views

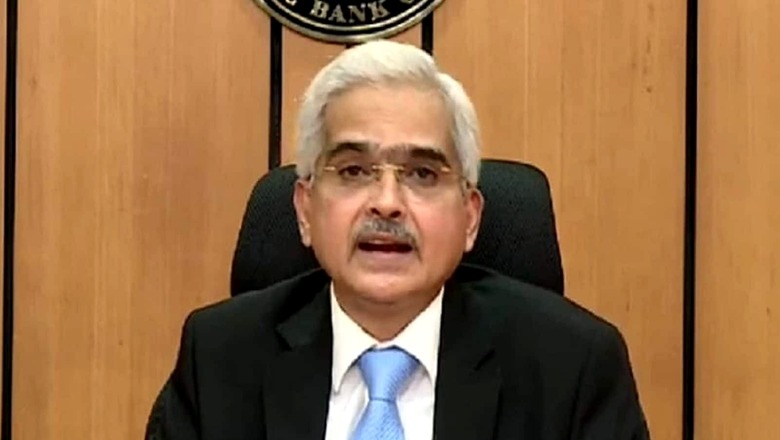

RBI Monetary Police Today: The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) is expected to keep the key lending rate unchanged and maintain ‘accommodative’ stance on December 8 amid emergence of another Covid-19 variant across the world. India’s central bank maintained the repo rate at record low 4 per cent for eighth consecutive times in the past. There will be no change this time as well. During the previous meet, RBI Governor Shaktikanta Das said, that the central bank would “continue with the accommodative stance as long as necessary to support growth.” To combat the threat posed by Omicron variant, RBI is likely to maintain status quo on policy stance as well.

1) Repo Rate, Reverse Repo Rate and Policy Stance:

RBI monetary policy committee (MPC) will keep the key lending rate or the repo rate unchanged at 4 per cent, said analysts. All 50 economists polled by Reuters expected the MPC to hold rates at its December 8 meeting. There will be no big surprise in policy stance either amid rising fear of Omicron cases in the country. “There is a renewed threat to global growth due to Omicron variant and the output gap in India still appears to be wide open justifying easy monetary policy,” said Sandeep Bagla, CEO, TRUST Mutual Fund.

Given the uncertainties associated with the scale of economic recovery, the RBI is expected to maintain its growth focus and continue with the accommodative monetary policy stance even as it moves towards gradual normalisation, said Care Ratings.

2) Inflation

The CPI inflation slightly increased to 4.5 per cent in October, against 4.3 per cent in September. The RBI has projected the CPI inflation at 5.7 per cent during 2021-22, 5.9 per cent in the second quarter, 5.3 per cent in third, and 5.8 per cent in the fourth quarter of the fiscal, with risks broadly balanced. CPI inflation for Q1 2022-23 is projected at 5.1 per cent. CPI inflation for Q1 2022-23 is projected at 5.1 per cent.

Amid the steep hike in food prices in several parts of the country, RBI may revise inflation forecast to 5.5 per cent to 5.3 per cent projected earlier. The RBI has been asked by the central government to ensure that the retail inflation based on the Consumer Price Index (CPI) remains at 4 per cent with a margin of 2 per cent on either side.

3) GDP forecast

The GDP posted a growth of 8.4 per cent in July-September 2021, compared to a 7.4 percent contraction a year ago, with gross value added (GVA) rising 8.5 percent. GDP in Q2 surpassed MPC’s forecast of 7.9 per cent. Around 90 per cent expect RBI to stick to its 9.5 per cent GDP forecast for the full FY22 for now, with some expecting an upward revision on the back of better-than-expected Q2 GDP numbers, showed a poll by CNBC-TV 18.

Liquidity Conundrum:

“The current liquidity flux looks somewhat sticky ahead, with an expected increase in currency in circulation being offset by government drawdown in surplus (implying increased spending) and possible capital flows. While FDI flows may remain steady ahead, further inflows to the tune of US$35-40 billion could potentially come from India’s bonds inclusion in global indices in one year’s period. Even with an elevated CAD/GDP ratio (1.7 per cent+ in FY22E and FY23E), BoP is likely to be $35bn and $55-60 billion for FY22 and FY23 respectively. Besides, the maturing long FX forwards in RBI’s book stand at a staggering $10 billion per month in coming quarter, and may add to durable liquidity, unless rolled over – albeit at the cost of distorting forward rates. Clearly, the journey from current Rs 8.5 trillion system liquidity to a pre-Covid normal of Rs 2 trillion is going to be long-drawn and exhaustive, if they continue in the current regime,” said Emkay Global Financial Services in a report.

Read the Latest News and Breaking News here

Comments

0 comment