views

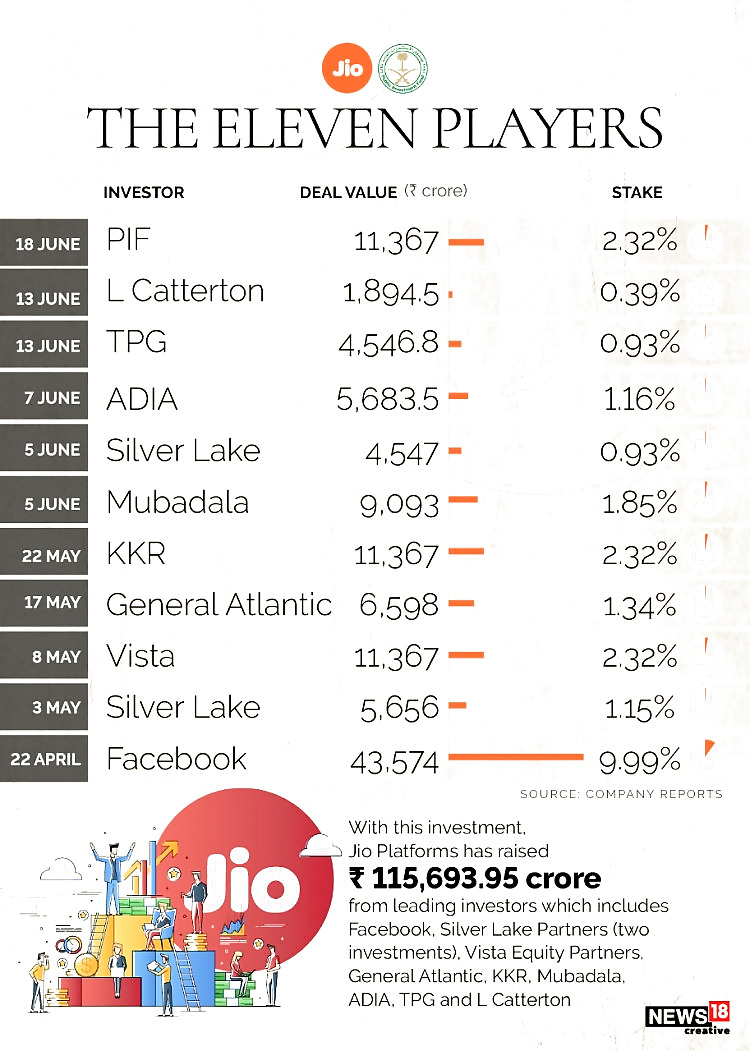

Reliance Industries Limited (RIL) on Thursday announced that Saudi Arabia’s PIF, one of the world’s largest sovereign wealth funds, will invest Rs 11,367 crore for a 2.32 per cent stake in Jio Platforms. This is a historic eleventh investment in the digital unit of RIL in nine weeks.

RIL, the oil-to-retail-to-telecom conglomerate, has now shed 24.7 per cent stake in Jio and raised Rs 115,693.95 crore from some of the world’s top technology investors. For some comparison, India's start-up ecosystem raised Rs 1.10 lakh crore last year, in what was its best year.

The investment by PIF, estimated to own combined assets of nearly $400 billion, in Jio Platforms is at an equity valuation of Rs 4.91 lakh crore and an enterprise valuation of Rs 5.16 lakh crore. It comes close on the heels of investments by private equity giants L Catterton and TPG last week.

In a statement, Reliance said PIF’s investment is another strong endorsement of Jio’s tech capabilities, and a strong endorsement Of Jio’s long-term growth potential.

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “We at Reliance have enjoyed a long and fruitful relationship with the Kingdom of Saudi Arabia for many decades. From Oil Economy, this relationship is now moving to strengthen India’s New Oil (Data-driven) Economy, as is evident from PIF’s investment into Jio Platforms.”

“I have greatly admired the defining role PIF has played in driving the economic transformation of the Kingdom of Saudi Arabia. I welcome PIF as a valued partner in Jio Platforms and look forward to their sustained support and guidance as we take ambitious steps to accelerate India’s digital transformation for enriching and empowering the lives of 1.3 billion Indians,” he added.

Yasir Al-Rumayyan, Governor of PIF, said the fund is delighted to invest in the business which is at the forefront of the transformation of the technology sector in India. "We believe that the potential of the Indian digital economy is very exciting and that Jio Platforms provides us with an excellent opportunity to gain access to that growth."

"This investment will also enable us to generate significant long-term commercial returns for the benefit of Saudi Arabia’s economy and our country’s citizens, in line with our mandate to safeguard and grow the

national wealth of the Kingdom.”

Jio, which runs movie, news and music apps as well as the telecom enterprise Jio Infocomm, has attracted the largest continuous fundraising by a company anywhere in the world.

The series of investments in Jio was led by a 9.99 percent stake sale to Facebook Inc for Rs 43,574 crore on April 22. Since then, General Atlantic, Silver Lake (twice), Vista Equity Partners, KKR, Mubadala Investment Company and ADIA, TPG and L Catterton have lined up for investments in Jio.

What is PIF?

PIF, founded in 1971, is the sovereign wealth fund of Saudi Arabia. It was founded for the purpose of investing funds on behalf of the Government of Saudi Arabia. PIF is developing a portfolio of high quality domestic and international investments diversified across sectors, geographies and asset classes.

PIF operates through six investment pools comprising local and global investments in line with its objectives to actively invest over the long term to maximize sustainable returns, be the investment partner of choice for global opportunities, and enable the economic development and diversification of the Saudi economy.

PIF aims to be a global investment powerhouse and the world’s most impactful investor, enabling the creation of new sectors and opportunities that will shape the future global economy, while driving the economic transformation of Saudi Arabia.

Comments

0 comment