views

Identifying a Deductible Business Expense

Collect all of your expenses. Go through your receipts and credit card statements and identify anything spent for your business. Put all receipts in a pile and go through each one individually, checking if it is a deductible expense. You should also make a spreadsheet in which you can track whether something is a business deduction or not.

Ask yourself if the expense is “ordinary.” An “ordinary” expense is an expense that is common and accepted in your business or your trade. For example, purchasing magazines for your dental office is an ordinary expense. Hiring a live band to perform would not be. Ordinary means “normal, common, and accepted under the circumstances by the business community.” If other businesses in your industry are not spending money on something, then it may not be an “ordinary” expense.

Ask yourself if the expense is “necessary.” A “necessary” expense is one that is helpful and appropriate for your trade or business. It does not have to be “indispensable,” i.e., one that your business couldn’t carry on without. However, the expense must have been spent on something necessary to the business. If you are unclear, then there are IRS publications you can read, which are available at the IRS website. For example, business travel is often a gray zone. You should see IRS publication 463 for more information on whether you can deduct travel expenses as a business expense.

Understand the deduction for home offices. In some situations, you can deduct for the business use of your home. If you are eligible to deduct the expenses of your home office, then you may be able to deduct a percentage of your household costs, such as your utilities, real estate taxes, internet expense, and cell phone. The percentage you could deduct would be equal to the percentage of your home that your home office occupies. However, you must meet the following requirements in order to qualify for the home office deduction: You must regularly use the part of your home exclusively for conducting business. The easiest example is if you have a room dedicated as your office. You can’t use the kitchen table as your office, since you also eat and cook in the kitchen. The home office must also be your principal place of business. You do not have to use the office exclusively. For example, you can do other job-related tasks outside of your home office, but the office must be where you substantially and regularly do your job.

Identify other common types of business expenses. The following are some of the more common business expenses which you can deduct for on your taxes: Employee pay: you can deduct what you pay your employees for services rendered. Retirement plans: you can deduct for the money set aside for your own retirement, as well as the retirement of your employees. Rent expenses: if you pay rent for a property you use for your trade or business, then you can deduct it. However, you can’t deduct if you will receive title or equity in the property. Interest: you can deduct for the interest you are charged on any money borrowed for your business. Taxes: you can generally deduct federal, state, local, and foreign taxes directly attributable to your trade or business. Insurance: you can typically deduct the necessary and ordinary cost of insurance for your trade, business, or profession.

Excluding Non-Deductible Expenses

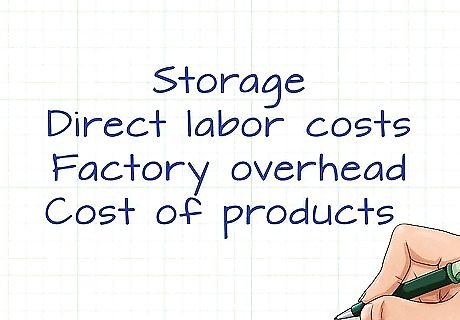

Exclude expenses for determining the cost of goods. You might manufacture or buy goods for resale. As you decide how much to charge consumers for the goods, you might include in your price things like the cost of storing the goods, which you then pass on to the consumer. If you include these expenses in the amount you charge consumers for the goods, then you can’t also deduct them as a business expense. The following are typical expenses included in figuring out the cost of goods: Storage Direct labor costs Factory overhead Cost of products or raw materials, including freight

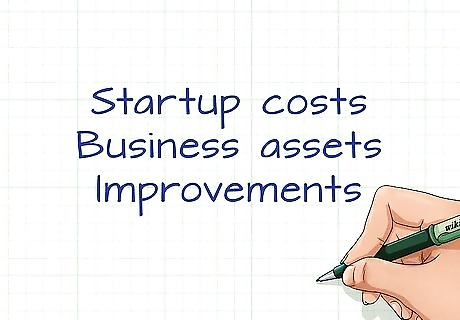

Identify capital expenses. You generally cannot deduct for capital expenses. Capital expenses are the investment in your business and are generally depreciated or amortized. You need to record any expenses that show up on your company or business balance sheet. You can also deduct the interest on any loan used to purchase the asset, or you can use the depreciation of the asset as a business expense. There are three types of capital expenses: the startup costs of your business business assets improvements to the business

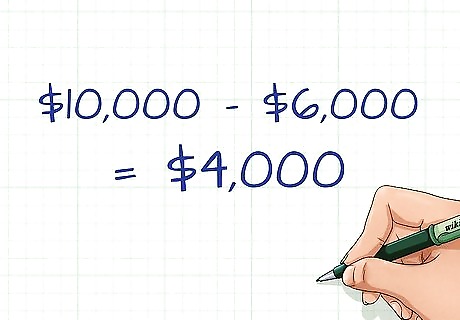

Exclude personal expenses. You can’t deduct for personal, living, or family expenses. However, there is a big exception: an expense might be partly used for personal reasons and partly used for a business purpose. In this situation, you can deduct the portion used for business expenses. For example, you might take out a $10,000 loan. If you use $6,000 for personal or family expenses, then you can’t deduct that amount. However, if you use $4,000 for business expenses, then you can deduct that amount as a business expense. If you use your car for both business and personal reasons, then you must divide the use based on actual mileage. However, you can’t take a deduction for driving to work, since the IRS considers that a personal expense.

Be careful when doing business with relatives. The IRS is particularly interested in business deals involving family members or involving a business in which a relative has an ownership interest. The IRS might assume that the businesses are used as shams to make tax-deductible transfers between family members. For example, paying a relative to be a “consultant” when they have no credentials looks questionable and would draw IRS scrutiny if you try to deduct the consultant fees as a business expense.

Getting Help

Get referrals for financial professionals. Ask people that you know if they would recommend their accountant. You can also ask your lawyer, banker, or business colleague for referrals. You might also contact your state’s Society of Certified Public Accountants. Type “your state” and “certified public accountants” or “CPAs” into a search engine. Look for a “Find a CPA” link on the Society’s website. The Society should run a referral service or host a listing of CPAs you can browse.

Schedule a meeting. After you have the name of an accountant or other tax professional, you should call and schedule a meeting. Tell them that you want to discuss business expenses. Also ask how much they charge ahead of time. Most accounting firms charge $100-275 an hour. If the accountant gives you a substantially higher quote, then you should get another referral.

Ask questions. Take your spreadsheet and your receipts with you to the meeting. Draw the accountant’s attention to any expense you are unsure about. Ask the accountant whether or not you can claim the expense as a business expense. You can certainly hire the accountant to do your taxes when they come due. However, you will still want to know ahead of time what you can deduct as a business expense. By getting that information, you could decide to stop spending money on certain expenses, especially if you won’t be able to deduct them from your business taxes.

Comments

0 comment