views

Getting Ready

Make sure you qualify as self-employed. According to the IRS, the general rule for which types of people qualify as independent contractors is that: "An individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done." In other words, if you set your own hours and control your relationship with your clients, you are probably an independent contractor. Specific criteria for being self-employed include: Being the sole proprietor of a business or an independent contractor. Being a member of a partnership that carries on a trade or business. Being otherwise in business for yourself (including a part-time business). Providing your own tools for your job. Being responsible for your own benefits. On the other hand, if you work as a salaried employee on the staff for a company or organization, you are probably not an independent contractor. If you are unsure what kind of worker you are, you can file IRS Form SS-8 to have the IRS examine your situation and make a decision for you.

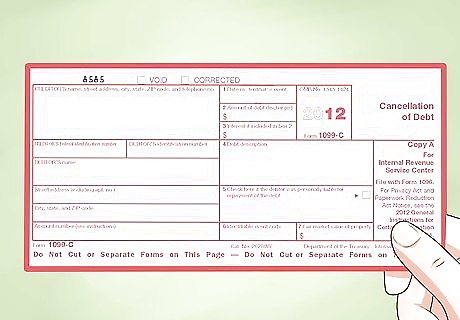

Gather any and all 1099 forms. These forms document how much income you received from each company you did freelance work for, and will be important for filing your taxes. Contact the institutions you have worked for as a freelancer if you have not received your 1099s by February 1st of the year taxes are due. Your clients are supposed to send you this information no later than January 31st.

Gather all your business receipts or invoices. Collect any receipts for money you spent on business expenses, as well as all invoices from the tax year. These receipts will be important if you want to claim any of these expenses on your taxes and thus decrease the amount of income you are responsible for paying taxes on. This includes invoices, receipts for supplies, business expenses, health insurance premium costs, and home office rent.

Separate W-2 forms and 1099s from employers. If you are employed as a regular employee of some company in addition to your freelance work, you will also have W-2 forms, which should be kept separate from you 1099s. A W-2 indicates that you are an employee of a business and taxes have already been deducted. A 1099 shows money earned from freelancing. Report income from W-2s on your 1040 form as normal. Do not report this income along with your 1099s.

Do a rough estimate of expenses versus income. Subtract your expenses from your income to find your net income. If you made a profit (net income) of more than $400 on freelance work, you must file a tax return and will owe self-employment taxes in the United States. Even if you make a net income of less than $400, you may still need to file a tax return. For more information, see https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center.

Print applicable freelance income tax forms from the IRS website. These will include the Schedule C, Schedule C-EZ, and Schedule SE forms, in addition to the standard 1040 tax form. These forms are easy to find by simply entering their titles in the search bar at the top of the page. Review the documents and read instructions before beginning. These forms can be quite complicated, so it is important to review these forms carefully.

Research your deductions. Part II of Schedule C in the IRS Publication 535 allows you to deduct certain amounts from your taxable freelance income. Check to see if any of these deductions apply to you. Many of the deductions you can make are actually percentages of the costs incurred. For example, any office supplies you may have purchased, as well as the cost of a dedicated work computer may be written off. It is also likely you can deduct a portion of your rent and other housing related expenses if you have a home office. As of the 2017 Tax Cuts and Jobs Act, you can take a 20% Qualified Business Income Deduction on your taxes. You can take this deduction if you earned money from a business you own by yourself or as a partnership. However, there are some limitations on the deduction if you earn more than $315,000 as a couple or $157,500 as an individual. These deductions can greatly reduce your tax liability and as such should be examined carefully.

Calculating Your Taxes

Calculate your gross yearly earnings. As with taxes for ordinary employees, the more money you make as an independent contractor, the more you owe in taxes. To find your earnings, first total up all of the money you made selling your goods and/or services as an independent contractor the previous year. If you received a 1099 from every client, this will just be the total of your earnings from each 1099. In the next few steps, you'll use this information to find your taxable income and determine how much you owe.

Calculate your deductible business expenses. Business expenses are directly tied to the operation of the business — supplies you bought, wages you paid for work you delegated, travel you made for your work, and so on. Things like groceries and entertainment expenses are not to be included. Note that, in addition to the business expenses above, self-employed people can also receive deductions for things like health insurance, retirement accounts and lawyers and accountant fees.

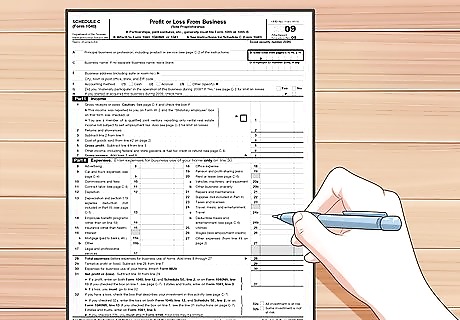

Fill out a Schedule C. This is also called a Form 1040 Profit or Loss from Business (Sole Proprietorship) form. This form (available here) is used to report your freelance income and expenses. You can use the Schedule C-EZ form instead of the regular Schedule C form if your freelance business expenses total less than $5,000 and if you have no employees and no home office deduction. This form (available here) is simpler and quicker to fill out. Use the steps below to fill out your Schedule C: Enter your total (gross) income from freelance work in Part I. Enter your expenses in Part II. Enter the cost of goods sold in Part III. If your freelance work involves selling any physical goods, you will need to enter the costs of those items, taking an inventory at the beginning and end of each tax year. Additionally, the amount you calculate for Part III will be carried over to Part I as an expense that offsets your gross income. Enter information on your vehicle in Part IV, if you are claiming it as a business expense. Enter any other expenses in Part V. This section includes miscellaneous expenses like bad debts, business start-up costs, or an money you invested making your place of business more energy efficient. Compute your total income or loss, and enter it on line 12 on your Schedule 1.

Don't forget to account for Self-Employment tax. Income tax isn't the only tax you need to pay as a self-employed person — like ordinary workers, you also owe money for payroll taxes which cover Social Security and Medicare, known as Self-Employment (SE) tax. For work done in 2019, this tax rate amounts to 15.3% of your net self-employment income. This rate comes from the 12.4% tax for Social Security and the 2.9% tax for Medicare. You'll calculate these taxes on form SE. For example, if your net self employment income is $80,000, your SE tax would amount to: 80,000 × 0.153 = $12,240 If your earnings are over the threshold for Social Security, you'll calculate your tax differently. As of January 2019, the threshold is $132,900, so you won't pay Social Security taxes on income above this amount. Starting from 2013, you must also pay an additional 0.9% Medicare tax if your taxable income is over a certain threshold: $200,000 for singles, $250,000 for married filing jointly.

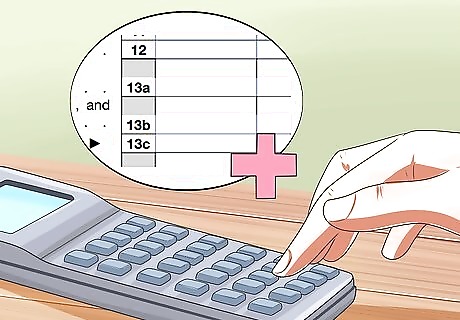

Add your taxes together to get your total. Once you know both your income tax and your additional estimated self-employment tax, add them together. This is the total tax you'll need to pay. You can pay your taxes either quarterly or annually. However, it's best to make quarterly payments so that you avoid a lump sum and possible penalties from not pre-paying your taxes. If you owe more than $1,000 in taxes, you are usually allowed to make quarterly tax payments. These freelancer tax payments help break up large amounts owed to alleviate you of the stress of having to pay it all at once.

Paying Your Taxes Annually

Complete the applicable IRS income tax form for the current tax year. This is usually a 1040 (available here) for most self-employed freelance workers. Use your schedule C and 1040-SE to guide you as you fill out these forms. Complete no later than the April 15th tax day deadline. The deadline to file taxes on income earned in 2018 is April 15th, 2019.

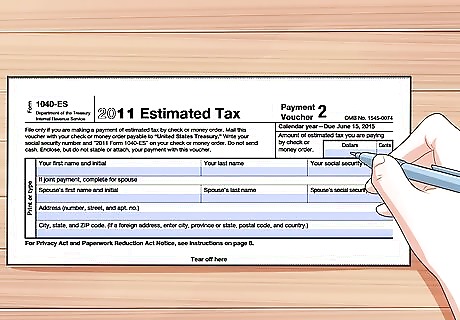

Record your total owed. Write down the annual amount of self-employment tax you owe on the tax payment vouchers included with Form 1040-ES. Make sure you take into account any prepayments you made toward your taxes, if you've sent in tax payments throughout the year. If you didn't make quarterly payments over the prior year, you'll need to pay all of your taxes now.

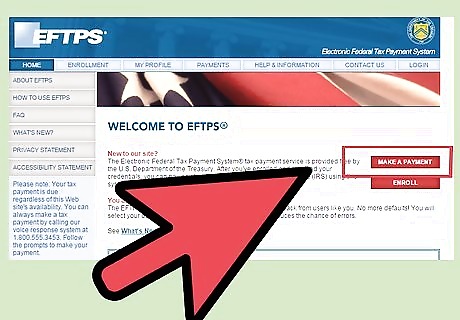

Pick a payment method. The IRS lets you pay your taxes two ways: electronically or by mail. See below: Electronically: Payments can be made using the Electronic Federal Tax Payment System (EFTPS) available here. Additional service fees may be charged for the convenience of paying online. Mail: The IRS considers the postmark date as your payment date. Write checks to "United States Treasury" and include the estimated tax payment vouchers in your envelope. Mail your 1040-ES voucher, schedule C, 1040, and payment to the appropriate IRS office for your region of the United States.

Making Quarterly Payments

Determine if you need to make quarterly payments. Self-employed people usually have the option of paying quarterly (rather than all at once) if they owe more than $1,000 in self employment taxes. In addition to preventing you from owing a large sum at the end of the year, this allows you to avoid penalties from not prepaying your taxes. The government requires you to prepay at least 90% of your taxes for the year or an amount equal to 100% of your prior year taxes. You need to pay these taxes in advance.

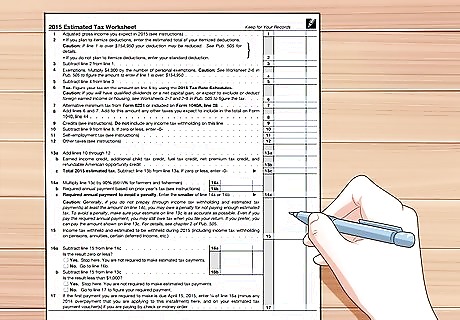

Fill out the IRS Worksheet Form 1040-ES. This form is available here. Fill out the worksheet on page 8. This worksheet form is to determine your estimated taxes for the year. In other words, since you don't have an employer withholding part of each paycheck for tax purposes, you need to determine if, how much, and when you are required to pay tax on your own. Use the tables on page 7 to determine your income tax liability. For example, if you are filing as a single person and you made $80,000 last year, you would use the instructions for income between $39,475 and $84,200: 4,543.00 + 0.22 (80,000 - 39,475) 4,543.00 + 0.22 (40,525) 4,543.00 + 8,915.50 = $13,458.50 If you have a previous year's tax return for similar work, use it as a guideline. First-time independent contractors must estimate yearly earnings to determine the applicable tax payment schedule — if you estimate too high or too low, you can re-file your 1040-ES later.

Add your self employment tax payment due dates to your calendar. You'll pay each quarter's taxes throughout the year, so payments are due every 3 months. Payments for income earned in 2019 are due on the 15th of April 2019, June 2019, September 2019, and January 2020.

Comments

0 comment