views

X

Expert Source

Samantha Gorelick, CFP®Financial Planner

Expert Interview. 6 May 2020.

By keeping track of your income and expenses each month, you can become a master of your money and meet your goals in a timely manner.

Creating a Budget

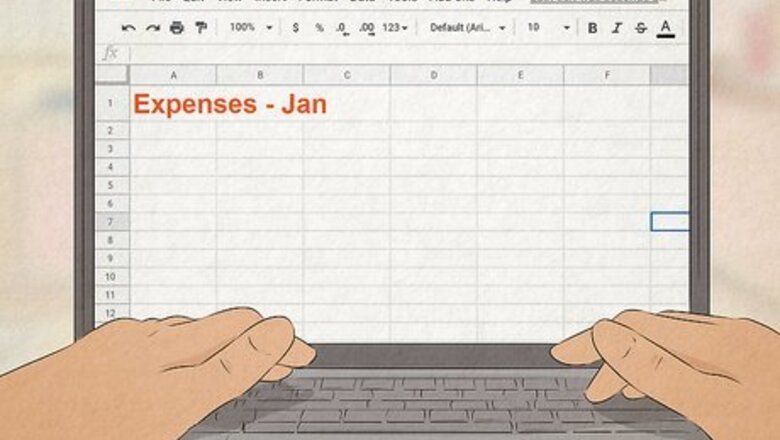

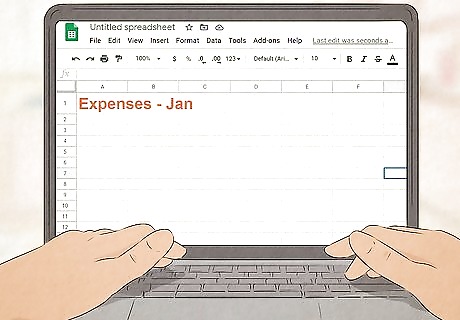

Create a budgeting spreadsheet. You can create a simple spreadsheet using Google Sheets or Excel. Your goal is to chart all your expenses and income during the course of a year, so make a spreadsheet that shows all your information clearly, allowing you to quickly identify any areas where you can spend smarter. Label the top row with the 12 months of the year.

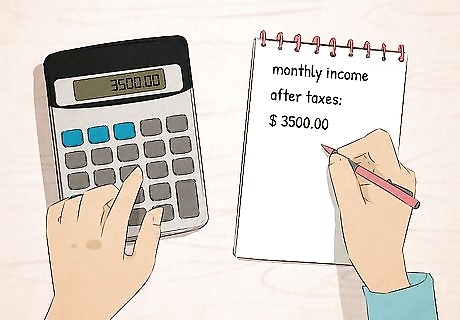

Find your monthly income after taxes. Your net income, or the income that is yours to spend, is your monthly income after taxes are deducted. If you are on a salary, this will be a fixed amount each month, which you can find on your paystub. If you work an hourly position, your income may vary from month to month, but you can find an average amount by looking at your last 3 to 4 paystubs. If you are a freelance worker or self-employed, you may be receiving your entire income without taxes taken out. Try to set aside about 20% of your income to pay your taxes at the end of the year.

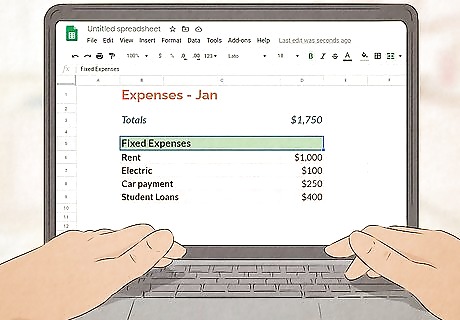

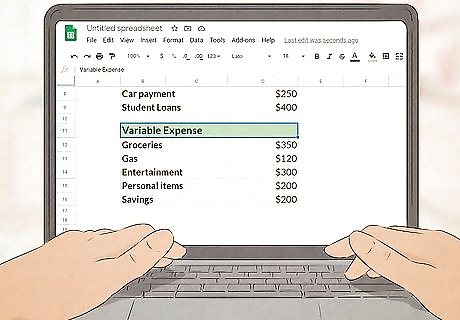

List all of your fixed expenses. Fixed expenses are the things that you pay the same price for every single month. This may include your rent, mortgage, some utilities, student loan payments, or a car payment. Add a label for each expense on the column at the very left of your spreadsheet, then write down the monetary amount you spend in each box underneath its corresponding month. For example: Rent: $1,000 Electric: $100 Car payment: $250 Student loans: $400 Credit card payment: $100

Write down your variable expenses. Variable expenses are the ones where the monetary amounts might change from month to month. These are usually the areas that are easy to cut back on if you’re trying to save money. Add these labels underneath your fixed expenses, then add them for every month that you can. For example, the month of March might say: Groceries: $350 Gas: $120 Entertainment: $300 Personal items (hair care, makeup, clothes, etc.): $200 Vacation fund: $50 Savings: $200

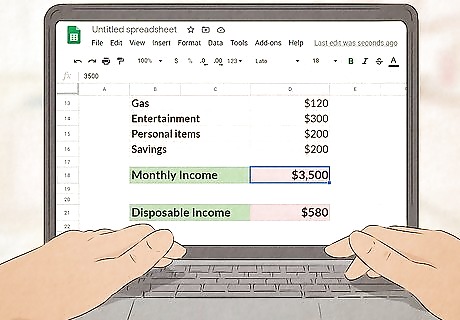

Compare your expenses to your income. To make your monthly budget, add up the total amount of money you spend every month from fixed and variable expenses. Then, subtract that amount from your monthly income. Whatever you have left over is your disposable income, or money that you have left at the end of the month. If you don’t have any money left or the number is negative, you’re probably spending more than you make each month. For example: $600 (fixed expenses) + $550 (variable expenses) = $1,150 per month. $2,000 (monthly income) - $1,150 (total expenses) = $850 disposable income.

Using Your Budget

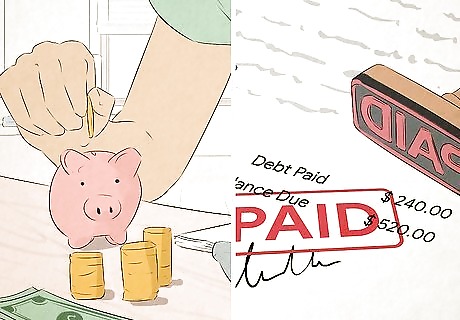

Pay all of your expenses first. Before you get into saving money or putting money towards a goal, you have to make sure that you are paying all of your bills. Make sure you’re allocating the bulk of your income every month toward your bills that you have to pay to keep a roof over your head and food in your mouth. There’s no point in saving money if you still have outstanding bills to pay! You should try to allocate 50% of your income towards living expenses / necessities.

Put your excess money toward a specific goal. Now that you know how much money you have left over at the end of the month, you can start putting that money toward your goals. You can put it into savings, pay off debt, or add it to a college fund for your kids. Make sure you know what you want to do with your extra money so you can make a plan. For example, you could split your extra money into paying off debt and putting it in a savings account every month. You could also give yourself a spending allowance or invest your excess money each month. Try to put 20% of your income toward savings or a specific goal.

Adjust your habits if you are overspending. If you calculated how much money you have left over at the end of the month and it isn’t much, you may need to adjust your spending habits. Try spending less on optional items, like clothing, entertainment, and going out to eat. Not everyone is in a position to cut back on spending right now, and that’s okay. Eating food, paying your bills, and buying clothes are all necessary to live life, and you shouldn’t feel bad about that. Try to be realistic on what you can cut back on. It’s easy to say that you can cut your entertainment budget in half, but it might not be fun to decline going out with your friends every time they ask. Around 30% of your income should be spent on things you want but don’t need.

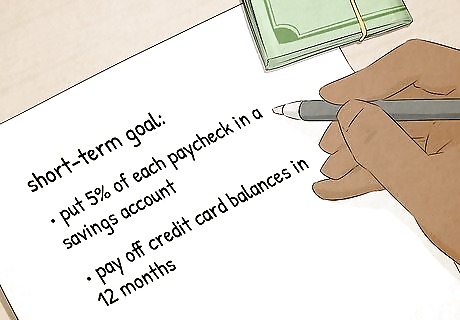

Set short-term goals to achieve within 1 year. Now that you know how much money you receive and spend each month, you can set goals for your spending habits. Short-term goals are things that you can achieve within 12 months, and they should be specific and actionable. For example: Put 5% of each paycheck in a savings account. Pay off credit card balances in 12 months.

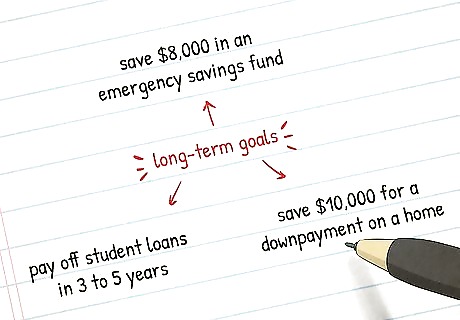

Create long-term goals to achieve within a few years. Long-term goals are your budgeting goals that might take a little longer than 1 year to achieve. They should also be specific and actionable, and you can think further ahead into the future. For example: Save $8,000 in an emergency savings fund. Pay off student loans in 3 to 5 years. Save $10,000 for a downpayment on a home.

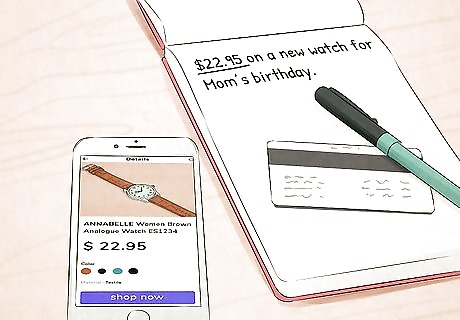

Write down what you spend every time you make a purchase. The best way to track how well you’re doing is to jot a note down every time you spend money. You can do this on a piece of paper, a note on your phone, or on a spreadsheet on the computer—whatever’s easiest. That way, you can see where your money is going and what you may be able to cut back on in the future. Be really specific when you write down what you spent money on so you don’t forget it. For example, you could write, “$22.95 on a new watch for Mom’s birthday.”

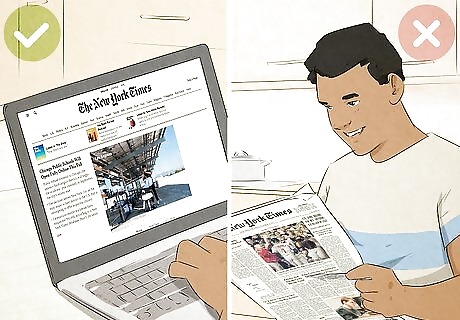

Reduce your spending by purchasing less expensive items. If you realize that you’re overspending, you may be able to make small changes to your habits that don’t affect your life much at all. For example, try buying in bulk at the grocery store instead of going for name-brand items. Or, make your coffee at home instead of buying one from a coffee shop. Small changes like this can add up over time, so keep at it! Try packing your lunch instead of buying one, exercising outside instead of at the gym, subscribing to an online newspaper instead of buying one, or getting your books from the library instead of buying them brand new.

Practicing Good Budgeting Habits

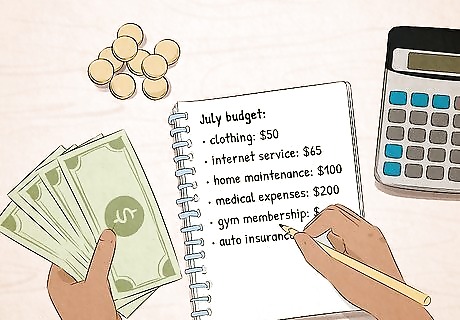

Review your budget every month. Your income or expenses may change from month to month, and it’s important to keep your budget updated. Be sure to keep track of your total spending and savings, and adjust your expenses if you need to. At the beginning of each month, take a look at last month’s budget and see how you did. This can help you make adjustments for the future. If you got a pay raise or paid off a debt, this can also affect your budget.

Use a budgeting tool to make your budget easier. Spreadsheets are great, but it can be tough to keep track of your info all on your own. If you want to make your budget run a little smoother, try updating your information onto a budgeting website or app. That way, you’ll already have a budgeting template, and you can set reminders on the website to upload your spending habits so you don’t forget. Quicken, Mint, YNAB, AceMoney, and BudgetPlus all offer budgeting services.

Treat yourself periodically, but within reason. Your money has to work for you, not the other way around. You don't want to feel like a slave to your budget, or to money in general, so it's important to allow yourself a small treat every month that won't break your budget. Take a look at your budget and decide what you can afford to splurge on. Some months you might be able to afford a new pair of shoes, other months you might go for a latte or a new notebook.

Pay off your debt every month, if you can. If you use credit cards or have student loan debt, you should try to pay off at least the minimum amount every month to avoid high interest rates. If you cannot pay off the current balances, prioritize paying them off within a reasonable time period so that you can get to zero balances. If you can afford to put more money toward your debt each month, you should prioritize that. Paying the minimum payment each month can take a long time to pay off your debt, and you can pay a ton of money in interest rates.

Keep money in savings for emergencies. You can never plan for emergencies, and they can destroy your budget if they catch you off guard. Try to set aside some money every month in case your car breaks down, you need medical care, or you lose your job. That way, you’ll have a cushion to help you out. It’s better to plan ahead for the unexpected now than let it catch you off guard. If something unexpected does happen, reach out to your credit card company and student loan company to see if they can forgive some late payments or hold off on collections for a few months. The general rule of thumb is to save enough money to cover 6 months of your expenses. For example, if you spend $1,500 every month, try to save $9,000 for emergencies.

Comments

0 comment