Aadhaar PAN Link Last Date Extended: From July 1, No Tax Refund, Higher TDS Rate; Check Details Here

views

PAN-Aadhaar Link: The last date for linking PAN with Aadhaar is extended to June 30, 2023. The government has made it mandatory for individuals to link their Permanent Account Number with Aadhaar in order to file income tax returns.

PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department in India. It is issued in the form of a laminated plastic card (commonly known as PAN card). It serves as a unique identification number for individuals and entities in India for tax purposes.

The Ministry of Finance said on Tuesday, “In order to provide some more time to the taxpayers, the date for linking PAN and Aadhaar has been extended to 30th June, 2023, whereby persons can intimate their Aadhaar to the prescribed authority for Aadhaar-PAN linking without facing repercussions. Notification to this effect is being issued separately.”

From July 01, 2023, the PAN of taxpayers who have failed to intimate their Aadhaar, as required, shall become inoperative and the consequences during the period that PAN remains inoperative will be as follows:

– no refund shall be made against such PANs;

– interest shall not be payable on such refund for the period during which PAN remains inoperative; and

– TDS and TCS shall be deducted /collected at higher rate, as provided in the Act.

– The PAN can be made operative again in 30 days, upon intimation of Aadhaar to the prescribed authority after payment of fee of Rs.1,000.

Those persons who have been exempted from PAN-Aadhaar linking will not be liable to the consequences mentioned above. This category includes those residing in specified States, a non-resident as per the Act, an individual who is not a citizen of India or individuals of the age of eighty years or more at any time during the previous year.

The statement added that more than 51 crore PANs have already been linked with Aadhaar till date.

Taxpayers Step-By-Step Guide To Check Aadhar-PAN Card Link Status

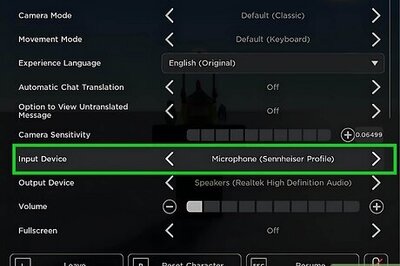

Step 1: View PAN-Aadhaar link status without signing in on www.incometax.gov.in/iec/foportal/

Step 2: On the e-Filing Portal homepage, go to ‘Quick Links’ and click on Link Aadhaar Status.

Step 3: Enter your PAN and Aadhaar Number, and click on View Link Aadhaar Status.

On successful validation, a message will be displayed regarding your Link Aadhaar Status.

If the Aadhaar-Pan link is in progress, then the below message will appear on the screen;

Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on ‘Link Aadhaar Status’ link on Home Page. Read more

Why Taxpayers Are Mandatorily To Link Their PAN and Aadhaar Cards By June 30?

Linking your PAN and Aadhaar is mandatory in India. The government has made it compulsory for individuals to link their PAN and Aadhaar as part of its efforts to curb tax evasion and improve compliance.

Who Does Not Require PAN-Aadhaar Link?

The ‘exempt category’, according to a notification issued by the Union Finance Ministry in May 2017, are those individuals;

1. Residing in the States of Assam, Meghalaya and UT of Jammu and Kashmir

2. A non-resident as per the Income-tax Act, 1961;

3. Of the age of eighty years or more at any time during the previous year;

4. Not a citizen of India.

Aadhaar PAN Link: Reasons For Which It Is Necessary To Link PAN Card With Aadhaar

If PAN becomes inoperative, you will not be able to furnish, intimate or quote your PAN and would be liable to all the consequences for such failure.

This will have a number of implications such as:

1. You will not be able to file return using the inoperative PAN

2. Pending returns will not be processed

3. Pending refunds cannot be issued to inoperative PANs

4 Pending proceedings as in the case of defective returns cannot be completed once the PAN is inoperative

5. Tax will be required to be deducted at a higher rate as PAN becomes inoperative.

Aadhaar-PAN Link Fees: How to pay Rs 1000 And What Will Happen After June 30, 2023?

The prescribed fee was Rs 500 till June 30, 2022 and Rs 1000 is being charged from July 01, 2022 to June 30, 2023 in a single challan which will be applicable before submission of Aadhaar-PAN linkage request on e-filing portal.

How To Link PAN With Aadhaar?

Via the Income-Tax Department Portal

Step 1: Go to incometaxindiaefiling.gov.in

Step 2: Click on the ‘Link Aadhaar’ option under the ‘Quick Links’ section of the webpage.

Step 3: You will be redirected to a new page where the PAN number, Aadhaar number and other required details like your name need to be entered.

Via SMS

Step 1: Dial 567678 or 56161 on a mobile device to send an SMS. The format should be UIDPAN (10-digit PAN card number), 12-digit Aadhaar card number, and space.

Step 2: Following that, an SMS will inform you of the PAN-Aadhaar link status. The Aadhaar and PAN will only be linked if the taxpayer’s date of birth matches both documents.

Read all the Latest Business News here

Comments

0 comment