views

Filling Out a Deposit Slip

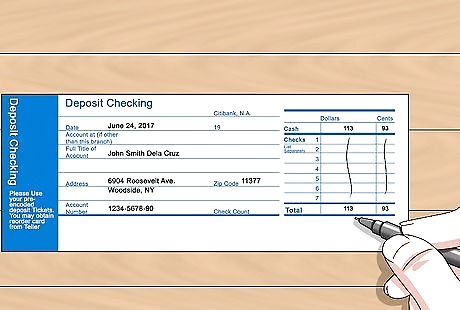

Check that the preprinted information is correct. Lots of information on the slip is already printed. Your name, address, bank name and address, and your account number should all be on the deposit slip already. Before depositing cash, check to ensure this information is present and correct. If the information is not present or incorrect, talk to a representative of the issuing bank. If you did not receive deposit slips when opening your account, contact the bank where you have the account. Many banks offer unnumbered deposit slips in their lobbies (in which case you will have to fill in your account number manually).

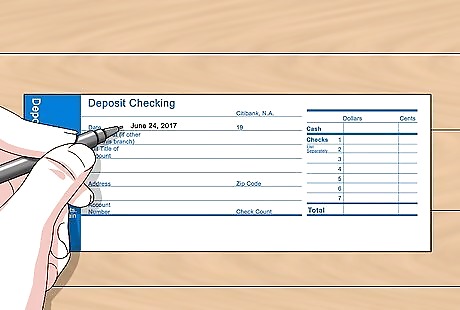

Write the date on the slip. There should be a space to the left of the deposit slip for you to write the date of your deposit. This will help the transaction proceed smoothly and prevent confusion.

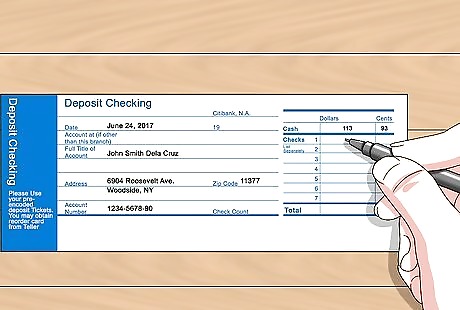

Indicate the amount of cash you’re depositing. Locate the line on which you are expected to total your cash. Typically, the cash deposit line is the first line on the right side of the deposit slip. It has a small black triangle next to it, along with the word “CASH.” Total the amount of cash you’re depositing and write it on this line. If you’re depositing checks along with cash, you can write the totals of your checks on the subsequent lines.

Total your deposit slip. When you’re done filling the slip out, add up your cash and check deposit amounts. Write the grand total at the bottom of the deposit slip. For instance, if you deposited two checks worth $50 and $100 in cash, you’d write $200 at the bottom of the deposit slip. Count the checks and go in some order, for example, ascending or descending order., so that you can make sure your balance equals the balance on the deposit slip. You have to write the check numbers on the deposit slip. Some check numbers are very long. So you can put the last four digits of the check number and then the check amount. Be careful when you do the math.

Depositing Cash in an Online Bank

Use an online bank with a physical location. Some online banks also offer walk-in locations where you can deposit cash. If you’re near enough to this physical location, depositing cash is similar to the process by which you’d deposit it at a traditional bank.

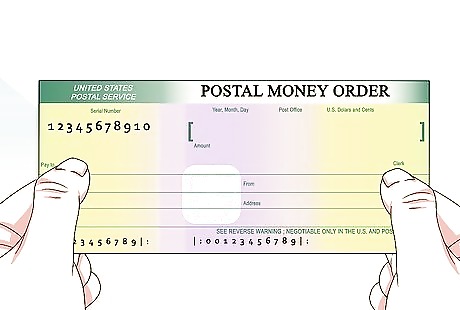

Use a money order. Money orders are like checks, but they are guaranteed by a public or private service like Western Union or the Indian Postal Service. Visit the money order service of your choice, then pay for the money order. From there, deposit it according to the instructions prescribed by your bank. The specific process by which you can deposit a money order vary depending on the online bank you use. Generally, you can scan or take a photo of the money order, then send the image to your online bank. In some cases, you might need to mail the money order to the bank. Check your online bank’s policy regarding money orders before you get a money order.

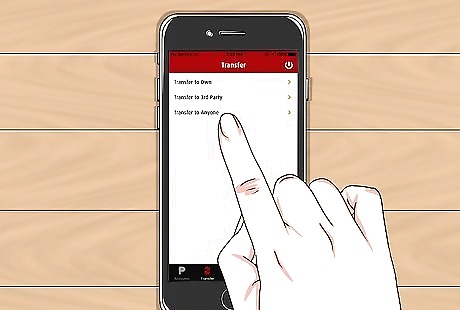

Transfer the funds online. If you use an online bank as well as a traditional bank, make a deposit at your local branch of the traditional bank. Then, transfer the funds to your online bank over the internet. The specific method by which you can accomplish this varies depending on the banks you use. Generally, however, you’ll have to set up an account online with your traditional bank, then select an “electronic funds transfer” or some similar formulation. You will then be prompted to provide the routing number for the online bank you wish to transfer the funds to. If you exclusively use an online bank, open a bank account at a local bank. Look for one with the lowest monthly fees.

Use a wire transfer service. Wire transfer services allow you to move money electronically from one account to another. They are provided by most major traditional banks. To deposit cash into your online account using wire transfer services, deposit the cash at your traditional bank. Request a wire transfer and fill out the bank’s transfer form. Requirements for using wire transfer services vary from bank to bank. Depositing cash in your online bank via wire transfer may result in a brief hold time before the money is available. There are often fees involved in using a wire transfer service. Ask about these fees before depositing cash using a wire transfer. If you exclusively use an online bank, the only way to move cash from the physical bank to your online bank is to open an account with a traditional bank. Look for one with the lowest monthly fees.

Depositing Cash in Other Ways

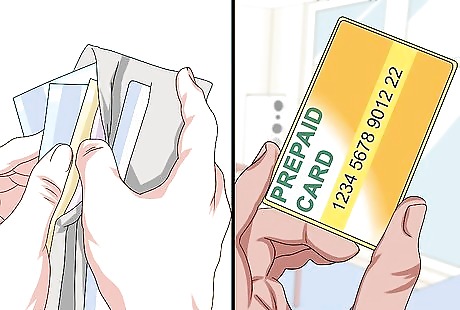

Put cash on a reloadable prepaid debit card. Instead of depositing cash in a bank, purchase a reloadable prepaid debit card. This card works the same way a regular debit or credit card does, and allows you to make purchases up to the amount deposited on the card. The process by which you deposit cash onto the card depends on the terms of the card. Some cards allow customers to deposit cash at the checkout register of certain big box stores. Cards that were obtained at banks usually require you to add more money to the card at the issuing bank. Before purchasing a reloadable prepaid debit card, ask the issuer how to deposit cash onto the card. If you find the process too difficult, consider another option for depositing cash. Reloadable prepaid debit cards are available online, at big box stores, and at many banks.

Deposit cash through an ATM. Automated teller machines (ATMs) are machines that distribute and, in some cases, receive cash so that you can access your bank account even when the bank is closed. Banks that are not linked to ATMs that allow deposits will not be able to accept cash deposits. Find a bank with access to a large ATM network. To find an online bank with a large ATM network, contact several banks and ask the bank representative, “Do you offer access to a large ATM network?” If the answer is “No,” look for another way to deposit your cash. Most online banks do not accept cash deposits via ATM. Cash deposited through an ATM might be put on hold for several days.

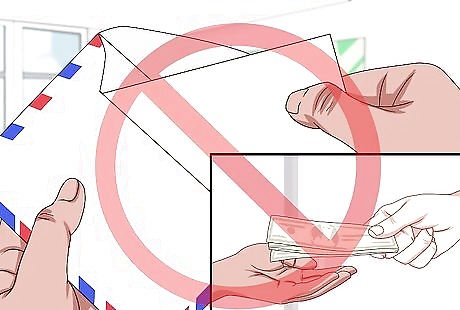

Do not send cash through the mail. While many banks – both traditional and online – allow you to deposit checks by mail, you should never send cash by mail. Most banks disallow this, but even if you encounter a bank that does, do not deposit money in this manner. The risk of your money getting lost is too great. Convert your money to a money order instead.

Comments

0 comment