views

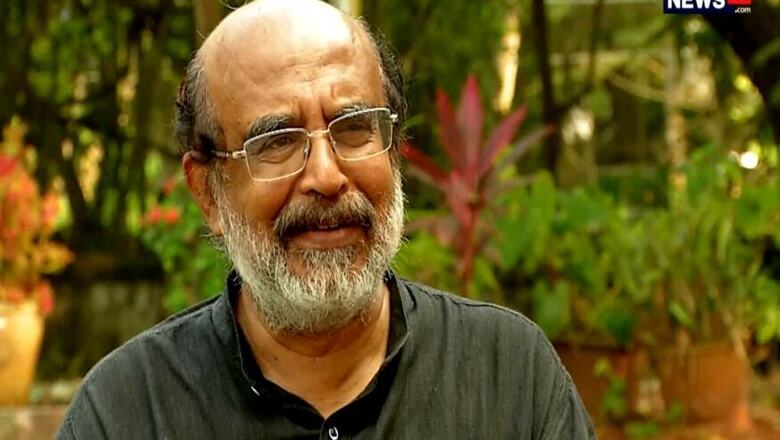

Kerala will reject “lock, stock and barrel” the Centre’s proposal of borrowing by states to meet GST revenue shortfall, state finance minister Thomas Isaac said on Monday. The Centre and opposition-ruled states like Punjab, Kerala, Delhi and West Bengal, are at loggerheads over the financing of the Rs 2.35 lakh crore Goods and Services Tax (GST) shortfall in the current fiscal. Of this, about Rs 97,000 crore is on account of GST implementation and rest Rs 1.38 lakh crore is the impact of COVID on states’ revenues.

The Centre last week gave two options to the states to borrow either from a special window facilitated by the RBI or from market and has also proposed extending the compensation cess levied on luxury, demerit and sin goods beyond 2022.

“Now that we fully understand Centre’s intentions on GST Compensation we have no choice other than to reject them lock, stock and barrel. No state with Aatmanirbhar can accept them. Enough is enough. No more surrender of states rights. GST Compensation is our constitutional right,” Isaac tweeted.

At the GST Council meeting on August 27 on compensation, Finance Minister Nirmala Sitharaman had said that COVID-19 is an ‘Act of God’ and it was necessary to differentiate between GST shortfall and the pandemic-related shortfall.

“We all got it wrong regarding Centre’s proposal on GST deadlock. This itself is sad commentary on proceedings of Council. We discuss for 5 hours and then the Chair comes up with proposals which are totally disconnected with discussions and no time left for any clarification,” Isaac tweeted.

While the Centre has reasoned its proposal on premise that it is already saddled with a large borrowing requirement given the slowdown in revenue collections due to a slump in the economy, non-BJP ruled states such as Punjab, Kerala, Delhi and West Bengal have already stated that raising debt is not an option for already stretched state finances.

During April-July of current fiscal, the total compensation requirement of states stand at Rs 1.50 lakh crore. Total GST collection during April-July was Rs 2,72,642 crore, which is 65 per cent of what was collected in same period last year.

The payment of GST compensation to states became an issue after revenues from the imposition of cess started dwindling since August 2019. The Centre had to dive into the excess cess amount collected during 2017-18 and 2018-19.

The Centre had released over Rs 1.65 lakh crore in 2019-20 as GST compensation. However, the amount of cess collected during 2019-20 was Rs 95,444 crore. The balance Rs 69,556 crore was paid from the excess cess collected in 2017-18 and 2018-19.

The compensation payout amount was Rs 69,275 crore in 2018-19 and Rs 41,146 crore in 2017-18.

Comments

0 comment