views

As an investor myself, I understand the importance of diversification in investment portfolios. Diversification is the process of spreading investments across different asset classes, sectors, and geographies to minimise risk and maximise returns. It is a crucial strategy that helps investors achieve their long-term financial goals while mitigating the risks associated with short-term market fluctuations.

Between April 2023 and January 2024, Indian investors put 17.66 lakh crore rupees in bank deposits, 3.96 lakh crore rupees in mutual funds, and 2.27 lakh crore rupees in small savings, totalling 23.89 lakh crore rupees.

Also Read: 5 Key Real Estate Investment Tips For Women

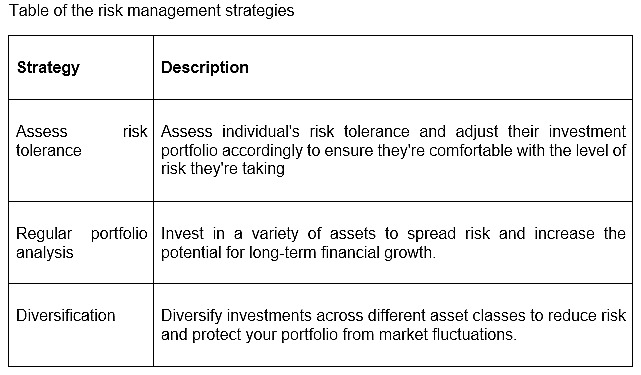

Strategies for a diverse portfolio

Building wealth requires calculated risks, but spreading those risks across a diverse array of assets is paramount for a secure financial future. Over the years, I’ve seen first-hand the power of diversification in helping Indian investors navigate the dynamic and often unpredictable financial landscape.

Asset Allocation: This is the foundation of diversification. It involves dividing your investable corpus across different asset classes like equity (stocks), gold, fixed income (bonds), real estate, and commodities. The ideal allocation depends on your risk tolerance, investment horizon, and financial goals. A young investor with a high-risk tolerance might allocate a larger portion to equities, while someone nearing retirement might prioritise the stability of bonds

Sector Selection: Spread your equity investments across various sectors like technology, healthcare, and financials. This ensures that your portfolio is not overly reliant on the performance of any single industry.

Consider a systematic investment plan (SIP): Driven by the consistent growth of systematic investment plans (SIPs), the mutual fund industry’s assets under management (AUM) reached an all-time high of Rs 50 trillion in December 2023. Notably, SIP-linked AUM accounted for Rs 10 trillion of the total AUM at the end of 2023.

SIP allows you to invest a fixed amount in mutual funds at fixed intervals, making it ideal for those who can’t invest a large sum at once. You can start with as little as Rs 500 and develop a disciplined investment strategy.

Geographic Diversification: Investing in stocks from different geographies, such as the United States, Europe, Asia, and Emerging Markets, adds to your diversified investments.

In 2021, Indian investment in the US experienced a significant surge, with a growth rate of over 200% compared to 2020. This increase was accompanied by a substantial rise in the number of transacting investors, which grew by over 250%. As a result, the total volume of investments doubled, reaching nearly $500 million in 2021 based on certain platforms that enable Indians to invest in US stocks.

This provides exposure to different growth patterns and economic cycles, potentially mitigating the risks associated with solely domestic holdings.

Commercial real estate: Commercial real estate delivers steady income (6-8% annual rent) with potential for capital appreciation in the value of the property. This combines bond-like income with stock-like appreciation. Consider adding high-quality properties to a well-rounded portfolio.

Risk management: To manage risk, investors should assess their risk tolerance, which is their willingness and ability to withstand potential losses for higher returns.

Risk tolerance is influenced by factors like financial situation, goals, and time horizon. Knowing one’s risk tolerance helps investors create a portfolio that matches their comfort level and avoids excessive risk.

Benefits of Rebalancing portfolio

Rebalancing a portfolio periodically can help minimise risk and optimise returns. It helps maintain a well-balanced portfolio by preventing over-concentration in certain asset classes, which can increase the risk of loss. Rebalancing also allows investors to take advantage of market movements and enhance overall portfolio performance by selling assets that have performed well and buying assets that have underperformed.

Additionally, rebalancing provides a disciplined approach to portfolio management, helping investors stay focused on their long-term investment goals and avoid emotional decision-making based on short-term market fluctuations.

Diversifying Your Portfolio for a Vibrant Financial Future

Just like during Holi, where colours are thrown to create a vibrant, balanced mixture, rebalancing your portfolio brings harmony to your investments. It ensures your assets are in the right proportions, like the perfect blend of reds, blues, and greens.

So this Holi, celebrate not just with colours, but with a well-diversified investment portfolio that sets you on the path to achieving your long-term financial goals.

-The author is the COO at Tradejini. Views expressed are personal.

Comments

0 comment