views

Prime Minister Narendra Modi on Wednesday hailed those who worked to make the Jan Dhan Yojana a success, and said the scheme has been paramount in boosting financial inclusion.

“Today, we mark a momentous occasion – #10YearsOfJanDhan. Congratulations to all the beneficiaries and compliments to all those who worked to make this scheme a success,” the prime minister said.

The Pradhan Mantri Jan Dhan Yojana has been paramount in boosting financial inclusion and giving dignity to crores of people, especially women, youth, and the marginalised communities, he said.

The scheme, launched on this day in 2014, is a national mission on financial inclusion encompassing an integrated approach to bring about comprehensive financial inclusion of all the households in the country. The plan envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension facility.

Guinness World Records has also recognised the achievements made under the Pradhan Mantri Jan Dhan Yojana. It has certified that the “Most bank accounts opened in one week as part of the Financial Inclusion Campaign is 18,096,130 and was achieved by the Department of Financial Services, Government of India”.

PMJDY brings about the objective of financial inclusion for all by providing basic banking accounts with a debit card with inbuilt accident insurance. The main features of PMJDY include Rs 5,000 overdraft facility for Aadhaar-linked accounts and a RuPay debit card with inbuilt Rs 1 lakh accident insurance cover. In addition, for accounts opened between August 15, 2014, and January 26, 2015, a life insurance cover of Rs 30,000 is available to the eligible beneficiaries. One of the salient features of Pradhan Mantri Jan Dhan Yojana is that after remaining active for six months, the account holder will become eligible for an overdraft of up to Rs 5,000.

PMJDY has been the foundation stone for many more people-centric economic initiatives. Whether it is direct benefit transfers, Covid-19 financial assistance, PM-KISAN, increased wages under MGNREGA, or life and health insurance coverage.

An SBI report in 2021 observed that states with higher PMJDY account balances saw a drop in crime rates and reduced alcohol and tobacco consumption, highlighting the program’s positive social impact.

TIMELINE OF THE SCHEME

The PM Jan Dhan Yojana was announced by Prime Minister Narendra Modi in his Independence Day address on August 15, 2014.

While officially launching the programme on August 28, 2014, PM Modi had described the occasion as a festival to celebrate the liberation of the poor from a vicious cycle. On the launch day, 15 million bank accounts were opened, which was recognized by the Guinness Book of World Records. The launch also included the issuance of 1.5 crore accident insurance policies in one day.

August 23–29, 2014: The government opened 18,096,130 bank accounts, which was another Guinness World Record.

June 27, 2018: Over 318 million accounts were opened and more than Rs 792 billion (US$12 billion) was deposited.

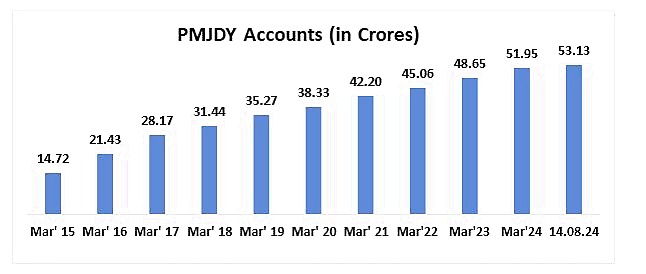

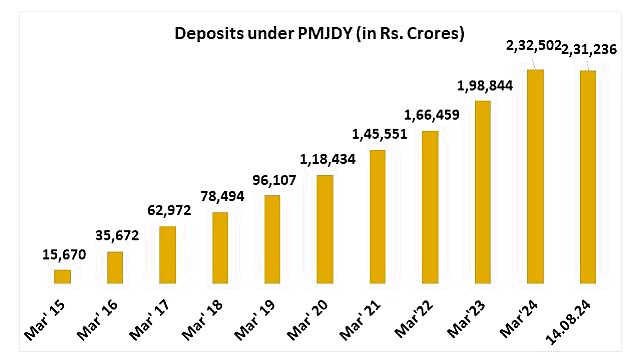

August 2024: More than 53.14 crore accounts have been opened, which is a 3.6-fold increase from March 2015. The total deposits under the scheme have also increased about 15 times compared to August 2015. Around 55.6 per cent Jan Dhan account holders are women and around 66.6 per cent accounts have been opened in rural and semi-urban areas. As of August 2024, 36.14 crore RuPay cards have been issued to PMJDY accountholders.

With the issue of over 36.06 crore RuPay debit cards under PMJDY, installation of 89.67 lakh PoS/mPoS machines and the introduction of mobile based payment systems like UPI, the total number of digital transactions have gone up from 2,338 crore in FY 18-19 to 16,443 crore in FY 23-24. The total number of UPI financial transactions have increased from 535 crore in FY 2018-19 to 13,113 crore in FY 2023-24. Similarly, total number of RuPay card transactions at PoS & e-commerce have increased from 67 crore in FY 2017-18 to 96.78 crore in FY 2023-24.

PMJDY has enabled savings while providing credit access to those without a formal financial history. Account holders can now show saving patterns, which makes them eligible for loans from banks and financial institutions. The closest proxy is sanctions under Mudra loans, which rose at a compounded annual rate of 9.8 per cent in five years from FY 2019 to FY 2024. This access to credit is transformative as it empowers individuals to grow their incomes.

Comments

0 comment