views

The central excise duty on petrol and the tax collected by the central government on fuel has increased by more than three times since 2014-15, even as crude oil price dropped to nearly half during the same period, official data analysed by CNN-News18 showed.

The central excise duty on petrol in 2014 was Rs 9.48 per litre. Currently, the central excise duty on petrol stands at Rs 32.9 per litre — an increase of nearly 3.5 times, data from the Union Finance Ministry showed.

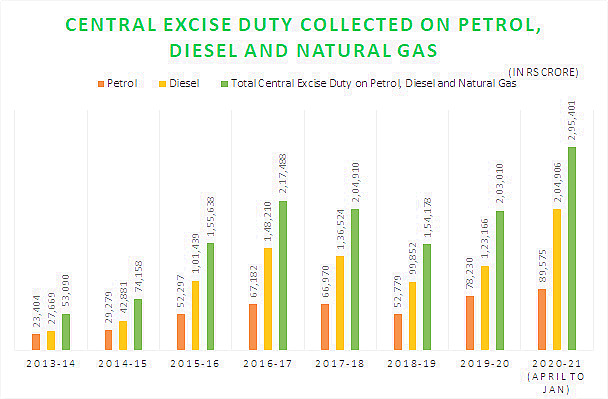

Similarly, the central excise duty collected on petrol was Rs 29,279 crore in 2014-15, which has increased to over three times in the first 10 months of 2020-21 to Rs 89,575 crore, as per the Finance Ministry data.

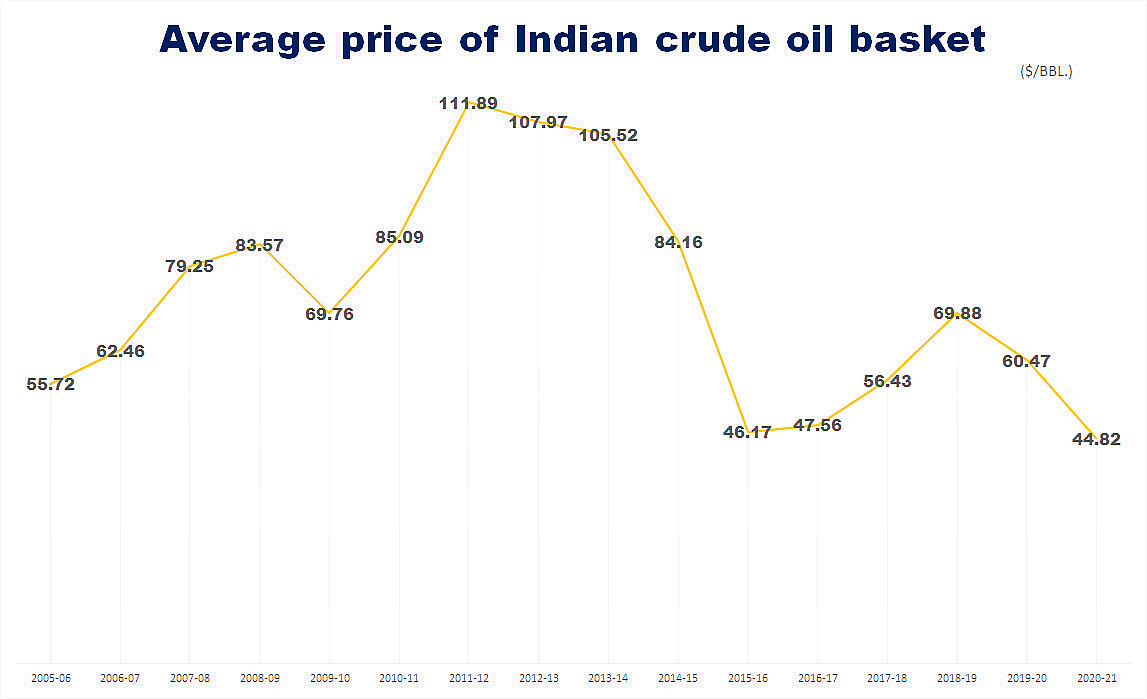

It is also important to note that the average price of Indian crude oil basket between 2014-15 and 2020-21 has dropped by almost half — from $84.16/bbl to $44.82/bbl. The average price of Indian crude oil basket was lowest in 2020-21 since 2005-06, as per the data from the Ministry of Petroleum and Natural Gas.

Indian basket of crude oil represents a derived basket comprising Sour grade (Oman and Dubai average) and Sweet grade (Brent Dated) of Crude oil processed in Indian refineries. Also, as per the petroleum ministry, India saved over Rs 5,000 crore in April-May 2020 as the government filled its three strategic underground crude oil storage by buying oil at its two-decade low price.

Central excise duty on diesel increased by nearly nine times since 2014

The central excise duty on diesel was Rs 3.56 per litre in 2014, which has shot upto Rs 31.8 per litre in 2021 — nearly nine times more.

Just like petrol, the tax collected by the Union government on diesel has increased by about five times since 2014-15. The central excise duty collected on diesel was Rs 42,881 crore in 2014-15. This increased to Rs 2.04 lakh crore during April 2020-January 2021 period, the Union Finance Ministry data showed.

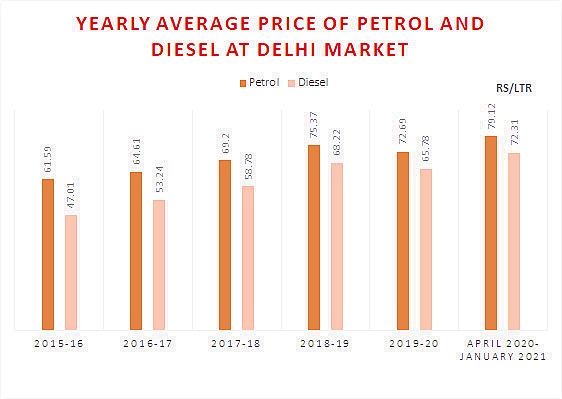

Traditionally, the price of diesel and the excise duty on it used to be lower than that of petrol, however, over the years, the gap has narrowed.

In 2013-14, during the last year of UPA-II, the excise duty on petrol was Rs 9.48 per litre, while that of diesel was Rs 3.56 per litre. In 2020-21, the per litre excise duty on petrol and diesel has increased to Rs 32.90 and Rs 31.80, respectively.

On the other hand, the difference between revenue from both the fuels increased. In 2013-14, the Centre collected Rs 23,404 crore from excise duty on petrol and Rs 27,669 crore from diesel — a difference of Rs 4,265 crore. In the first 10 months of 2020-21, this gap increased to Rs 1.15 crore, when Rs 89,575 crore was collected from petrol and Rs 2.04 crore from diesel.

Since March 2020, the central excise duty on petrol has increased by Rs 12.92 per litre, while that on diesel has increased by Rs 15.95 per litre. As per the government, the excise duty rates have been calibrated to “generate resources for infrastructure and other developmental items of expenditure” keeping in view the present fiscal position.

Total central excise duty collected on petrol, diesel, natural gas increased by about 4 times

The total central excise duty collected on petrol, diesel and natural gas increased by about four times since 2014 when it was Rs 74,158 crore. During April 2020-January 2021 period, this increased to Rs 2.95 lakh crore.

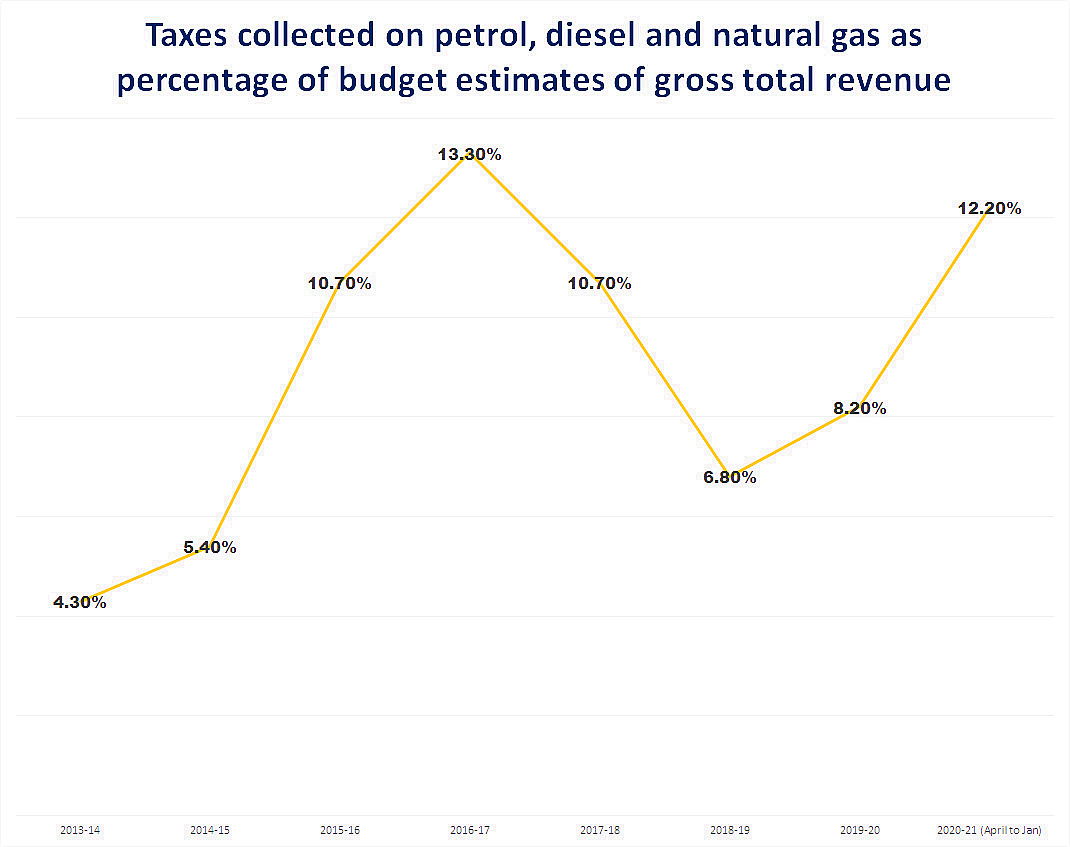

Further, the central taxes on petrol, diesel and natural gas as a percentage of the budget estimates of gross total revenue has increased by close to 126 percent since 2014-15, when it was 5.40 percent. In April 2020-January 2021 period, this has jumped to 12.20 percent. This was only 4.30 percent in 2013-14, the last year of the UPA-II.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment