views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Developing a Filing System

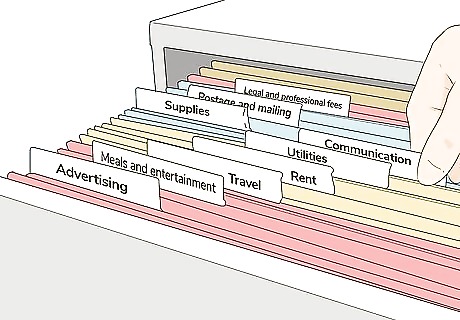

Choose a convenient file storage system. It's easier to develop a habit of filing receipts immediately if your file storage is easily accessible. For most small businesses, a basic filing cabinet will suffice. Keep it in a place that you frequently pass so you don't have to go out of your way to file your receipts. Often, the best place for your file storage system is right next to the desk where you handle business finances. That way, everything you need is close at hand. If you have a smaller business without a lot of receipts, a smaller file box might work better for you. For example, you might get a plastic box with hanging folders.

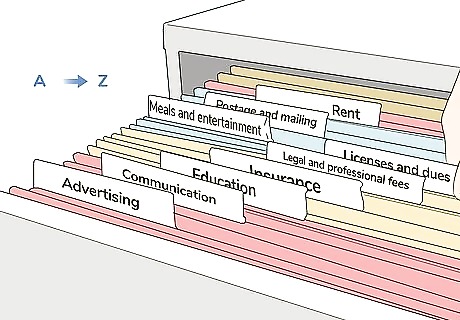

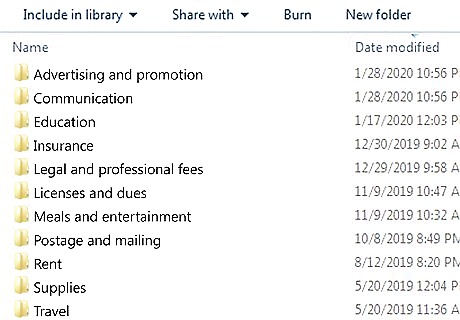

Organize your receipts by category. When you do your taxes, you'll have to total your deductions under specific categories. If you file your receipts in these categories, you'll have already done this work. At tax time, all you'll have to do is add them up. Categories you'll need include: Advertising and promotion (business cards, mailing lists, website development, social media ads) Meals and entertainment (lunch meetings, dinners with clients) Travel (airfare, auto expenses, tolls, mileage, lodging, meals while away on business) Rent (payments for leased office space or rented equipment) Utilities (electricity, water, heat/air-conditioning, trash pickup for the workplace) Communication (phone expenses, internet access) Supplies (office materials, cleaning supplies, coffee or bottled water in the office) Postage and mailing (PO Boxes, shipping fees) Legal and professional fees (accountant/bookkeeper fees, attorney's fees) Insurance (business liability insurance premiums, worker's compensation premiums for employees) Licenses and dues (business licenses, professional licenses, trade association dues, franchise fees) Education (professional development, continuing education for professional licenses, job training for you or employees)Tip: If a receipt includes expenses in multiple categories, make a copy of the receipt for each of the categories. On each copy, note the total deduction from that receipt in that category.

Keep your receipts in chronological order. While this isn't specifically necessary, it can help you estimate your taxes when you file quarterly taxes. It can also help you more easily locate a specific expense. If you have a lot of receipts in a single category in a month, calculate a monthly total and include that in your file at the end of the month. It will make adding up expenses during tax time easier and minimize the risk of mistakes.

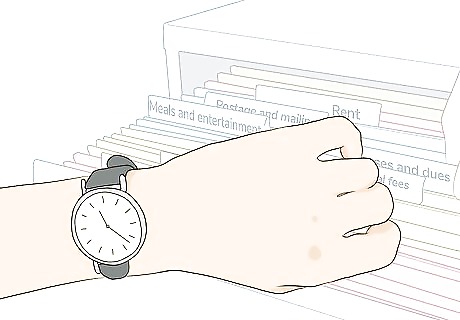

Schedule a specific time to file your receipts. Use the system that works best for you and that you can keep up with. Some small business owners prefer to file their receipts immediately, while others set aside a time once a week to go through them and file them. Whatever method you choose, you want to make sure you're going through your receipts and filing them while the particular transaction is still fresh in your mind so you know what that particular receipt is for. If you simply collect your receipts in a box and don't bother to categorize them, you'll have difficulty come tax time and you may end up losing deductions you could have taken if you were better organized.

Documenting Expenses

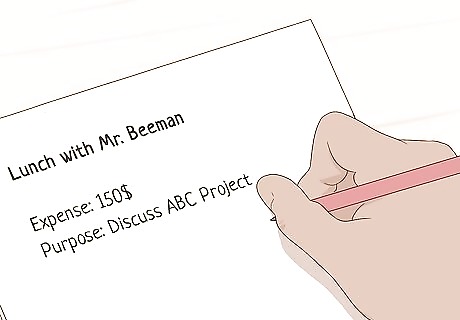

Note the business purpose of each expense on the receipt. Keeping in mind that you're going to be keeping receipts for 6 years, something that seems obvious a week after you incur the expense might not be something you remember several years later. While this may not apply to office supplies, meals and travel can be more difficult. For example, if you went out to lunch with a client, you might note the client's name and the general subject of the lunch meeting. With travel expenses, note the reason for the travel. You might also include a brochure or other information. For example, if you traveled for a trade convention, you might attach a brochure for the convention to the receipts connected to that convention.

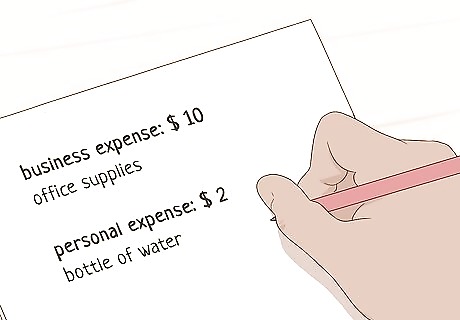

Separate business and personal expenses on the same receipt. Ideally, you're keeping business and personal expenses as separate transactions. However, it's not always convenient to do so. If you have personal expenses on the same receipt as business expenses, underline or highlight the business expenses and calculate a new total for tax purposes. For example, if you bought office supplies and picked up a bottle of water for yourself while you were checking out, the bottle of water would be considered a personal expense, not a business expense. You'd deduct the cost of that water (don't forget sales tax, if applicable) from the total to get the new total of your deductible expenses.

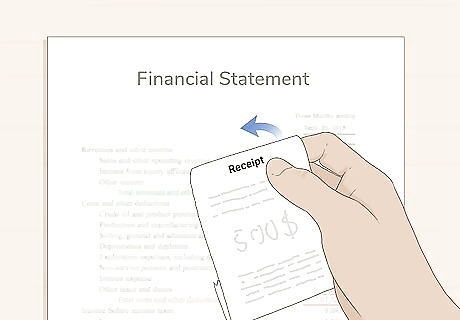

Match receipt transactions with financial statement entries. When you get your business banking and credit card statements each month, print them out and compare them to your receipts. Mark or highlight every transaction on each statement that you have a receipt for. If there's a transaction on one of your statements that you believe is deductible, but you don't have a receipt for, you might be able to get a receipt reprinted for your records. Contact the vendor to find out if this is possible.Warning: Avoid using cash to pay for business expenses. It's difficult to track and doesn't leave a paper trail like credit or debit cards do.

Going Paperless

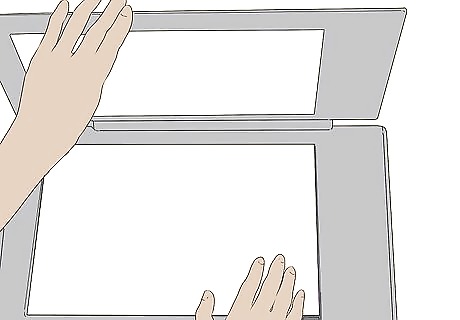

Scan all receipts before you file them even if you're keeping paper files. Most receipts are printed on thermal paper, which degrades over time. The IRS recommends that you keep your receipts for 6 years. However, the ink on a thermal paper receipt may have faded to the point that it just looks blank after that long. Most office printers include a scanner. If yours doesn't, invest in one and remember that the purchase is also a tax-deductible office expense. If you make notes on each receipt, scan them after you've made your notes.Tip: You can also take photos of your receipts with a smartphone.

Keep your image files organized and labeled by category and date. Mimic your paper filing system with your digital filing system, creating folders for each category. Typically, your computer or electronic device will save the files chronologically by default. You can also create folders within the category folders for months. This will help you more easily find a specific receipt image, as well as organize your deductions so you can more accurately estimate your quarterly taxes.

Use a receipt organizing app on your smartphone. There are several smartphone apps that can help small business owners keep track of deductible expenses and organize receipts. Some also help you track your mileage and other expenses you might not have receipts for. If you decide to use an app, make sure it's not the only thing you use to keep track of expenses. You never know when the company that made the app might go out of business or discontinue the app.Tip: If you use accounting software for your business, choose an app that syncs with your accounting software account. Then the expense information from your receipts will automatically be uploaded to your books.

Upload scanned images to a cloud server. While you may be keeping your scanned images on your computer or smartphone, you also want to make sure those files are backed up. Keep in mind that you have to keep those files for 6 years and it is unlikely that 6 years from now you'll still have the same smartphone and the same computer. Out of an abundance of caution, you might also want to create a hard copy backup on a CD or thumb drive. For example, you might keep one year's worth of deductible expenses on a thumb drive and label each thumb drive with the year. Keep these thumb drives in a safe or other secure location.

Ask vendors to email you receipts whenever possible. Many venders are willing to email you receipts instead of (or in addition to) giving you a physical receipt. Email receipts are preferable for record-keeping since they don't degrade the way physical receipts on thermal paper do. You can set up folders in your email account to mimic the folders in your physical filing system. Print your email receipts and file them in your physical filing system just in case. You might lose access to your email address or change it.Tip: Use your business email address for receipts for business expenses, not your personal address.

Comments

0 comment