views

In what could lead to payouts for India, the US is planning to impose retaliatory tariffs on nations that tax internet-based companies.

According to a report by Bloomberg, the move will hit six nations including India. The tariff could total almost USD 1 billion annually.

The six countries are Austria, Spain, Turkey, UK, Italy and India.

The duties are in response to countries that are imposing taxes on technology firms that operate internationally such as Amazon.com Inc. and Facebook Inc. In each of the six cases, the USTR proposes to impose tariffs that would roughly total the amount of tax revenue each country is expected to get from the US companies.

The Internet Association, whose members include Amazon, Facebook and Alphabet Inc.’s Google, welcomed the USTR’s move.

The USTR’s action “is an important affirmation in pushing back on these discriminatory trade barriers as the US continues to work to find a viable solution at the OECD,” the group said in a statement.

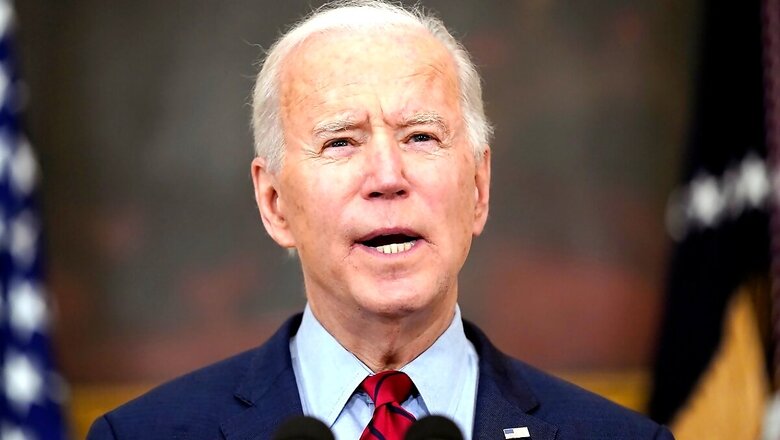

The proposal is a key pillar of President Joe Biden’s $2 trillion infrastructure spending plan, which calls for an increase in the U.S. corporate tax rate to 28% while eliminating some deductions associated with overseas profits.

Without a global minimum, the United States would again have higher rates than a number of other major economies.

Separately, a group of Democratic senators unveiled a legislative proposal to roll back parts of former President Donald Trump’s 2017 U.S. tax cuts.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment