views

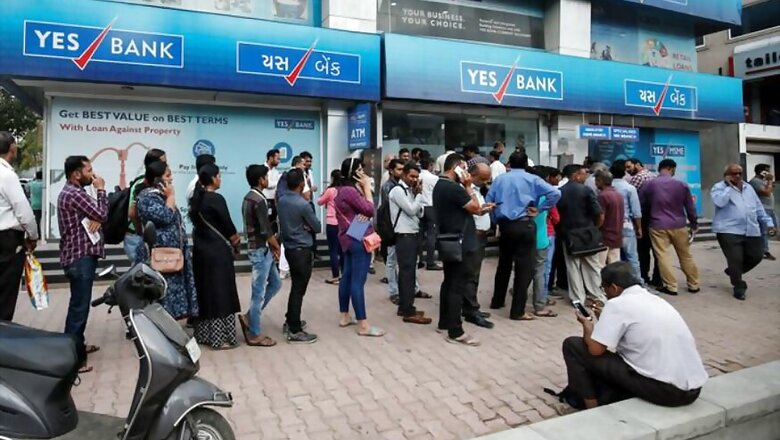

New Delhi: From today, depositors at India’s fourth-largest private bank cannot withdraw more than Rs 50,000 of their own hard-earned money. The amount can be higher only for certain emergencies and the restrictions will be in place for a month at least. The RBI imposed these restrictions late Thursday on Yes Bank, in a move some say was overdue, leaving depositors in a tizzy. For the next 30 days, Yes Bank will also not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment.

In the last few months, a similar fate has befallen depositors of cooperative banks like PMC Bank, where again withdrawals were severely restricted by the RBI to Rs 1,000 to begin with. Depositors of several smaller, relatively unknown cooperative banks, have also faced similar restrictions in the recent past, and these repeated restrictions have eroded the trust of the small depositors in India’s already frail banking and financial systems.

RBI’s own data for calendar 2019 shows that it had put at least four cooperative banks under similar or harsher withdrawal restrictions between January and September — Kolikata Mahila Cooperative Bank and United Cooperative Bank from West Bengal, Hindu Cooperative Bank from Punjab and PMC Bank. The case of PMC came in the public eye because it was a large cooperative bank with significant monies invested by depositors.

Trust in India’s banking and financial sector is anyway at an all-time low for the ‘aam aadmi’ now because of the peculiar and painful decisions taken under the watch of the Modi government. In its first term, this government announced demonetisation on November 8, 2016, rendering more than 80 per cent currency in circulation invalid almost immediately and also restricting withdrawals from banks.

The effects of demonetisation and its disastrous consequences on India’s economy are being felt even today, with no real evidence of black money having been caught though that was the avowed intention of this exercise. The NBFC and other arms of the financial system in India are still struggling with the aftershocks imposed by demonetisation.

Now, as troubles of Yes Bank and its depositors mount, it is important to understand what led to the present crisis and why the humble depositors are nearly always left holding the can.

What RBI Says

The financial position of Yes Bank has undergone a steady decline largely due to inability of the bank to raise capital to address potential loan losses and resultant downgrades, triggering invocation of bond covenants by investors, and withdrawal of deposits. The Yes Bank annual report for 2018-19 shows that its capital adequacy ratio was the lowest in three years as of March 2019 at 16.5 per cent. This ratio further fell to 16.3 per cent by the end of September 2019. The capital adequacy ratio denotes how much capital the bank has against risks. One doesn’t have a fair idea about the ratio at the end of the December quarter since Yes Bank deferred declaration of its Q3 results but suffice it to say that the RBI finally found the situation alarming enough to move in.

Why Restrictions Were Imposed

At the end of September 2019, Yes Bank had more than Rs 2 lakh crore in deposits — a big enough number for the government and the RBI to want to protect from further erosion. Limiting withdrawals now will probably stop a run on the bank till regulators find new investors to infuse much-needed capital.

Sucheta Dalal welcomed the RBI restrictions, saying “And there is action... on @YESBANK if not RANA Kapoor. Thank god the govt acted Now and didn’t wait for a run on the bank!”

Governance Issues

The RBI has said Yes Bank experienced “serious governance issues and practices” in recent years which have led to steady decline of the bank. There was the famous falling out between the two co-promoter families to begin with, where Rana Kapoor and sister-in-law Madhu Kapur fought a very public battle over control of the bank. Then came the bad loans and as of March 2019, the bank had under-reported these by over Rs 3,000 crore. Now, as an independent director, Uttam Prakash Agarwal resigned this January after citing corporate governance issues at the bank, and concerns obviously grew. Before that, RBI had unceremoniously asked Rana Kapoor to leave the board.

Funding Absent

Despite repeated attempts and assertions by the board of the bank about raising much-needed funds, nothing came in. The RBI also noted that the Yes Bank management was trying to find ways to strengthen balance sheet and liquidity and was in talks with various investors, including a few private equity firms. Some other banks were also believed to be in the race. While talks between potential buyers and the bank did happen, none eventually came forward with a bid. In the meantime, Yes Bank continued to face a regular outflow of liquidity.

What Next

The government has been nudging state-owned SBI and LIC to together pick up majority equity stake in Yes Bank to save it from going bust. SBI has already said its board of directors has approved the investment and LIC’s assent could also be a matter of time. State-owned entities stepping in to prevent a private bank from going bust is the latest in a series of government bailouts this country has seen.

The stock markets and Yes Bank investors, mutual funds with significant exposure to the stock are all deeply worried with the dramatic swing in fortunes on Dalal Street on Friday morning in the Yes Bank scrip. But if the government does succeed in getting its own entities to save the bank from a collapse, perhaps depositors would be thankful in the long run.

Comments

0 comment