views

Calculating Common Real Estate Commissions

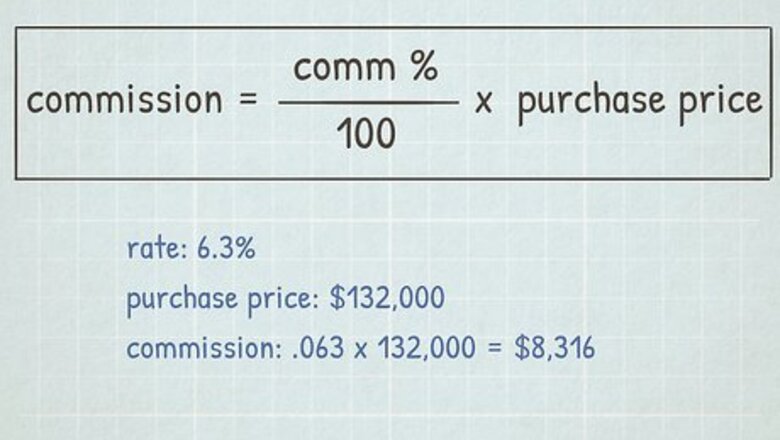

Multiply the commission percentage by the purchase price to find out your total commission. To estimate commission, simply multiply the percentage by the purchase price of the property. Remember to convert percentage to decimal first by dividing it by 100. Rate: 5.5%; Purchase Price: $200,000 → .055 x 200,000 = $11,000 Rate: 4.75%; Purchase Price: $325,000 → .0475 x 325,000 = $15,437.50 Rate: 6.3%; Purchase Price $132,000 → .063 x 132,000 = $8,316 Formula = C o m m % 100 ∗ P u r c h a s e P r i c e {\displaystyle {\frac {Comm\%}{100}}*PurchasePrice} {\frac {Comm\%}{100}}*PurchasePrice

Familiarize yourself with common commission amounts. When you buy or sell a home, the broker receives a percentage of the sale value as commission. This is their payment for helping you buy or sell the house. This percentage typically ranges between 5% and 7%, with the average currently around 5.5%.

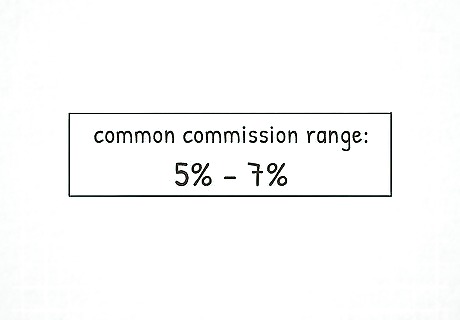

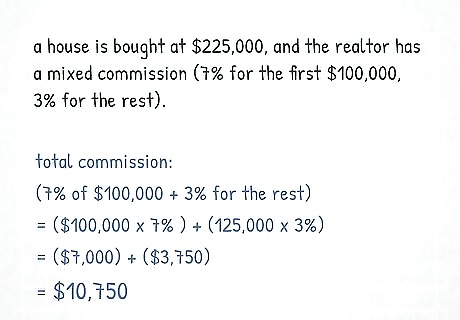

Discuss your specific commissions before signing any paperwork. Some brokers have arrangements where there will be a certain percentage charged on the first $100,000 of the home value, and a smaller percentage charged on the remainder of the house. On rare occasions, the commission is a flat fee. If you buy a house for $225,000, and your Realtor has a mixed commission (7% for the first $100,000, 3% for the rest), you would simply break the price up and calculate separately: $225,000 - $100,000 = $125,000 ($100,000 x 7%) + (125,000 x 3%) ($7,000) + ($3,750) Total Commission = $10,750

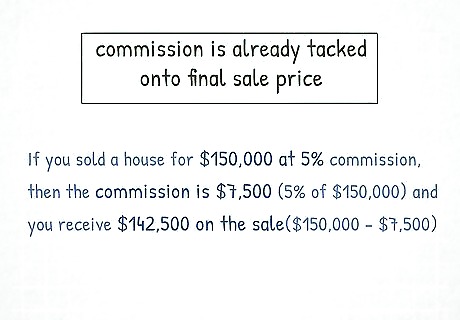

Remember that commission is already tacked onto final sale price. A commission reduces the seller's net proceeds from the sale. The seller pays it in one sense because it reduces the net proceeds. For example, if you are selling a home for $200,000, and if the dollar value of the commission is $10,000, you will receive $190,000 for your purchase. If you sold a house for $150,000 at 5% commission, you receive $142,500 on the sale, or $150,000 - $7,500 in commission. If you buy a house for $225,000, and your Realtor's commission is 4.6%, then you'll be paying your Realtor $10,350. In a typical real estate contract in the United States, the buyers do not pay the real estate commissions. It is taken out of the seller's proceeds. The buyer pays the agreed upon purchase price plus their closing costs. If you are buying a house and the seller is not offering a real estate commission, then you may end up paying the real estate commission on top of the purchase price. It depends on what you negotiate with the Realtor.

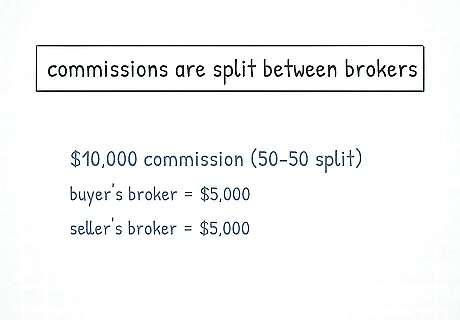

Understand how commissions are split between brokers. The standard arrangement is that the broker representing the buyer and the broker representing the seller will each split the commission 50/50. At this point the broker would then split the commission according to the brokerage/agent contracted agreement. Note that if you choose not to use a broker, the seller's broker would receive the entire commission. The commission fee between the seller and broker is always negotiable. If you had $10,000 commission, $5,000 would go to the buyer's broker, and $5,000 would go to the seller's broker.

Calculating Total Cost of a Sale

Settle on the commission amount ahead of the sale. Before selling a property, make sure to determine exactly what the commission will be in percentage form. Commissions are often negotiable, and do not be afraid to ask for a reduction in commissions, especially if you are selling a high-value property. In some cases, the broker and agent will split the commission. In these cases, you may need to negotiate with both of them to determine what their total commission will be, and then they can work out an appropriate commission split and divide the commission between them. For this section, assume you settled on a 5% commission with your Realtor for a ranch house in Georgia.

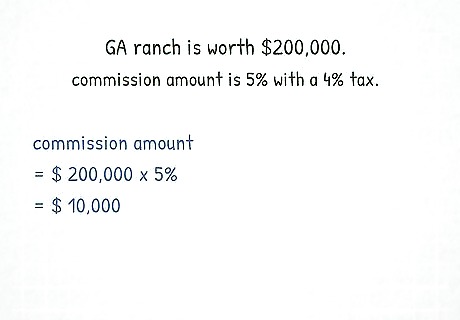

Determine the property's gross sale price. Once the commission is determined, you need to determine the sale price of your property. Ask your agent for help in understanding the sale price of your home. The commission will be based on the total price of the home, not the amount the seller gets to keep after a mortgage or other lien is paid off. The sale price will only be finalized once you have agreed to an offer from a buyer and the appropriate legal documents have been signed and confirmed. Continuing the example, pretend this GA ranch is worth $200,000. Note that gross sales price refers to the price of your home before any deductions are taken off. This means before any taxes, commissions, fees, etc.

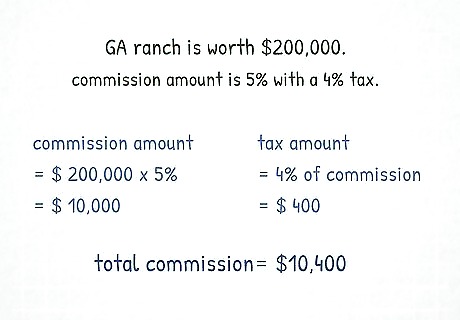

Calculate the commission by multiplying the gross sales price of the property by the commission percentage that was agreed upon. For example, our ranch that sold for $200,000 with a 5% commission rate would result in a $10,000 agent commission. Remember to convert the percentage to a decimal (by dividing by 100) before multiplying if your calculator does not have a "%" button. 200 , 000 ∗ 5 % = 10 , 000 {\displaystyle 200,000*5\%=10,000} {\displaystyle 200,000*5\%=10,000}

Add taxes to the commission amount. Since commission is being paid in exchange for a service, the commission amount is often taxed just like any other purchase with a sales tax. Sales tax rates vary between states and countries. To calculate this, simply find out what the sales tax amount is (say, 4%), and multiply that amount by the commission amount. This will tell you the amount of tax that is owed, and you can simply add this amount to the total commission owing to obtain the total cost of the commission. For example, multiply 4% (or 0.04) by your $10,000 commission and you get $400 in sales tax. This means your total commission would be $10,400. Note that sales tax is not charged in all states on commissions.

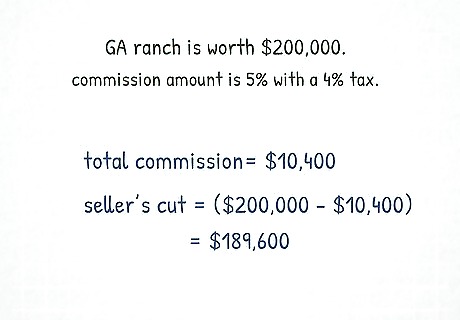

Subtract the commission from the total sale to determine your cut. To determine the net proceeds you will receive for your home after commission and other selling costs, subtract the commission and other selling costs from the amount of the purchase price. For example, if commission was the only selling cost, and the ranch's purchase price is $200,000, and your total commission was $10,400, then you would have net proceeds of $189,600. Keep in mind that there are other selling costs besides commission to factor in when you are determining what the net proceeds are. A real estate agent can help estimate these costs for you.

Comments

0 comment