views

X

Research source

Reporting New Hires

Determine if you are required to report. "Employers" have to report "hew hires" to their state run directory. An "employer" under the law includes governmental entities and labor organizations. Basically, if you are required to have an employee fill out a W-4, you are an employer. "New hires" are employees that have not previously been hired by you, or employees that were previously employed but have been separated fro at least 60 consecutive days. You do not need to report any employee that leaves and comes back if that employee was not formally fired or removed from payroll. Some states will require you to report independent contractors. However, federal law does not require this.

Make sure you report in a timely manner. Federal law requires that your new hires be reported within 20 days of the "date of hire." The date of hire is the day your employee first performs services for wages. While the federal reporting period is 20 days, some state laws require you to report sooner. For example, in Georgia, you are required to make new hire reports within 10 days of hiring the employee.

Report online. Most states have an online system you can use to report your new hires. If you have access to a computer, you should consider using online resources to make reporting easier. For example, in California, you can register with the Employment Development Department's e-Services for Business. Once you establish a username and password, you will be sent a confirmation email that confirms your identity. Once you verify enrollment you will be able to use the service to file new hire reports. In California, you can report new hire information online using various methods: The File Report of New Employee option allows you to complete the state new hire form (DE 34 in California) online. Using this option, you can enter up to 30 new employees at one time. After selecting this option you will fill out an electronic form and submit it. You will receive a confirmation number as soon as you submit the information. The Attach a Return File allows you to attach your DE 34 information as a file attachment on the internet. Once you attach the completed DE 34 using the online system, you will submit it and receive confirmation immediately.

Report manually. If you do not have access to a computer or do not have the ability to report electronically, every state allows you to report new hire information manually. Whether you gather the information in a W-4, a state report form, or a form you create on your own, you can send the required information to your state's employment department. For example, in Georgia and California, you can mail or fax your new hire reports to the New Hire Reporting Program or the Employment Development Department respectively.

Ask your payroll service to report for you. If you do not want to make new hire reports at all, a lot of payroll service companies will offer reporting services. If you use a payroll service provider already, ask if they have the ability to report new hires for you. If they do, they will simply use the information they receive from an employee's W-4 to make the required report.

Ensure compliance with multi-state filing requirements. If you are a multi-state employer who has employees working in multiple states, you can submit new hire reports in one of two ways. First, you can make multiple reports to each state the employee is working in. If you choose this option, you will simply make a separate report for each state and submit it using your preferred method. Second, you can select one state where you will make every report for the multi-state employees. If you choose to report in only one state, your reports must be submitted electronically. In addition, you must notify the federal Secretary of the US Department of Health & Human Services, in writing, of the state you are choosing to report in. You can make this notification electronically by submitting a Multi-state Employer Registration Form online. You can also send it to the Department in the mail.

Avoid penalties for failing to report. If you do not report new hires in a timely manner your state might impose civil penalties for your noncompliance with the law. Federal law leaves the imposition of penalties up to each individual state. If penalties are assessed, the fine may not exceed $25 per newly hired employee. However, if you conspire with your employee to avoid reporting, you can be fined up to $500 per newly hired employee. Some states might also impose non-monetary penalties as well. For example, in California, you can be assessed a $24 penalty for each new hire you fail to report. If the failure to report is intentional, you can be fined up to $490 for each instance.

Understand what the information is used for. The information you report is used by the federal and state governments to match the reports with individuals having child support obligations. This helps governments locate individuals, establish child support orders, and enforce existing orders. In addition, the information can be used by state agencies to detect and prevent incorrect benefits payments (e.g., for workers' compensation and/or unemployment benefits). State agencies can also use the information to prevent the improper receipt of benefits such as food stamps, welfare, and Medicaid.

Gathering the Required Information

Obtain the four required reporting elements. Federal law requires you to provide four pieces of information about the newly hired employee. However, each state can have different requirements and may require more information to be reported. Under federal law, you must obtain the employee's name, address, Social Security number, and the employee's date of hire. In Georgia, for example, you must also gather the employee's actual start date, medical insurance availability, and the state of hire.

Ensure you have an accurate Social Security number. If your employee does not have a Social Security number, they will need to apply for one with the Social Security Administration. If you have an employee who can not fulfill the Social Security number requirement, you should have them fill out federal Form SS-5, which is an application for a Social Security card. The service is free. Once the form is filled out and submitted by the employee, you will be able to move forward with your reporting obligations.

Make sure you have your information available. Federal law also requires you to submit three pieces of information in each new hire report. Some states may require you to submit more. Under federal law, your new hire report must contain your name, address, and Federal Employment Identification Number (FEIN). In California, for example, you must also report your business name, phone number, and your California employer account number.

Include optional information if you choose. Some states give you the option of reporting additional information that can be used to help state and federal agencies implement the purpose of the law. If you are willing and able, you should report optional information as well. For example, in Georgia, you have the choice of reporting the employee's monthly salary, information regarding whether you provide and offer multiple medical insurances.

Ask your employee to fill out a W-4. You can collect the required information almost any way you want. One of the most efficient ways to do so is to make a copy of each new employee's W-4. The W-4 tax form will usually include all the required information you need and it is a form the employee is required to fill out irrespective of your reporting obligations. Once you obtain a copy of your employee's W-4, you will simply report the information found there. You can even send the entire W-4 and comply with your reporting requirements. If you are using W-4s to report, make sure you put your FEIN and address at the top of each W-4. Additionally, make sure all of the information on the W-4 is legible.

Obtain a state new hire reporting form. Most states have created specific new hire reporting forms you can use to gather the required information from new employees. If you want to use your state's new hire reporting form, you will need to visit the appropriate government website and download a copy. Give a blank form to each new employee and ask them to fill it out. If you do not want to burden your new employee, you can fill the form out yourself using information gathered on W-4s. For example, in Georgia, you would use the Georgia New Hire Reporting Form. In California, you would use Form DE 34.

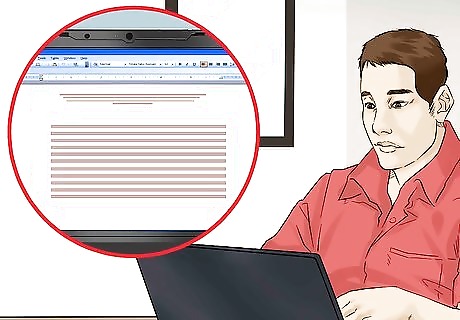

Make a spreadsheet. If you are unable to use state and federally offered forms, you can even create your own spreadsheet to collect the required information. In Georgia, for example, you can make a spreadsheet so long as it includes all the required information and is created with at least 10-point font. Your address should be displayed at the top of the spreadsheet.

Call your state's employment department for assistance. If you need help reporting new employees to your state's new hire reporting program, call your state agency for help. Every state has a phone number you can call. For example, in California, you can call the New Employee Registry Hotline.

Comments

0 comment