views

India’s digital public infrastructure (DPI) has received support from the World Economic Forum as well as G20 countries. Founder-chairman of UIDAI Aadhaar project, Nandan Nilekani, in the recently concluded three-day summit Business-20 under G20 in New Delhi, said, “India did in nine years what would have taken 47 years through traditional means. We went from being one of the most unbanked countries to the most financially inclusive countries.”

Digital public infrastructure (DPI) is a digital network that enables countries to give economic opportunities and social services in a safe and efficient manner. Inclusive DPI fosters economic growth and competition over time.

According to a report published by United Nations Development Programme (UNDP) in September 2022, titled ‘Bold investments for digital public infrastructure: Quantifying the human and economic impact’, an estimated 16 to 19 million micro, small and medium enterprises (MSME) worldwide could obtain a source of capital through DPI to support long-term growth. It can prove to be a key player in economic growth of low and middle income countries where growth is majorly dependent on MSME. Reports show that DPI can increase the growth share of such countries by an estimated 20 percent to 33 percent in MSMEs.

Here’s how DPI contributes to the Indian banking system and MSME:

- The Economic Survey 2023 by the finance ministry shows that the benefits of DPI were clear during Covid, particularly for the MSME sector. Highlighting different data facts, Nilekani said: “India was able to transfer $4.5 billion to the bank accounts of 150 million citizens during Covid-19 owing to DPIs, while 700 million people already have their bank accounts connected to their Aadhaar numbers.”

- The Global Findex Database 2021 shows that in India, women’s account ownership increased even more quickly, from 26 percent to 78 percent, in less than 10 years following the establishment of the World Bank’s digital identity system. At present, one out of every five MSME investments in the country are led by women. This happened due to DPI, which facilitated the process of entrepreneurship for a woman by providing a safe and convenient environment inside as well as outside.

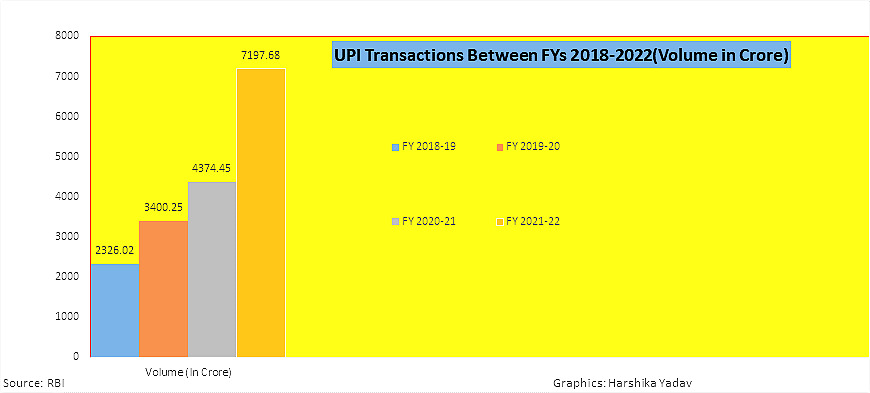

- The Economic Survey stated that in FY 2022, the unified payments interface, or UPI – a major sector under DPI – accounted for 52 percent of the total 8,840 crore financial digital transactions. It is a system that integrates numerous bank accounts and functions into a single mobile app to make payments without cash anytime. The Reserve Bank of India (RBI) report, shared by the ministry of finance, showed a growth of more than 200 percent in digital payment volume in the last four years since 2018-19.

- The Economic Survey also shows that in only three years, the share of digital money transactions in value and terms through UPI skyrocketed from 17 percent in FY 2019 and 27 percent in FY 2021 to 52 percent in FY 2022. It reached a new peak in December 2022, with 782 crore transactions worth Rs 12.8 lakh crore. In FY 2022-23, UPI processed 2,922 crore contactless merchant transactions for approximately Rs 21.7 lakh crore till December 2022.

- Union minister of state for finance, Dr Bhagwat Kisanrao Karad in a written reply to a question in Lok Sabha in March 2023 said: “As per the data sourced from National Payments Corporation of India (NPCI), UPI transactions registered in FY 2021-22 were 45 billion, showing eight times growth in the last three years and 50 times growth in the last four years.”

Comments

0 comment