views

Setting Up Your Income Statement

Gather your financial information Before you begin creating your income statement, gather all the necessary financial information you'll need, including revenue, expenses, and any other income or losses. Make sure you have a paper or something such as excel to create an income statement. Your income statement would be written out as the name of your company, and then writing income statement and the date written as For the Month Ended October 31. Then you would write out the main things you'll be using on the income statement, Revenues, expenses, gross profit.

Choose a time period for your income statement. Income statements measure revenues and expenses during a certain period of time and are typically generated on a monthly, quarterly, or annual basis. Pick the duration that you want to use for calculating your income statement. Businesses that are publicly traded must generate income statements on quarterly and annual basis to file with the Securities and Exchange Commission. Businesses also generate income statements on a periodic basis to identify business trends and evaluate financial results. Decide on the time frame for which you want to create the income statement, like a quarter or a fiscal year. A fiscal year is a 12-month accounting period that businesses use for taxing purposes.

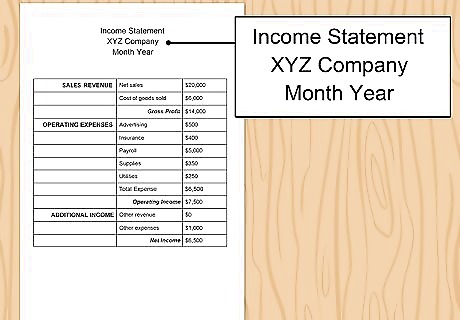

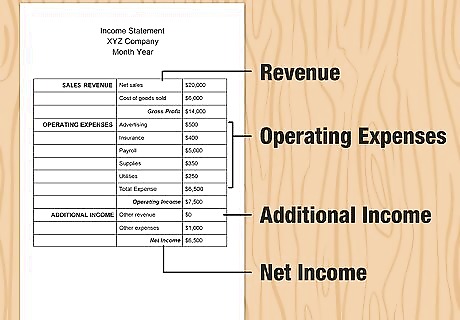

Write the income statement header. At the top of the document, write the name of the company. On the line directly beneath the company name, write "Income Statement." On the next line, write the period of time that the income statement covers.

Format the body of the income statement. Income statements have four distinct sections. The first section of the income statement calculates gross profit, or the total amount of money made, from sales revenue and cost of goods sold. The second section calculates your total operational expenses. The third section calculates gains and losses unrelated to your operational costs. The fourth section calculates net income, or the money you’ve made in profit after subtracting your expenses from your revenue.

Preparing the Gross Profit Section

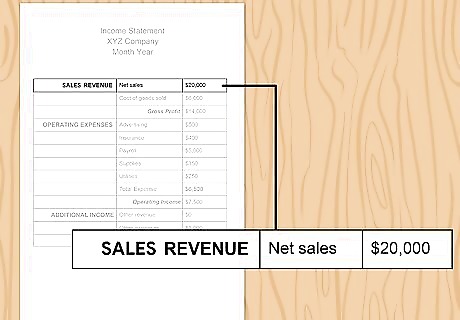

Write "Sales Revenue" below the income statement header. Sales revenue includes all revenue earned from the sale of goods and services, regardless of whether or not the cash has been collected. List sales revenue for the period you selected. For example, say that you sold 10,000 units of inventory for $5 USD a piece. You would record sales revenue of $50,000 USD, even if your customers haven't all paid you yet. List all the revenue you generated during the period you're reporting on. This could include sales revenue, rental income, interest income, or any other sources of revenue your business generates. Make sure to Write Revenue and then on the next line indent and list out your revenues in order. Write your numbers directly to the right parallel to the revenues written out. When totaling your revenues on the left side of the numbers you will put all your revenues and when you write out your total revenues at the end you add them all up and right on the far right side the total revenue.

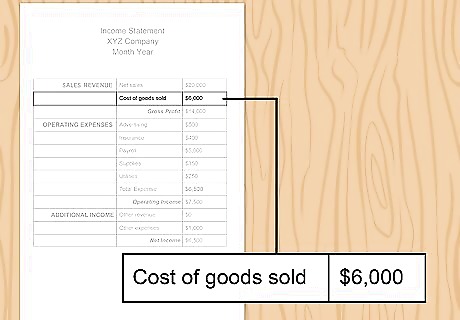

Calculate your cost of goods sold. The cost of goods sold is comprised of the direct labor, direct materials, and manufacturing overhead expense you incurred to create the inventory that you sold. List the cost of goods sold for the period underneath your sales revenue. For example, if you sold 10,000 units of inventory during the period and paid an average of $2 USD for each unit, you would record $20,000 USD for the cost of goods sold. If you're a reseller, the cost of goods sold is typically the price that you paid to purchase the inventory. If your business sells physical products, you'll need to calculate the cost of goods sold. This includes the cost of materials, labor, and any other costs directly related to producing and delivering your products. For a basic income statement, the main things you will write out would be revenue, and expenses, and subtracting the total two to get your net income. But an extended income statement will start to include your COGS and gross profit and operating expenses.

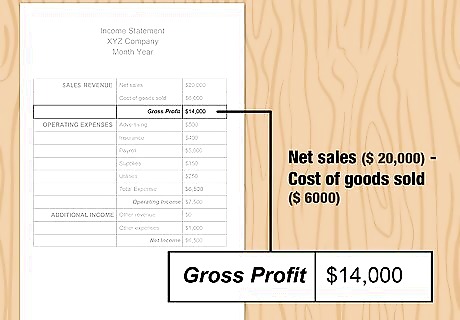

Subtract the cost of goods sold from sales revenue to find your gross profit. Your gross profit is the total amount of money you made during the period before your expenses. Write the difference between your sales revenue and the cost of goods sold on the next line on your spreadsheet. For example, if sales revenue is $50,000 and the cost of goods sold is $20,000, you would record gross profit of $30,000 on the income statement. Use a green pen or change the font color to show that the number listed is a profit.

Totaling Your Operational Expenses

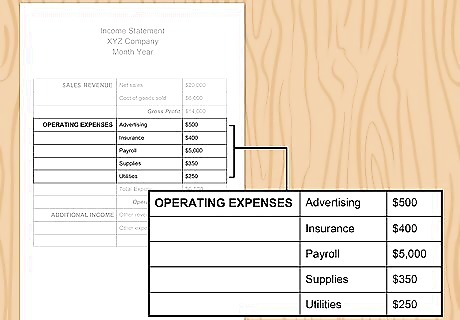

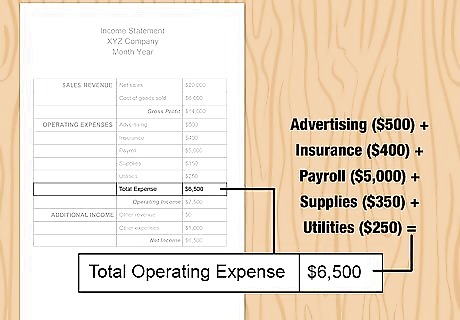

Write all the types of operating expenses the business has. Operating expenses are expenses that directly relate to business administration. Next to each line item, list the amount of expense incurred during the period. List all the expenses you incurred while running your business during the period you're reporting on. This could include salaries and wages, rent, utilities, marketing expenses, and any other costs related to running your business. Common operating expenses include salary and wages for those employees not directly involved in the product of goods, rent, insurance, office supplies, professional fees, utilities, transportation expense, marketing, depreciation, and property taxes. Direct labor has already been deducted from the Cost of Goods. If the business has a large variety of expenses, you can group similar line items into one category to save space. For example, you can create an "Employee compensation" line item that includes salaries, health insurance premiums, retirement benefits, payroll taxes, worker's compensation, and payroll processing fees.

Calculate your operating income: Subtract your total operating expenses from your gross profit to figure out your operating income. This is the income your business generated from its operations before accounting for any other income or expenses.

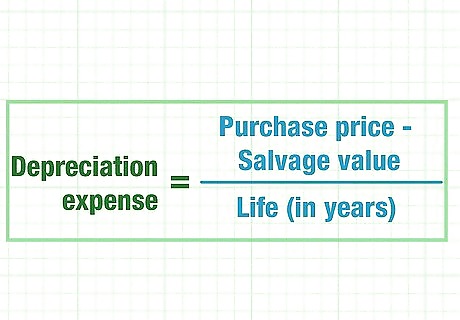

Find the depreciation and amortization for your business. Depreciation and amortization are both methods that reduce the recorded cost of assets. Depreciation is most commonly calculated using a straight line method, which is gradually reducing the cost of a tangible asset over its useful life. Amortization is used for intangible assets and is calculated similarly to depreciation. If you had any other income or expenses during the period you're reporting on, such as investment income or interest expenses, list them separately.

Add together the expenses to find how much money you’ve spent. Take all of the items in your expenses list and add them together with a calculator. Write your total expenses on the next line of your spreadsheet. Use a red pen or change the font color to red to signify that the expenses should be subtracted at the end. Add up your operating income and any other income or expenses to calculate your net income. This is the total amount of income your business made during the period you're reporting on.

Calculating Gains and Losses

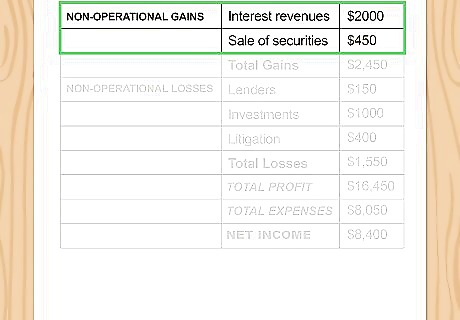

Write the non-operational gains the business has. Non-operational gains are revenues that don't directly relate to business operations, sales, and production. These revenues are from activities that are different or peripheral to normal operations, such as investments or unrelated sales. Next to each line item, list the amount of revenue incurred during the period. Common non-operational gains include interest revenues and gains from the sale of securities. These items add to the income of the enterprise while expenses reduce income.

Add the gains together to find the total. Once you list all the non-operational gains your business has, add them together so you have one number for total gains. Put the total gains on the line directly underneath your list so you can easily find it later. Write your gains in green so you know that they’re a profit.

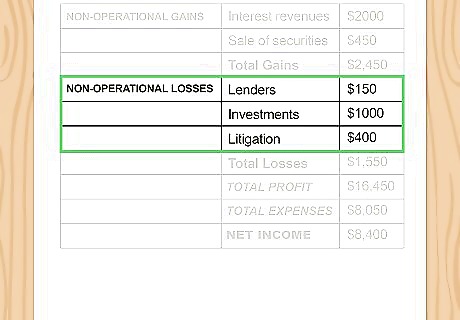

Calculate the non-operational losses the business has. Non-operational losses also don't directly relate to the business operation or sales. Next to each line item, list the amount of expense incurred during the period. Common non-operational losses include interest expense paid to lenders, losses from the sale of investments, and losses from litigation.

Combine your losses to find the total. Add together everything listed in your losses section of your income statement to get your total losses. Write the total on the next line of your statement so you can easily find it later. List the total losses in red to color-code your spreadsheet. That way, you know to combine them with your other operational expenses.

Finding the Net Income

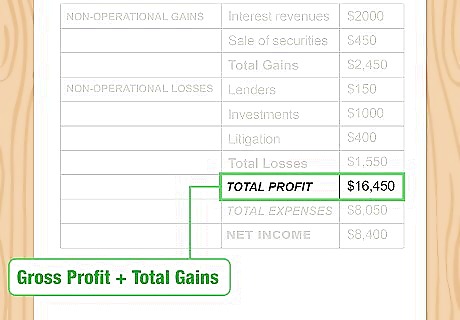

Add the gross profit to your non-operational gains. Find the gross profit you calculated in the first section and the gains in the third section of your statement. Add the numbers together to find the total profit your business gained over the period of time.

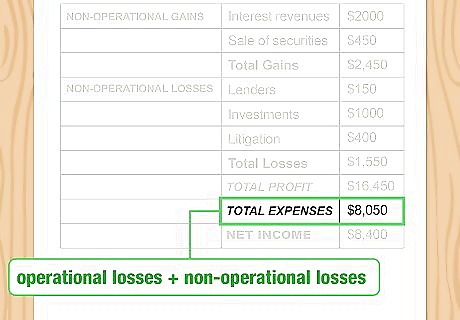

Find the total expenses by combining operational and non-operational losses. Locate the total operating expenses from the second section and your non-operational losses from the third section of the income statement. Add the 2 numbers together to find the total amount of expenses your business had.

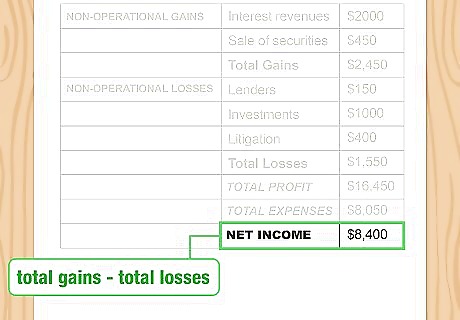

Subtract the total losses from your total gains to find your net income. Take the expenses you just calculated and subtract them from the profits. Write down the net income at the bottom of your statement. Your net income could be positive or negative depending on how much you spent and earned during the period of time.

Review and analyze your income statement Once you've completed your income statement, review it carefully to make sure all the numbers are accurate, and the statement is clear and easy to understand. Use your income statement to analyze your business's financial performance and identify areas for improvement.

Update and Revise your Income Statement If necessary, revise and update your income statement to reflect any changes in your business's financial situation. Keep your income statement updated and use it to track your business's financial performance over time.

Comments

0 comment