views

X

Research source

(Note: this article describes how to submit a dispute by mail, but you can also submit a dispute online by visiting http://www.experian.com/disputes/main.html.)

Preparing to Submit a Dispute

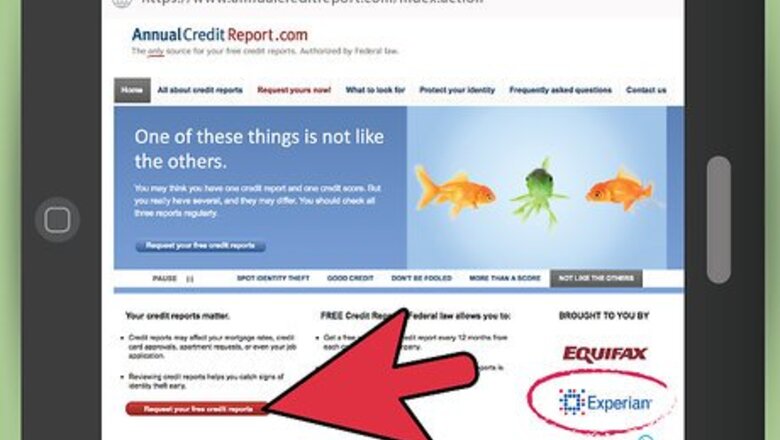

Get a copies of your credit report. The three nationwide credit reporting agencies (Experian, Equifax, and TransUnion) use a central website to provide free annual credit reports in compliance with the requirements of the Fair Credit Reporting Act. Visit http://annualcreditreport.com to order your credit report online. You will be given the option to order a report from any combination of the three agencies. You can order one report from each agency every 12 months. Order a copy of your Experian report and check for errors. You can also order reports from Equifax and TransUnion to see if the same errors appear on each report.

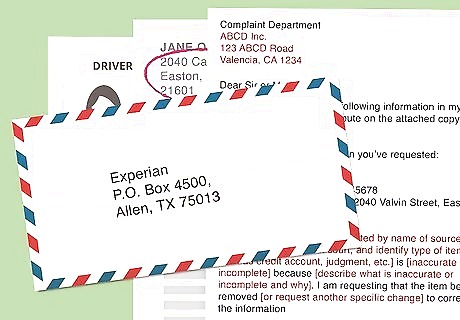

Make a copy of your ID. You will need to submit a copy of your identification with your dispute. Make a legible photocopy of your driver's license or state ID care to include with your documents.

Copy a document showing your address. Experian requires that you submit a copy of a utility bill, bank statement, or insurance statement along with your documents. If you do not have a recent utility bill or bank or insurance statement, copy another document that Experian can use to link your name and your address. Do not include the original document, as Experian will not return the document to you.

Writing Your Dispute Letter

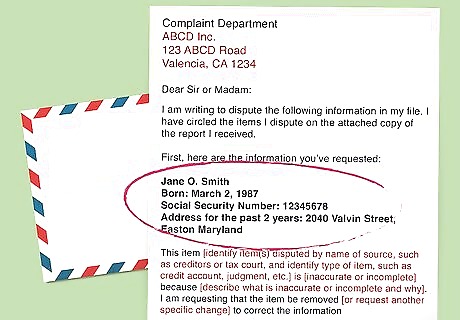

Provide your identifying information. Experian requests that you include the following information in your letter: Your full name and middle initial (and generation, such as Jr., Sr., II, III, etc.); Your date of birth; Your Social Security number (or a note that you were never given a Social Security number); and All addresses where you have lived for the past two years.

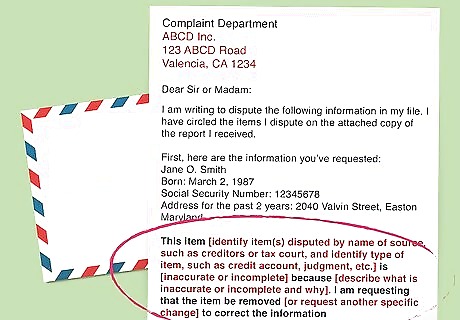

Describe the inaccuracies you want to dispute. For each item on your report that you believe to be inaccurate, list the account name and number, and describe why the information is wrong. Consider the following samples: "My credit repot indicates that my GE Capital Account XXXX-XXXX-1234 is 30 days late. This is incorrect, because I have never been late in making payments on this account. Please remove this inaccurate information." "My credit report contains a negative Verizon Visa account numbered XXXX-XXXX-5678. This account is more than seven years old and should be removed from my credit report."

Mail your dispute letter. Send your letter, along with copies of your ID and the other document showing your address, to Experian at: P.O. Box 4500, Allen, TX 75013. Consider sending your letter via certified mail and requesting a return receipt. The receipt confirms when you mailed your dispute letter.

Getting a Response

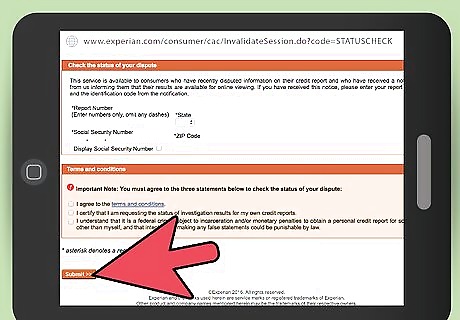

Check the status of your dispute. Experian allows you to check on the status of your dispute online. Simply visit https://www.experian.com/status. You will need to enter your Social Security number, state, zip code, and report number. Your report number appears on your Experian credit report.

Wait 30 days. Once Experian receives your dispute letter, they will contact source of the disputed information, such as the creditor who reported it or the vendor who collected the information from a public record source. This process may take up to 30 days (21 days for Maine residents). After Experian finishes investigating your dispute, they will send you the results of their investigation. If the source of the information does not respond to Experian's investigation, Experian will either update the information according to your request or delete the inaccurate data.

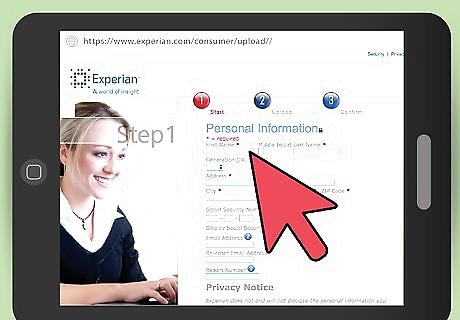

Continue the dispute if you are unsatisfied. Experian may conclude its investigation and determine, based on the information it received from your creditor, that the disputed information in your credit report is accurate. If you still disagree, you can continue your dispute by contacting Experian's National Consumer Assistance Center. You will need to provide documentary evidence that disproves the creditor's claim, such as a proof of the payment you made that the creditor denies receiving. Mail your supporting document(s) and a letter explaining that it disproves an inaccurate item on your credit report to P.O. Box 4500, Allen, TX 75013. You can also submit your document(s) and explanation online by visiting https://www.experian.com/consumer/upload//.

Comments

0 comment