views

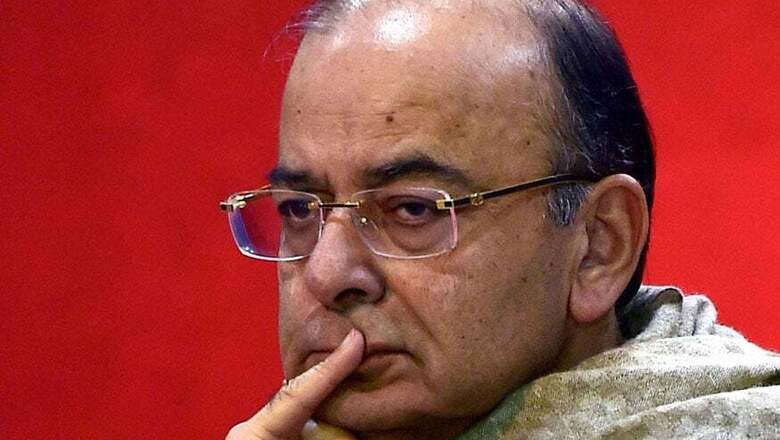

New Delhi: To assuage market fears, Finance Minister Arun Jaitley on Sunday said there is no move to impose long-term capital gains tax on share transactions, an issue investors are hugely touchy about.

The statement came a day after Prime Minister Narendra Modi reportedly dropped a hint on increasing taxes on capital markets and the need for all sections, including market players, to contribute to the national exchequer.

"The speech (of the Prime Minister) has been misinterpreted (by a section of the media) that this is an indirect reference to the fact that there could be a long-term capital gains (tax) on security transactions. This interpretation is absolutely erroneous," Jaitley said on the sidelines of Digi Dhan Mela in the city.

Currently, long-term capital gains on the sale of listed securities are exempt from taxes. These are profits on sale of shares on a stock exchange platform after a holding period of one year or more.

He further said the Prime Minister has made no such statement directly or indirectly.

"Therefore, I wish to absolutely clarify that there is no occasion or opportunity for anybody to reach such a conclusion because this is not what the Prime Minister said nor is the intention of the government as has been reported in a section of the media itself," he said.

On Saturday, Modi had said "those who profit from financial markets must make a fair contribution to nation-building through taxes... We should consider methods for increasing it in a fair, efficient and transparent way".

"... Now it is time to re-think and come up with a good design which is simple and transparent, but also fair and progressive," Modi had said, adding that for various reasons, contribution of tax from those who make money on the markets has been low due to illegal activities and frauds or due to the structure of our tax laws that offer low or zero tax rate on certain types of financial income.

Profit gained from share transaction in less than one year is called short-term capital gains, which are taxed at a flat rate of 15 per cent at present.

At the same time, all stock market transactions attract securities transaction tax (STT) in a range between 0.017 per cent and 0.125 per cent.

Jaitley asserted that the government has taken a number of steps to reduce blackmoney -- revised tax treaties, IDS, taxing benami properties and the like.

About demonetisation, he said the effort is being made to reduce usage of cash in the economy by replacing it with digital currency.

"Common people are getting to understand (benefits of digital currency), but there are certain sections who take time to understand and some of our political friends also take time to understand this," he said.

It is in the interest of every country that it becomes less-cash economy and a lot has been written about this, Jaitley added.

Digital economy has picked up in the last one and a half months, he said, adding that out of 75 crore debit and credit cards, 45 crore are actively used.

Making a pitch that the less-cash economy will help strengthen government finances, the finance minister explained that the higher tax buoyancy leads to lower deficit so that allocation towards rural infrastructure and defence can be increased.

One of the evils of the cash economy is the low revenue realisation of the government and higher deficit, he pointed out.

The current Budget size is Rs 20 lakh crore and the government's revenue from both direct and indirect taxes is Rs 16 lakh crore, leaving a gap of about Rs 4 lakh crore.

If revenue realisation is higher, the government has more opportunity to spend on development and future generation is also not unduly burdened with debt, Jaitley reasoned.

Talking about various steps taken by the government to promote digital economy, Jaitley said taxes on PoS machines have been removed, charges by merchant have been done away with till December 31.

Post December 31, the charges have been brought down to 0.25 per cent for transaction up to Rs 1,000 and 0.5 per cent for one up to Rs 2,000 so that payment remains cheap even after that.

To promote digital transaction, the government today announced the first set of winners under the Lucky Grahak Yojana and Digi Dhan Vyapaar Yojana.

"It is a big step and such moves will help encourage people shift to digital payment system. Digital transaction will help make the economy better and cleaner," he said.

Speaking on the occasion, IT and Law Minister Ravi Shankar Prasad pointed to a 300-350 per cent jump in digital transactions.

Comments

0 comment