views

Several savings schemes have been launched by the government in order to encourage people to invest in government-backed schemes. If you are looking for risk-free investments that come with tax benefits, then here are some schemes that you can consider investing in. These schemes are implemented through banks, financial institutions and post offices.

Government Securities (G-Secs)

Retail investors have a number of ways to invest in government securities Treasury bills (T-Bills) and the Government of India (GoI) dates bonds on the primary market. The maturity period varies from 91 days to 40 years, depending on the length of the particular arrangement of the liabilities of the respective organizations. No TDS is applicable on the interest and G-Secs can be stored in the current demat account. G-Secs can also be used as collateral to borrow funds in the repo market.

Sovereign Gold Bonds (SGBs)

The SGBs are issued by the Reserve Bank of India on behalf of the GoI and is denominated in grams of gold. Investor must pay the agreed price in cash and the bonds will be redeemed in cash at the time of maturity. SGB is exempt from making charges and purity and also eliminates the risks and cost of storage. The bonds can be held in demat form and TDS is not applicable.

Atal Pension Yojana (APY)

The Atal Pension Yojana is a guaranteed pension scheme by the government to provide financial security to those employed in the unorganized sector like maids, drivers, gardeners, among others. Under this, a fixed minimum pension will be provided at the age of 60 years depending on the donation rendered by the subscribers. It comes with tax exemption under section 80CCD of the Income Tax Act, 1961. The GoI also contributed 50 percent of the subscriber’s contribution or Rs 1000, whichever is lower.

National Pension Scheme (NPS)

NPS is a pension scheme for someone who wishes to schedule early retirement and has a low-risk appetite. There is a deduction of up to Rs 1.5 lakh. It provides seamless portability across jobs and locations. Until retirement, the accumulation of pension wealth rises over time with a compounding effect.

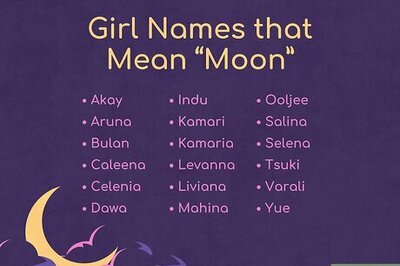

Sukanya Samriddhi Yojana

The scheme is designed for the girl child and investments of up to Rs 1.5 lakh are excluded under section 80C of the income tax act. The account can be opened in the name of the girl child by any parent or guardian till the child attains 10 years of age. The account can be opened in banks or even in post office.

Prime Minister Vaya Vandana Yojana (PMVVY)

This scheme is designed for senior citizens. The pension is payable at the end of each period during the policy term of 10 years, as per the frequency requested. Loan up to 75 percent of the purchase price will be allowed after three policy years.

Pradhan mantra Jeevan Jyoti Bima

This is a term insurance plan that aims to secure your family’s future with a life cover. It offers life insurance cover for death due to any reason and provides death coverage of Rs 2 lakh to the beneficiary in case of sudden demise.

National Savings Certificate (NSC)

NSC provides guaranteed return and bears practically no risk. It comes with a fixed maturity period of Rs 5 years. There is no upper limit on the purchase of NSCs but only Rs 1.5 lakh is exempted from income tax.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment