect, such as pay stubs or W-2 statements. If your determination letter concludes that you aren't eligible for benefits and you believe this determination is incorrect, you can appeal. You have 16 days to file your written appeal. Information on how to appeal will be included with your determination letter.

Participate in an interview if necessary. The benefits office may schedule a phone interview if they need more information to process your claim. Make sure you are available at the phone number you provided on the date and time the interview is scheduled. The office will only make one attempt to contact you and these interviews cannot be rescheduled. If a phone interview is scheduled for you, you'll receive a notice in the mail with the date and time of the interview and the number they will call to reach you. If that number is incorrect or if you have a better number for them to use, contact the office as soon as possible to get the number changed. The notice includes a "Claimant's Separation Statement" form. Fill this form out immediately and mail it back to the office at the address shown on the form. The office needs to receive it before your scheduled phone interview.Tip: Continue to file weekly claims for every week you are eligible for unemployment benefits while the investigation is going on. If you receive benefits, you will get benefits for these weeks. However, you won't get any benefits for weeks in which you failed to file a weekly claim.

Maintaining Your Eligibility

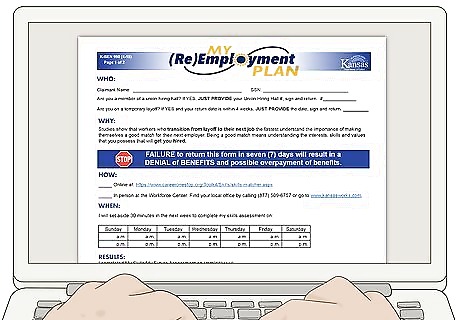

Fill out your reemployment plan form. The KDOL sends the "My Reemployment Plan" form along with your monetary determination letter. This form must be sent back to the KDOL at the address on the form within 7 days of the date on your determination letter. If you don't send the form back, your benefits may be denied or you may have to pay back benefits you've already received. If you lose the paper form included with your determination letter, you can download a copy from the KDOL unemployment benefits website at https://www.getkansasbenefits.gov/Forms.aspx. A copy of the form is also available in Spanish.Tip: It's a good idea to make a copy of your form after you complete it. The information on the form will be helpful to you in your job search.

File a weekly claim for each week that you want benefits. You can file weekly claims online at https://www.getkansasbenefits.gov/ or by calling the Kansas Unemployment Contact Center. you will be asked 13 questions about your job-seeking activities and work during the week. You must answer all of these questions to file your claim. Depending on your answers to the questions, you may receive less in benefits for the week. For example, if you worked part-time during the week, you would get less in benefits. However, you must still file a claim for that week to keep your claim active.

Perform at least 3 job-seeking activities each week. As a condition of maintaining eligibility for unemployment benefits, the KDOL requires you to actively search for employment. Approved activities include submitting applications or résumés for work, attending job interviews, or conducting searches on job posting websites. You'll also get credit for workshops and job training you complete, such as a résumé review course or a certification program. Attending a job fair also counts as a job-seeking activity.

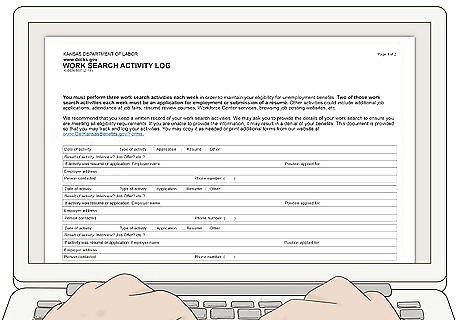

Maintain a log with information about your job-seeking activities. The KDOL will audit your job-seeking activities. Keep a log that lists each activity, the date that activity took place, the location of that activity, and any other relevant information. If you submitted an application or résumé to a potential employer, include information such as the name and address of the company and a description of the position. If you applied for the job based on an online listing, you might want to print a copy of the listing to include with your log. Along with copies of any job listings you responded to, attach brochures, pamphlets, copies of emails, and other documents related to your job-seeking activities. All of these documents provide evidence of your activities in the event of an audit. The KDOL has a form you can use. You can also get paper copies of this form at your local Workforce Center.

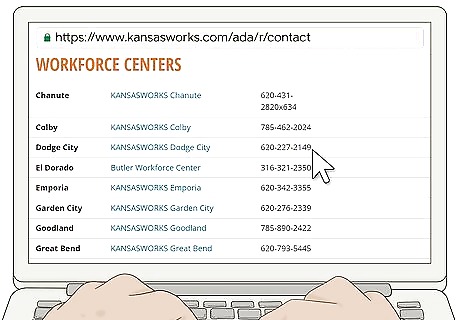

Participate in reemployment services if required. The KDOL will send you a notice if you're required to attend any programs offered by your local Workforce Center. If you get one of these notices, your attendance is mandatory unless you've already found another job. To find your local Workforce Center, go to https://www.kansasworks.com/ and scroll through the list until you find the location closest to you. Even if you aren't required to participate in reemployment services, you are welcome to sign up for programs that interest you or that you think would benefit your job search.

Comments

0 comment