views

Eating for Less

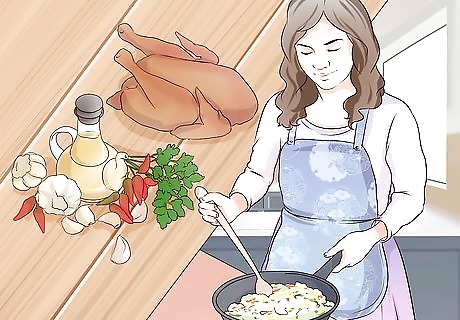

Cook from scratch. Cooking food from scratch at home is a great way to save money on food. Even when cooking at home, many people buy pre-made meals. These are convenient but relatively expensive. Buy the ingredients and make it yourself. Buy staple ingredients instead of pre-made meals. You will be able to make much more food for much less money, for instance, by buying a bag of uncooked rice than by purchasing microwaveable rice bags. If you eat large portions, cutting down a little can save you money. Try to save part of the meal for later. Freeze leftovers if you won't eat them right away. Try new flavors and spices. A fish fillet or chicken breast can become a more exciting dish with a novel sauce or seasoning. Try a spice you are unfamiliar with, or a condiment from an Asian, African, or farmer's market in your area.

Shop with a list. Make a list of the food items you need. Buy only the items on that list. Your grocery bill can double or triple if you make impulse purchases or buy things you don't really need. Don't shop while hungry. If you make a weekly menu, use that to draw up your shopping list. Stick to the menu during the week. Use coupons. A great way to save money is to find store or product coupons and then plan your meals around them. If there is an excellent sale on meatballs, consider a meatball sub night. If you find a coupon for bread, it's time for bread pudding or French toast.

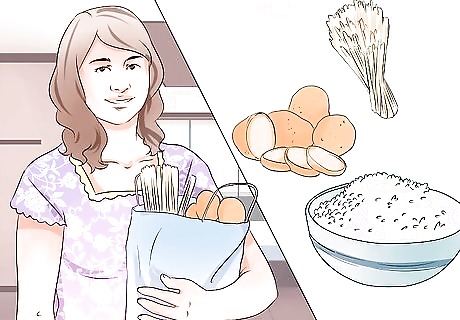

Buy meal extenders. Certain inexpensive and healthy foods make a relatively small meal larger. For instance, adding more potatoes to a beef stew will feed more people. Other examples include rice, pasta, quinoa, and couscous.

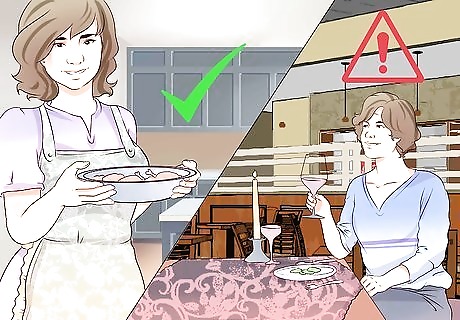

Cut down on eating out. Restaurant food is usually more expensive than eating at home and can quickly add up. Making your own lunch and going out for meals less often will save you a lot. The same goes for coffee. Brew it yourself instead of going to a coffee shop or a vending machine. View the menu before you go to dinner. Otherwise, you may feel "put on the spot" if prices are more expensive than you anticipated. Take home your leftovers, and turn one meal into two. Look for restaurant specials. Some places offer free or discounted kids' meals. Others may offer daily specials or discounts for police, senior citizens, or active military personnel. Drinks, especially alcoholic ones, can be the most expensive part of a meal. Cut down on beverages, and you will save on your restaurant bill. Drink water.

Eat less meat. Turns out that a vegetarian diet can be cheaper than a carnivorous diet Make sure you take your supplements, or you could get deficiency diseases.

Buy in bulk. Buying non-perishable items in bulk is a great way to save money. This includes pasta, canned items, dry boxed goods, common spices, cooking oils, frozen foods, and household items like toilet paper and paper towels. In the U.S., you can buy bulk items from wholesale stores like Costco. Split a membership with a friend. Wholesale stores usually have a small membership fee, and if you split the fee with a friend, it will be worth the money. Another option is to start a food co-op with nearby families. You can save money by combining purchases and buying in bulk. See how to start a food co‐op for more information.

Grow your own food. The most cost-effective way to save on food, if you have the time, is to grow your own! Simple crops like lettuce and other leafy greens can be grown indoors by a window with little effort. Save even more by investing in perennial plants that keep on giving year after year. Examples include fruit, herbs, and berries.

Take advantage of nutrition assistance in your area. If you can't afford to buy food, there are programs to make sure you and your family don't go hungry. You may qualify for governmental assistance, or there might be organizations in your area that provide assistance without applications and income restrictions. If you are struggling, don't be afraid to ask for help, even if it's just short-term. In the U.S., you can apply for SNAP, the federal Supplemental Nutrition Assistance Program, or apply for state assistance. Often income requirements are more lenient than you might expect, or there are sliding-scale options to provide partial funding.

Saving on Housing Costs

Consider moving to a cheaper neighborhood. It can be a pain, but moving even a few blocks can sometimes save you a lot. If you have the chance to move to the outskirts of a major city or even to a cheaper part of the country, you might save significantly. Move closer to work. This could save you money on housing and transportation. Look up prices in various neighborhoods through websites like Zillow. While you're at it, look up your own neighborhood. You may find you're paying too much where you live now.

Find a roommate. Splitting your rent with another person (or more), even for just a few years, can provide major savings. Imagine cutting your rent in half — or more! Ask friends and family if they have any responsible friends, co-workers, or family who are looking for a room. You can also use ad services like CraigsList to find roommates.

Negotiate with your landlord. If you have a good rental history and are a good neighbor, your landlord may work with you when you tell him/her the cost of rent may force you to leave. Use Zillow or a similar resource to demonstrate that your rent is too high. Offer to sign an extended lease for a discounted price. If you're able to, ask your landlord if you can pay for a full year upfront. They may discount the total price by a month or 2.

Save on homeownership. A mortgage can be your largest monthly expense. Finding ways to lower this cost can drastically improve your financial outlook. Buy a bank-owned property. These homes have typically been foreclosed upon, and the bank doesn’t want to hold them, so they may auction them at less-than-market value. Consider refinancing your mortgage if you've held it for several years. You might be able to find a better interest rate. To keep your long-term costs down, retain the original payoff date, but the lower interest rate will reduce your monthly payment. Consider a micro-house. These homes are short on space, but they're easier on the wallet. In the U.S., the most popular micro-housing company, Tumbleweed, allows you to pay around $6,000 down and make monthly payments of less than $500.

Find housing assistance in your area. If you’re struggling to find housing that you can afford, there is government help for people whose income is below a certain level. These services will help you find housing or even pay a portion of your rent. The U.S. government offers assistance through HUD, and many states offer subsidized housing. For instance, you can apply for affordable and middle-income housing in Manhattan, NY, though you might end up on a waitlist.

Saving on Bills

Get rid of cable. Paying for TV can be ridiculously expensive. Options like Netflix and Hulu+ offer more entertainment at a fraction of the cost of cable or satellite. Broadcast TV is always the cheapest choice (though not available in some locations). If you have a computer, use an HDMI cord to display it on your TV (even if you just want to listen to music). The NBA offers "League Pass," a streaming service for basketball fans who prefer not to use cable. Check your area for blackouts, but this can be a great way to watch live basketball without cable. Similar passes are available for other sports, such as the NFL's "game pass."

Save on cell phone bills. Cell phones are another money sucker, but if you're dedicated to saving, there are lots of low-cost options. Many companies offer pay-as-you-go plans that are significantly less than contract plans, and even if you are locked into a contract, some companies will pay your termination fee if you switch to their service. If you do enough research, you can likely reduce the amount you pay each month for your phone.

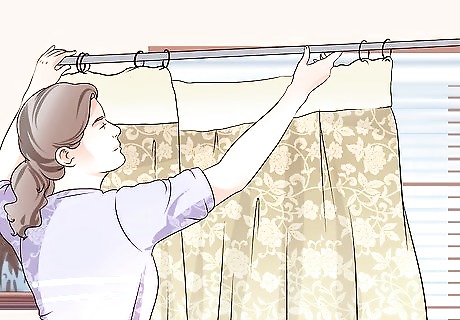

Insulate your home or apartment. If you live in a cold area, you could be paying more for heating than you really have to. By properly insulating your home, you’ll save a lot of money heating your home and providing hot water. Just hanging thick curtains to keep heat inside your home overnight, caulking gaps in windows, and placing a blanket against the air gap below an external door can save you money on heating. Replace furnaces, heaters, appliances, windows, doors, insulation, and other parts of your home with energy-efficient alternatives. These investments can be expensive initially but will pay off over time.

Use less electricity on appliances. Major appliances like washers, dryers, dishwashers, refrigerators and air conditioners all use a lot of energy and likely make up the bulk of your monthly electricity bill. Make sure you use these appliances as efficiently as possible, and you will see the impact on your monthly statement. Never leave refrigerator doors open or run a less-than-full dishwasher. Use laundry equipment for full loads and not just a few items. Even these small steps will increase your energy efficiency. Switching to more efficient appliances can further reduce your costs over time. See how to cut down your electricity bill for more information.

Limit your use of major electronic items. If you spend a lot of time watching a big-screen TV or running other large electronic devices, you might be able to save yourself some money by doing it less. Use one electronic device at a time. Don't leave the TV on when you are on the computer.

Change your energy source. You can say goodbye to traditional energy bills altogether if you make some lifestyle adjustments and get your own source of electricity! Solar panels, windmills, and waterwheels are all available for personal use and are cheaper than ever. In an energy-independent home, you’ll have power when everyone else loses theirs. You don’t even need a huge amount of sunlight to make a solar system pay off. Solar panels are extremely popular in Germany, for example, which sees less sun than Seattle (which has 200 or more rainy days per year). Installing solar panels on an average American home usually costs around $10,000. You can get a bank loan and tax write-offs for doing so. In some cases a power company may even pay you for your extra electricity if you make more than you use. However, this is only a viable option if you will actually save money in the long run. See consider installing a renewable energy system for more information. Alternately, you may be able to switch energy providers and get a lower rate. This option is only available in deregulated markets, however.

Having Fun for Less

Take advantage of free community resources. Find inexpensive or free events sponsored by your city or town. There may be more than you realize. Check with your city recreation department for activities that might be fun for you and your friends. You might find, for example, that the community center shows a popular movie on Friday nights or that there’ll be a free music festival in the park next weekend. Donation-based yoga classes are available in some areas. Many cities sponsor free art exhibits once or twice a year. Museums may offer free admission every so often.

Invest in games. Board games are a great way to have fun while spending as little money as possible. After the initial purchase, it's free entertainment forever! You can have food or drinks at home, play with friends, and have just as much fun as going out on an expensive date. Try the classic games (Life, Monopoly, Sorry) as well as newer ones (Apples to Apples, Settlers of Catan, Ticket to Ride, etc.). You and your friends can have a weekly Game Night and rotate it among your homes. Cards Against Humanity is another good money savers option because it's available for free download at home. This game may not be appropriate for kids (or extremely polite society), but many people find it exceptionally entertaining.

Read more. Reading is fun, cheap (or free) and a great way to spend your time in a fulfilling way. Start with easy-to-read classics, like Harry Potter and Game of Thrones, if you’ve been away from the literary world for a while. Get a library card. Borrow books for free. With the appropriate reading device, you can borrow e-books for free. Cheap, used books are available online and at many bookstores. Additionally, many older books in the public domain are available for free and can be read online or downloaded to an e-reader.

Make a movie theater at home. Instead of buying expensive movies, start a small movie theater in your living room for your friends or family. Get everyone to chip in a little, and then put together a big party, complete with movie, popcorn, and games. You wind up owning a free or cheap movie, and you have fun with your friends!

Travel inexpensively. Traveling nationally or internationally doesn’t have to be cost-prohibitive. There are lots of ways to cut expenses, making travel cheaper than you ever thought possible. Carefully choose where you stay. Check out hostels, Airbnb rooms, and campgrounds to save on lodging. Plan your travel in advance to save on the cost of tours. Planning ahead will make the trip more fun, and you will be more knowledgeable about the location when you get there. Travel during the "offseason," when flights are cheapest. You can research your tickets, find good deals, and buy at least six weeks in advance so that even if you are traveling during the busy season, you'll pay less than regular price.

Travel off the beaten path. Tourist areas are typically expensive, but you can get by more cheaply in less popular areas. This kind of travel experience offers more “adventure” and authentic experience than just going from landmark to landmark.

Making Other Lifestyle Changes

Be smart with credit. Take a healthy approach by having as few credit cards as possible with balances as low as possible. You can waste a lot of money by paying high interest on credit, so make credit card payments a priority. Pay off your balances every month. If you can't manage that, at the very least make the minimum required payment each month. Use cards for small transactions only. Getting rid of credit cards altogether is the best option for many people, as using cards can make it easy to spend more than they can really afford.

Shop at thrift stores first. You don't have to buy everything at Goodwill, but make a practice of checking craigslist or thrift stores before buying big-ticket items. Often you can find new or barely used items there for less than half of what they regularly sell for. Look for specials like "All coats 1/2 price on Tuesdays" or "Everything with a pink tag 50% off..." etc. Remember that anything you buy on sale is a bargain only if you were already planning to purchase it. Before making a purchase, always research your options online to make sure you're getting a good deal.

Find cheaper methods of transportation. Cars are expensive. By changing how you get around, you can save yourself lots of money. This may be tough if you’re in a rural area, but you should still have some options for using your car less, even if you don't ditch it altogether. Using public transportation, it will probably take longer to get where you want to go, but you can use that time to drink coffee, read the news, check your email or talk on the phone. A monthly bus pass is usually cheaper than a tank of gas, to say nothing of car payments, registration, insurance, maintenance, and repair. Try biking or a combination of biking and public transport. Most modern buses and trains allow you to transport your bike, so you can combine the two to make your trip as quickly as possible. Biking helps you exercise and saves you money on gas. Consider getting an electric car or trading your car in for one that is smaller or that you can buy with cash. Each of these options can save you money.

Find side work. There are a lot of ways to make extra money, even if you already have a full-time job. Some people are even able to turn a hobby into a part-time job, such as freelance writing, selling handcrafts or buying and selling antiques. This extra income can be set aside as savings or used to help make ends meet.

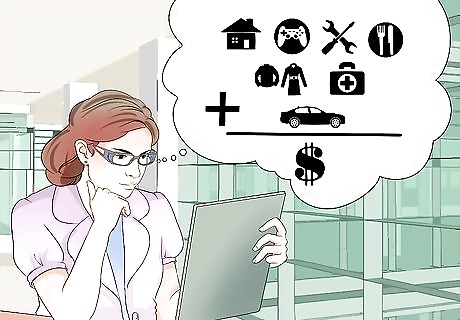

Determining Where you Spend the Most

Categorize your spending patterns. Most people's expenses consist of housing, utilities, entertainment, clothing, food, travel, and medical care. Start by reviewing the checks you've written and your credit card statements for the last few months. Add up what you spent in the above categories and any others specific to you. While you're at it, take a close look at your bank statements, too. Credit card companies and online banks offer a feature that will summarize your spending for a given period of time, based on the names of the businesses where you spend money. If you don't use debit or credit cards, keep a careful accounting of your monthly expenses. For example, keep track of your food spending, both at the grocery store and at restaurants.

Analyze your spending. After you have gathered this information compare the totals in each category. Do they seem reasonable, especially as percentages of your paycheck?

Create a budget. Set a monthly target for how much money you should allocate to each category. See how to budget your money for more information. Include a target for retirement savings, even if it's quite small to begin with. Start by saving at least 1% of your monthly income for retirement. Slowly increase that percentage over time. You'll find you can gradually adjust to that allocation. The more you save for retirement, the better your later years will be. (If you don't think that's important, talk with someone who is already retired.) Generally financial experts recommend spending less than 30% of your monthly income on housing. In some locations, this may not be realistic. If that's the case where you live, it may be necessary to change neighborhoods. In addition to saving for retirement, build up a savings account as an emergency fund. Set aside about six months' worth of living expenses in case you lose your job or become incapacitated. Be sure to base your budget on your actual spending habits. If your budget and spending habits don't match up, then your budget might not last very long.

Look for ways to save. Once you have created your budget, you will see the areas in which you need to reduce spending. Find ways to save in those categories. Address your largest expenses first. For example, if your monthly rent is $900, and you spend $300 a month on food, you might consider finding a cheaper rental. If you have a mortgage, think about refinancing at a lower interest rate. Meanwhile, look for ways to lower food costs. Don't eat at restaurants. Find recipes utilizing nutritious but inexpensive ingredients. If you could use help tracking your spending, consider using an app like Quicken, Mint, or PocketGuard.

Comments

0 comment