views

New Delhi: The Modi government, after a Cabinet meeting on Wednesday, allowed foreign companies to own up to 49% stakes in Air India. While Foreign Direct Investment (FDI) was already open in the private aviation sector, the government’s decision has opened up the doors to FDI for India’s national carrier. This comes at a time when the government is considering disinvestment of the national airline, which is faced with crushing debts and losses.

One way out of the crisis would be disinvestment. In July this year, the Cabinet Committee on Economic Affairs (CCEA) had given an in-principle approval for considering strategic disinvestment of Air India and its five subsidiaries. Indigo had already expressed interest in buying stakes in Air India.

Aviation and infrastructure experts believe Wednesday’s decision will open up competition for buying stakes in Air India while simultaneously retaining its ‘Indian-ness’.

Jitendra Bhargava, former Executive Director of Air India and author of the book ‘The Descent of Air India’, said, “What the government has done is that it has broadened the spectrum of potential investors. This is a step in the right direction because the need of the hour is not to create more barriers for investment, but to break them down to attract more investments for Air India.

“The provision already exists for other airlines, so why not Air India? The government has also taken care of the emotional connect that people have with Air India by ensuring that the majority stake will remain in Indian hands.”

Infrastructure expert Akhileshwar Sahay said, “Ahead of disinvestment, this puts Air India at par with all other airlines. Now, the Tatas can bid for Air India in partnership with Singapore Airlines. This is a very logical step. Since 51% of the stake will remain with Indians, Air India will remain an Indian company. Its ‘Indian-ness’ will remain intact while simultaneously attracting global capital and best practices.”

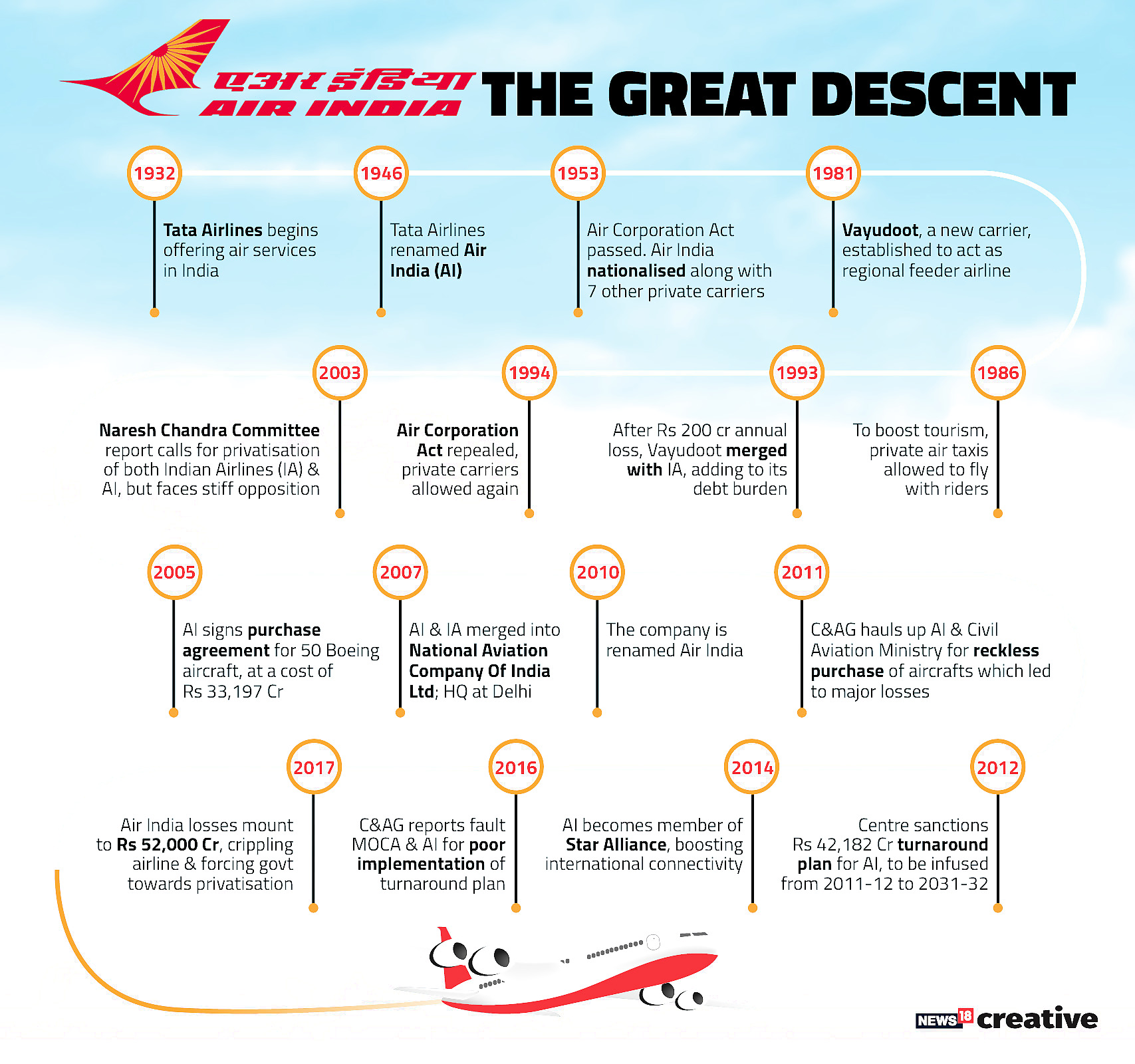

Over the past ten years, ever since the merger of Air India and Indian Airlines, Air India has stacked up a massive debt.

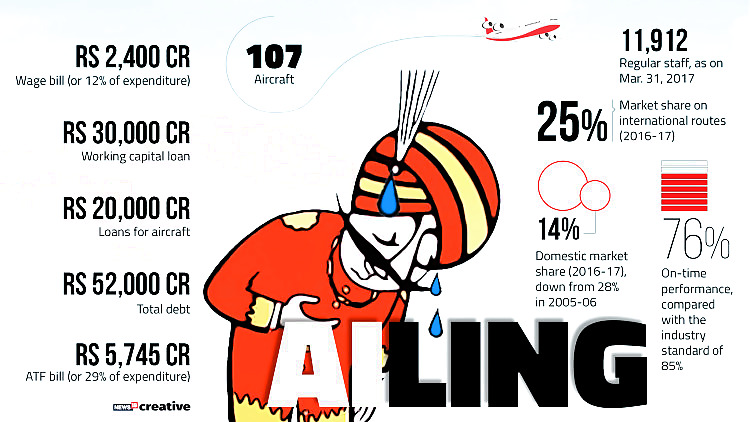

According to figures tabled by the Ministry of Civil Aviation in the Lok Sabha during the Winter Session of Parliament, Air India had taken loans worth Rs 51,890 crores that is yet to be repaid. On top of this crippling debt, Air India has accrued losses of Rs 19,619.28 crores between financial years 2013-14 and 2016-17.

Minister of State (MoS) Civil Aviation, Jayant Sinha, said in Parliament, “The total outstanding loans on Air India as on 30.09.2017 (provisional) is Rs 51,890 crore.” Of the total amount, Rs 18,364 crore is for aircraft loans and Rs 33,526 crore for working capital loans.

While the losses incurred by the national airline have gone down since FY 2013-14, it still remains a significant amount.

In 2013-14, Air India incurred losses amounting to Rs 6,279.60 crore. The loss figure came down to Rs 5,859.91 crore in 2014-15 and further down to Rs 3836.77 crore in 2015-16. In 2016-17, the figure marginally dropped to Rs 3643 crore in 2016-17.

Comments

0 comment