views

Tax incentives have always acted as a catalyst in ensuring wider insurance adoption. Though well-balanced and growth-oriented, the most awaited financial event of the year – Union Budget – turned out to be a wistful affair for those expecting a tax rebate over and above the standard limit on insurance policies. The proposal, instead, stated that insurance policies with over Rs 5 lakh annual premium purchased after 01 April 2023 would no longer be eligible for tax exemption under Section 10 (10D).

The policy that could escape the axe of this rule is – ULIPs or unit-linked insurance plans. ULIPs will continue to follow the same rule of LTCG (long-term capital gains) tax – if the yearly premium of a ULIP plan purchased after 01 February 2021 exceeds Rs 2.5 lakh, then they will be subject to taxation, just like every other equity-oriented investment.

While ULIPs reward investors under favourable market conditions, it is also true that they bear a risk under volatile markets. So, how should one go about financial planning in light of this recent announcement?

Now that the financial year comes to a close, here’s rounding up what this development means and how it impacts an average investor.

Union Budget 2023’s proposal regarding Section 10(10D)

In the Union Budget 2023, Finance Minister proposed that the maturity amount for insurance policies with a cumulative annual premium exceeding Rs 5 lakh will not be eligible for a tax rebate under Section 10 (10D). The announcement excludes ULIPs or unit-linked insurance plans and will have no tax implications on them. The rule is applicable for policies bought after 31 March 2023.

However, the proposal does not impact the tax exemption applicable to the amount received on the death of the insured individual. Since the upper limit for taxation is Rs 5 lakh annually, this won’t have an impact on most policyholders but it would impact HNIs (High Net-Worth Individuals) who usually would have insurance premiums exceeding this limit.

Last few days: Where should you invest to reap maximum returns?

While traditional plans have come under the axe of taxation, there is still time to make wise investments well before the deadline and save up. Out of insurance-cum-investment options, guaranteed return plans are often considered a viable avenue for every kind of investor since they do not let your funds get affected by market volatility.

Your rate of return is locked at the time of purchase and the principal amount as well as returns are shielded from any fluctuations. The new-age guaranteed return plans offer returns as high as 7.5% that are completely tax-free, depending on terms and conditions. They also come with a life cover that is 10 times the annual premium and also qualifies for tax benefits under Section 80C. This is why these plans are deemed to be a great alternative to other traditional options like FD or PPF, etc.

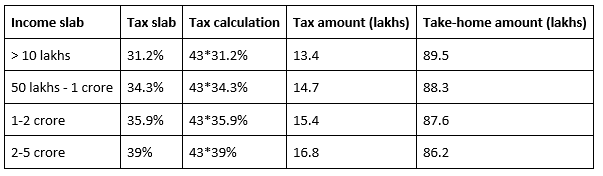

How the rule impacts your returns before and after 31st March?

With the new financial year around the corner, it is important to act now and invest your money today to reap maximum returns. Let us illustrate how –

Let’s say you invest Rs 1 lakh monthly in the plan for 5 years at a rate of 7.5%. The total maturity amount will be Rs 1.03 crore including the interest of Rs 43 lakhs. The tax liability is zero; this maturity amount will be your take-home amount.

Here is what happens if you fall under the taxable bracket –

Now, if you buy a guaranteed return plan before 31 March 2023, your plan would never be counted in the taxable bracket even if you cross the Rs 5 lakh limit in the future. As opposed to the above-mentioned range of Rs 89 – 84 lakhs, your take-home amount will be Rs 1.03 crore. So, choose wisely and invest early to make the most out of your savings and returns.

-The author is president and CEO, Policybazaar.com.

Read all the Latest Business News here

Comments

0 comment